Blog | 09 Feb 2021

Australia’s Tourism Industry: Not so lucky

While it is true that Australia’s experience with the COVID-19 pandemic has at least to an extent fitted Australia’s traditional moniker as the ‘lucky country’, the same cannot be said for country’s travel and tourism industry. Australia, like many other countries in the Asia-Pacific (APAC) region, has taken a firm stance on borders, with international arrivals severely restricted since the start of the pandemic. Inbound tourists to Australia are estimated to have declined more than 80% in 2020 relative to 2019, comparable with the 83% decline estimated for APAC in aggregate.

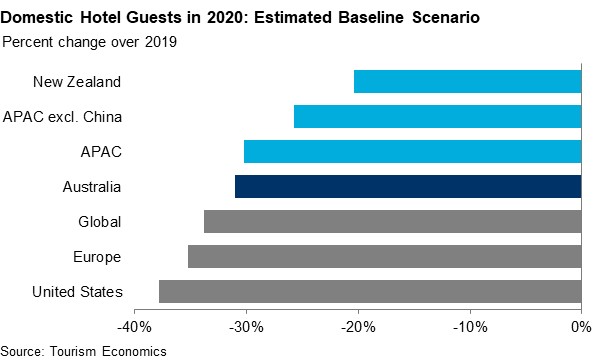

In addition, in a unique approach compared with most other countries, several Australian state and territory governments have also implemented border restrictions on interstate travel at various stages during the pandemic, often in response to only a small increase in new cases. This has had a negative impact on domestic tourism, with an estimated decline in Australian resident visitors of 31% in 2020—the most of any APAC country except for China. (See Tourism Economics’ blog post and research briefing for a full analysis).

The imposition of state border restrictions has been particularly controversial among tourism operators, as domestic travel (which accounted for 80% of total tourism spend in Australia in recent years) is essential to the recovery of the sector while international travel remains severely curtailed in the near future. Restrictions on interstate travel dampens the potential boost available from Australian residents substituting outbound travel for domestic trips.

The combined impact on Australian tourism of international and interstate restrictions, in addition to broader economic weakness, has been significant. The total contribution of travel and tourism to Australian GDP is estimated to have fallen from almost 11% in 2019 to a draft estimate of just 6% in 2020—the lowest in recent history. The impact on employment has also been substantial; an estimated 770,000 tourism-supported jobs were at risk in 2020 from the downturn in travel.

The importance of a rebound in domestic tourism cannot be understated. If domestic travel spending regains 2019 levels in 2021, for instance, as many as 300,000 extra jobs could be supported compared with Tourism Economics’ most recent forecasts, even with limited international travel.

There is no doubting the benefits of tough border restrictions at both a national and state level, with the spread of new COVID-19 infections being contained so effectively and allowing a return to normality of sorts throughout much of the country. However, the costs of this approach have not been evenly distributed, falling heavily on sectors including travel and tourism and hospitality. The broader recovery of the Australian economy will ultimately be limited while those sectors continue to suffer. Constraints on tourism recovery also exacerbate other issues in the economy, such as the lingering impact from restricted migration. As long as these restrictions continue to benefit some parts of the economy at the expense of others, targeted support such as extensions of JobKeeper, JobSeeker, and/or tax concessions are warranted for those sectors most in need.

Tags:

You may be interested in

Post

Promising trends signal optimism for the hotel sector

The global travel recovery took great strides in 2023, with some destinations already reporting a full recovery back to pre-pandemic levels. Trends continue to suggest further growth in tourism activity going into this year, signalling optimism for the hospitality sector going forward. But risks stemming from inflation, geopolitical tensions and climate change will persist.

Find Out More

Post

High satisfaction generates loyalty in the cruise industry, but experiences vary across segments and destinations

Tourism Economics’ latest cruise industry research briefing based on research among active cruisers identified strong underlying satisfaction with cruise experiences globally as nearly 90% rated their last cruise as good or very good.

Find Out More

Post

Global Cruise Trends Report: March 2024

This report delves into research conducted in Q4 2023 across five key cruise markets, all indicating strong cruise demand. Our comprehensive market intelligence aims to equip the travel industry with insights into the significant growth potential in the cruise industry.

Find Out More