Blog | 29 Apr 2024

Why Bernanke’s review of the state of forecasting matters – to the Bank of England, Oxford Economics and you

Innes McFee

Managing Director of Macro and Investor Services

Have you ever heard thoughtful criticism of a business practice from a respected expert and wondered how you could apply that insight to your own organisation?

The review of the Bank of England’s forecasting process by former US Federal Reserve chair Ben Bernanke is an opportunity for forecasters, including Oxford Economics, to using it to assess their own forecasting processes.

After the BoE was heavily criticised for responding too slowly to surging inflation over the last few years, Bernanke was tasked with reviewing the bank’s forecasting models. In his recent report, Bernanke found that the BoE’s baseline economic model suffered from “significant shortcomings” that impacted its decision-making and the credibility of the institution.

The report specified 12 recommendations to improve BoE’s forecasting, with a focus on:

- Improving and maintaining the forecasting infrastructure

- Developing a forecast process that supports decision-making

- Communicating the economic outlook more effectively

At Oxford Economics we firmly agree with Bernanke’s forecast process recommendations to the BoE. The review also sparked us to consider our forecasting approach and how we would fare in a similar exercise.

Update the forecasting infrastructure to reflect current conditions

Bernanke essentially found that the BoE’s forecasting infrastructure – especially the main macroeconomic model – is no longer fit for purpose. From time to time, every model requires additions and reformulations to reflect current economic conditions, structural shifts and variables. Apparently the BoE hasn’t revised its model adequately, causing it to fall into disrepair.

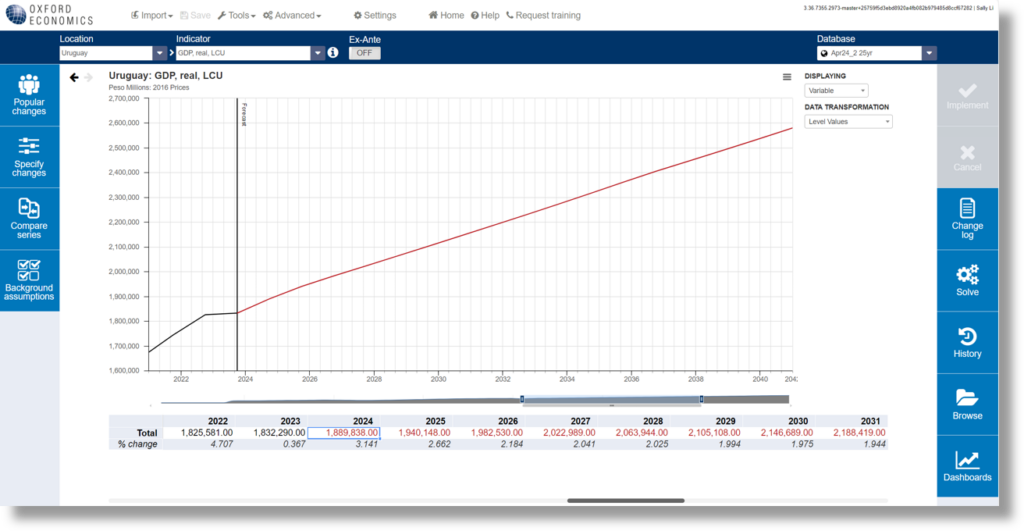

Our Global Economic Model has been updated over time to address shifts such as the growth of the financial sector, climate change and an increasingly dynamic energy sector. We believe these additions will help clients prepare for and adjust to changes in the years ahead.

Bernanke’s review also pointed out the need to observe and incorporate unanticipated structural changes in the model. A crucial example that Bernanke rightly identifies is the Phillips curve. As we have long argued, the Phillips curve was clearly very flat in the UK and in other economies prior to the pandemic. In the New Keynesian model, a flat Phillips curve implies a weak transmission of monetary policy. But the lack of maintenance on the Bank’s COMPASS model suggests this crucial factor in monetary policy making may have been overlooked, or even worse dismissed based on groupthink and dogmatism.

We were disappointed that the review did not delve deeper into the nature of the bank’s model, which still uses a dynamic stochastic general equilibrium (DSGE) methodology, a largely theoretical model that emerged around the time of the global financial crisis more than 15 years ago.

In contrast, Oxford Economics relies on a semi-structural model that uses theory and empirical evidence to support better-informed policy decisions. This is similar to the semi-structural model used by the Fed during Bernanke’s tenure. There is a clear argument that semi-structural models, like ours, are well suited to informing policy.

Enhance decision-making using a baseline forecast combined with potential scenarios

The BoE continues to use the flawed fan chart concept to illustrate a range of uncertainties around its central forecast. We believe that these fan charts are so wide that they seem to suggest almost any outcome is possible. Also, they convey nothing about model uncertainty, which is critical.

Oxford Economics produces a baseline forecast, which is our most likely scenario given the available information. We also offer alternative economic scenarios that help clients plan for a range of outcomes and develop their lists of business actions.

These scenarios also articulate key risks around the outlook, which enables clients to understand the parts of the baseline forecast that remain open to judgement. This is important because economists always must use judgement to adapt a model to the current perceived environment.

Enable greater insight with focused communications

Finally, Bernanke suggested ways that the BoE more clearly communicate its view of the economy to the public. The bank, he added, needs to detail the forecast, the risks and uncertainties around the forecast and the policy rationale.

Communications is an area where all economists can improve, ourselves included. Trying to communicate with a broad audience – those with different levels of expertise and preferences in absorbing information – is challenging. We rely on a heavily quantitative approach to macroeconomics, but we focus on telling the story of the forecast in a way that resonates with every reader.

We also engage with our audience. Oxford Economics welcomes suggestions for research topics and challenges to our forecast from clients. We talk to other businesses, financial market participants, forecasters and economists about the outlook. In this way, we aim to continuously learn about our clients and their priorities so we can tailor our storytelling to their needs.

Go beyond the basics

To keep up with structural economic changes and reflect them in a macroeconomic model, organisations like the BoE and Oxford Economics must develop a transparent forecast process, use scenarios, rely on good judgement and demonstrate a desire to continually improve communications.

The BoE indicated it would act on the recommendations issued in the Bernanke report and reform its forecasting processes, although we expect that change will take place slowly. We sympathise with the bank’s challenges in producing rigorous, insightful and actionable economics. The Bernanke Review is clear that the BoE must go back to the drawing board and get some of the basics right. But the work doesn’t stop there.

To learn more about the Bernanke review of the BoE’s forecasting processes and Oxford Economics’ response, read our full report, “What the Bernanke review says about the state of forecasting.”

Author

Innes McFee

Managing Director of Macro and Investor Services

+44 (0) 203 910 8028

Innes McFee

Managing Director of Macro and Investor Services

London, United Kingdom

Innes McFee is the Managing Director of Macro and Investor Services, based in London. Innes oversees the activities of the Macro & Investor Services teams globally, including the Global Macro Forecast and Global Macro Service.

Innes joined Oxford Economics in 2017 after 6 years at Lloyds Banking Group as a Senior Economist. At Lloyds Innes was responsible for the economic scenarios underpinning the Group’s internal planning and stress testing; analysis of key risks; and developing Lloyds’ approach to multiple economic scenarios for IFRS9. In addition, Innes’ role included developing the Group’s capability in modelling macroeconomic fundamentals and UK banking markets and advising the Group Corporate Treasury on financial market developments.

Prior to joining Lloyds Innes was an Economic Advisor at HM Treasury where his roles included management of the UK’s foreign currency reserves; US economist; and G20 macroeconomic policy advisor. Innes has a first class undergraduate degree in Economics from the University of Durham and a MSc in Economics from Warwick University.

Would you like to learn more about how we get our forecasts right? Contact us today

Tags:

Related Services

Service

Global Economic Model

Our Global Economic Model provides a rigorous and consistent structure for forecasting and testing scenarios.

Find Out More

Service

Global Scenarios Service

Explore the implications of key risks to the world economy.

Find Out More