Turmoil in UK markets raises threat of a housing crash

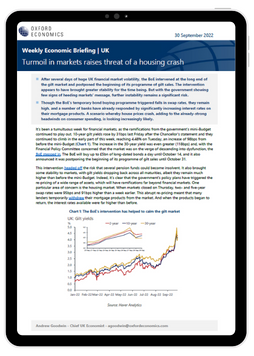

After several days of huge UK financial market volatility, the BoE intervened at the long end of the gilt market and postponed the beginning of its programme of gilt sales. The intervention appears to have brought greater stability for the time being. But with the government showing few signs of heeding markets’ message, further instability remains a significant risk.

What you will learn:

- Though the BoE’s temporary bond buying programme triggered falls in swap rates, they remain high, and a number of banks have already responded by significantly increasing interest rates on their mortgage products. A scenario whereby house prices crash, adding to the already-strong headwinds on consumer spending, is looking increasingly likely.

Tags:

Related Services

Service

UK Region and LAD Forecasts

Regularly updated data and forecasts for UK regions and local authority districts.

Find Out More

Service

UK Macro Service

Track, analyse, and react to macro events and future trends in the United Kingdom.

Find Out More

Service

European Cities and Regions Service

Regularly updated data and forecasts for 2,000 locations across Europe.

Find Out More

Service

European Macro Service

A complete service to help executives track, analyse and react to macro events and future trends for the European region.

Find Out More