News | 12 Mar 2024

Oxford Economics Introduces Proprietary Data Service

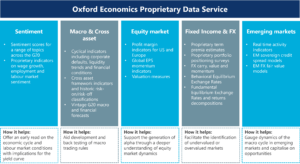

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service. This exclusive add-on is designed to arm asset managers with deep insights into economic cycles, asset valuation as well as market momentum and sentiment, thereby enabling them to gauge market movement and capitalise on emerging investment opportunities more effectively.

“We frequently receive requests for the data that underlies our key calls, and we are excited to make it available to our clients,” Innes McFee, Managing Director of Macroeconomic and Investor Services at Oxford Economics said. “Navigating today’s volatile investment landscape requires an intricate understanding of both economic trends and market dynamics. Our new offering introduces an extra layer of detail for asset managers to sharpen their investment decisions.”

In addition to sophisticated models and macro and financial forecasts, this data service offers high-frequency indicators, including sentiment data Oxford Economics developed in collaboration with Penta Group. This partnership has led to the development of proprietary indicators on wage growth, employment and labour market sentiment, offering early insights into labour market conditions and their impact on the yield curve.

“At Oxford Economics, we have developed models of key labour market indicators across the G20 using daily sentiment data. Both our back testing and current application of these models have consistently and accurately forecasted trends, such as the strength in UK wage growth,” McFee highlighted. “The combination of these sentiment data and activity data empowers asset managers to monitor market conditions in close to real time.”

The introduction of the Proprietary Data Service underscores Oxford Economics’ dedication to equipping asset managers with actionable, timely intelligence to sharpen investment decisions.

Would like to learn more?

To trial Oxford Economics’ Global Asset Manager Service, click here.

To subscribe to Beyond the Headlines – Oxford Economics’ newsletter for asset managers, click here.

Tags:

You may be interested in

Global Asset Manager Service

A complete solution for asset managers who require convenient access to high quality, market-relevant analysis on key global markets.

Find Out More

Emerging Markets Asset Manager Service

Emerging markets insight and opportunity at your fingertips.

Find Out More