Blog | 02 May 2024

Chinese office markets look set for a lost decade

Nicholas Wilson

Associate Director, Real Estate Economics, Asia

Over the past six years, China’s office markets have experienced a notable decline, marked by consecutive years of falling rentals, increasing vacancy rates and weakening investor confidence. The decline in market values, ranging from 15% to 30% off their peak levels, has been driven by decreases in net operating incomes (NOI) and heightened risk premiums. Despite the persistent downward trends and a significant oversupply issue, developers continue to introduce new office projects to the market, further exacerbating the vacancy rate problems that have reached new record highs across many cities.

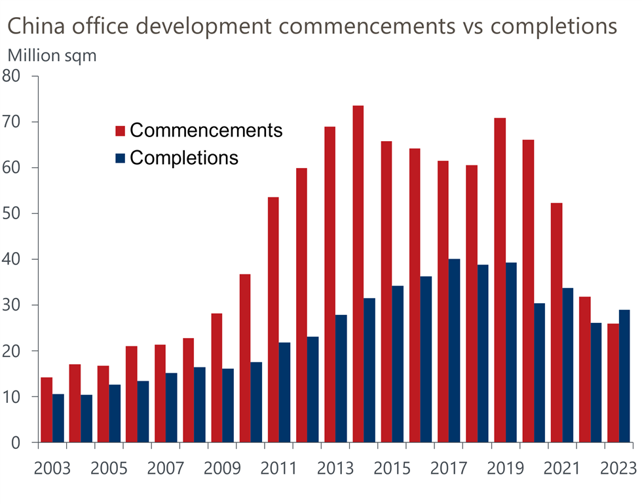

Chinese office project starts have run ahead of completions for two decades

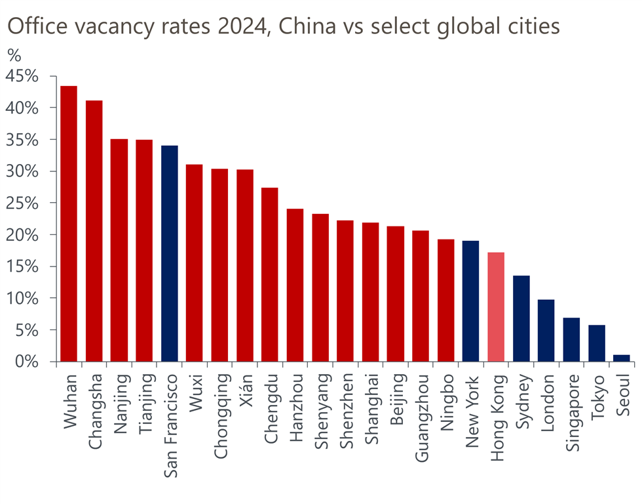

The global office sector is being challenged by the shift to work-from-home arrangements, impacting demand side fundamentals. In China, the influence of flexible working arrangements is often perceived as minimal, though evidence suggests that its effects are likely understated. Despite the prevailing global headwinds, China’s office markets have been flooded with new supply, evidenced by higher vacancies relative to other global markets. All major cities across China currently have vacancy rates above 20%, with nearly half of the major cities exceeding 30%. This means China has the highest vacancy rates of all major markets globally.

The continued oversupply is highlighted by a two-decade trend in which every year except 2023, developers have commenced more office projects than they have completed. The concerns are twofold. First, projects that have been completed have consistently run ahead of underlying demand. Second, this build-up of development projects over the years has created a massive future supply pipeline. The net result of this exuberant volume of project starts is that there is now over 300 million square meters (3.2 billion square feet) of office space currently under construction or on hold. This supply pipeline is equivalent to ten years of average supply delivery, in a market already burdened with 20%-40% vacancy rates. The likelihood is that many of these projects currently under construction will never reach practical completion.

Most Chinese markets won’t require any new office space for at least five years.

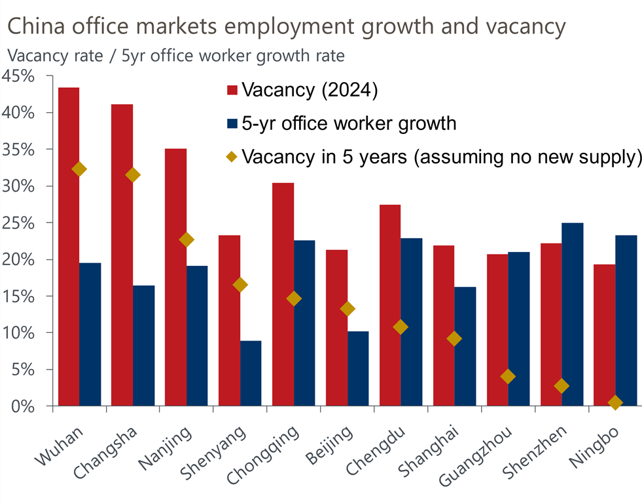

On the demand side, China’s labour market continues to transition, shifting towards more office-based jobs despite an overall contraction of the labour force. This shift brings some positive fundamentals that could drive net absorption rates in the future. However, the relative increase in new office workers compared to the levels of current vacancies and new supply suggests that developers need to move their focus away from constructing new offices to allow the market to move towards equilibrium.

Our analysis, which applies city-level forecasts for office worker growth over the next five years against current occupancy rates, suggests that most markets won’t require any new office space for at least five years. In some markets, vacancy rates would still be high even with zero new supply out to 2029. Exceptions exist in cities like Guangzhou, Shenzhen, and Ningbo, where vacancy rates are lower and employment growth projections are higher. In other areas though, vacancy rates are likely to remain well above frictional levels for at least the next decade, regardless of the volume of new supply.

Considering the extensive amount of office space currently under construction or on hold across various Chinese cities, the period of elevated vacancy rates and oversupply is almost guaranteed to extend beyond 2030. This will reduce any likely rental growth across these markets and deteriorate investment confidence further. A migration away from older, less efficient office buildings is likely to accelerate, putting upward pressure on asset obsolescence over the coming years. Older stock will need to be withdrawn from the market to maintain some semblance of supply-demand balance.

This comes at a time when Chinese developers are already under significant distress due to the severe oversupply of residential construction. What’s more, recent reports suggests urbanisation rates for some of China’s major cities are slowing rapidly, with many choosing smaller regional cities or towns. Shanghai based MetroDataTech reported that there was a net outflow of people for both Shanghai and Shenzhen in 2023. High unemployment amongst young graduates, a lack of white-collar jobs and low starting salaries are driving many to relocate to smaller cities and towns. If this trend were to continue, this could further exacerbate high levels of vacancy rates in major cities, and create a potential misallocation of office supply.

Contact us today to explore how we can support your location decision-making

Author

Nicholas Wilson

Associate Director, Real Estate Economics, Asia

+65 6850 0129

Nicholas Wilson

Associate Director, Real Estate Economics, Asia

Singapore

Nick joined Oxford Economics in July 2022 to lead the Real Estate Economic Service (REES) for Asia Pacific. Nick is responsible for researching, forecasting and analysing commercial real estate trends across all major markets and sectors in the region. He has over 12 years of experience researching and advising clients on commercial real estate strategies, covering direct, indirect and listed markets. Nick holds a Masters (MSc) in Finance from the University of Ulster, United Kingdom and a Bachelor of Business (majoring in Real Estate) from the University of Queensland, Australia.

Tags:

Related Reports

Click here to subscribe to our real estate economics newsletter and get reports delivered directly to your mailbox

MINGTIANDI: Oversupply weighs heaviest on China’s office markets

Chinese office markets look set for a lost decade

Relative return index signals improving CRE attractiveness

Real Estate Trends and Insights

Read more analysis on real estate performance and location decision-making.

Read more: Real Estate Trends and Insights