Ungated Post | 14 Aug 2020

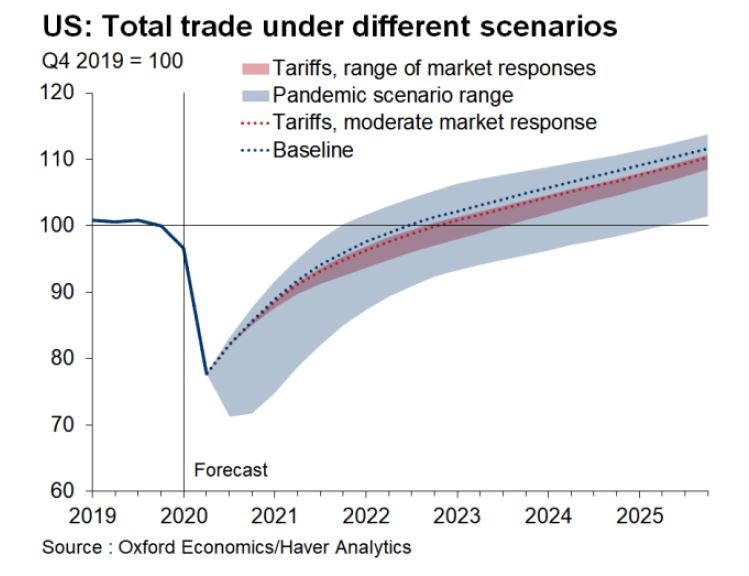

Chart of the week: US: Total trade under different scenarios

Innes McFee

Managing Director of Macro and Investor Services

Trade is already one of the hardest-hit US sectors in the coronavirus crisis and faces major risks depending on the path of the pandemic in our GSS scenarios. While an escalation in tariffs would have a noticeable impact on GDP, trade would be hurt much worse. If markets react sharply to the new tariffs, with equities retracing March lows, trade activity could see its recovery delayed by almost two years, and the impact would persist well into the medium term.

Tags:

You may be interested in

Post

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More