Blog | 31 Mar 2023

Africa risks squandering its critical mineral opportunity

Gerrit van Rooyen

Economist, OE Africa

There is a scramble for African critical minerals amid the “New Cold War” brewing between the US and China. This presents several African countries with the opportunity to become major players in the global critical mineral value chain as Western powers try to break China’s monopoly in the mining and processing of these minerals.

Critical minerals those deemed essential to a country’s economic development or national security, have no viable substitutes, and are vulnerable to supply chain disruption. Countries have different definitions for critical minerals, depending on their needs. The US currently considers these 50 minerals critical.

The World Bank estimates that the production of certain critical minerals—such as graphite, lithium, and cobalt—could increase six-fold by 2050 to meet the growing demand for clean energy technologies. However, this massive opportunity for Africa could be hampered due to the continent’s leaders holding grudges against former colonial nations, and not recognising that swift reforms are needed to counter competitors.

Africa is no stranger to foreign powers competing to exploit the continent’s minerals for strategic purposes. This time around, however, Africa wants a bigger share of the spoils by taking part in the beneficiation process, not simply being a cheap producer of raw materials.

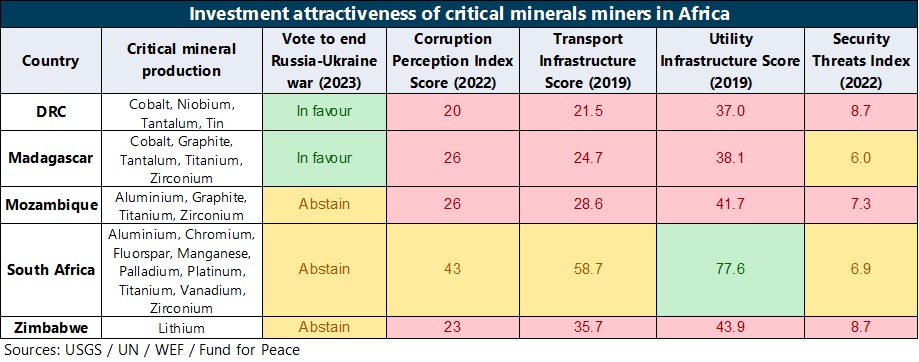

Western countries are more than receptive to this desire as this would help to diversify global supply chains. However, many African countries remain sympathetic to Russia and China, or are looking to pit the Western and Eastern powers against each other to score the most lucrative deals. This is exemplified by the large number of African countries that abstained from voting for the UN resolution to end the Russian war in Ukraine.

Other hurdles facing Western countries trying to expand their critical minerals portfolio into Africa include myriad well-known development issues: widespread corruption, infrastructural deficiencies, security risks, and a shortage of high-skilled labour.

Speakers at this year’s Investing in African Mining Indaba highlighted that persistently high levels of corruption and cronyism are the biggest obstacles to mining investment in Africa. The challenge to establish critical mineral processing and manufacturing capacity will be formidable given the necessary skills and infrastructure. Building batteries, for instance, is far from easy—it requires cheap and reliable electricity as well as experienced engineers and rigorous quality controls.

Tanzania’s first president, Julius Nyerere, famously said, “Africa must run while others walk” in reference to the pace of development Africa needs to compete with more advanced economies. Indeed, Africa will face stiff competition from the likes of Australia, Canada, Indonesia, Chile, Argentina, and Brazil, which all have significant critical mineral reserves and plan to boost their refinery and battery-building capacities. The South American nations recently announced plans to coordinate actions to enable the local beneficiation of its regional lithium resources.

Similarly, African countries should collaborate to create regional critical mineral processing and manufacturing hubs, which would help nations to pool financial resources, share data and skills, and spread risks. Encouragingly, Zambia and the Democratic Republic of Congo (DRC) took the first step in this direction in April 2022 by signing a cooperation agreement to facilitate the development of a battery value chain. The implementation of the Africa Continental Free Trade Agreement should also help to break trade barriers and could serve as a platform for leaders to engage in discussions to build critical mineral processing hubs.

Author

Gerrit van Rooyen

Economist, OE Africa

+27 (0)21 863 6200

Gerrit van Rooyen

Economist, OE Africa

Cape Town, South Africa

Gerrit van Rooyen has led the analysis of country risks and macroeconomic forecasts for several sub-Saharan African countries at Oxford Economics Africa for more than six years. The countries he has covered includes South Africa, Namibia, Botswana, Mauritius, Mozambique, Angola, Sao Tome and Principe, and Cape Verde. Gerrit has postgraduate degrees in Financial Economics and Journalism from the University of Stellenbosch and worked as a financial journalist at Media24 for nearly three years before joining Oxford Economics Africa. He was named Business Journalist of the Year at the 2015 Media24 Legends Awards and was also the overall winner of the 2022 Focus Economics Analyst Award for Angola, beating other top macroeconomic forecasters, such as Fitch Solutions, EIU, and JP Morgan.

Tags:

You may be interested in

Post

Easter Egg-onomics

The cause of Easter egg inflation of 50% or more this year is largely explained in the latest paper from our Africa team on one of the key countries at the start of the supply chain, those producing the raw ingredient.

Find Out More

Post

Africa: Radical Faye looks strong in Senegal’s presidential election

The first round of Senegal's presidential election will take place on Sunday, March 24. The race is unpredictable, given the dramatic backdrop to it. In this Research Briefing, we set out the main dynamics relating to the election and refresh our political scenarios.

Find Out More

Post

The long-term outlook for Northern African cities

North African cities are forecast to experience some of the fastest rates of employment and population growth over the long term. GDP growth is also forecast to be near the top of the global pack, just trailing behind sub-Saharan Africa.

Find Out More