Ungated Post | 10 Jan 2017

Brexit: Who Could Take London’s Place in the EU?

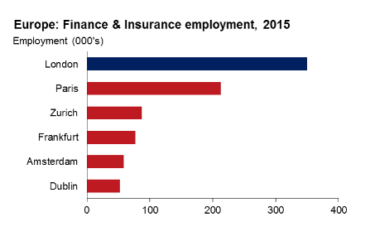

In considering the risk that London may shed financial services jobs as a result of Brexit, we do need to consider whether any alternative EU city has the capacity to absorb the jobs that London loses.

A simple comparison of the scale of financial sectors says ‘no’. But that ignores three things: that broader office-based employment in European cities suggests that they have more scale than is often assumed; that jobs may possibly split between cities (the ‘end of agglomeration’) and that artificial intelligence means that the number of jobs that other cities need to absorb may not be nearly as large as the number of jobs that London might potentially lose.

Download the free executive summary.

Tags:

You may be interested in

Post

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More