Blog | 23 Apr 2021

Quantitative Easing: Is the cure worse than the disease?

James Nixon

Head of Climate Change Macroeconomics

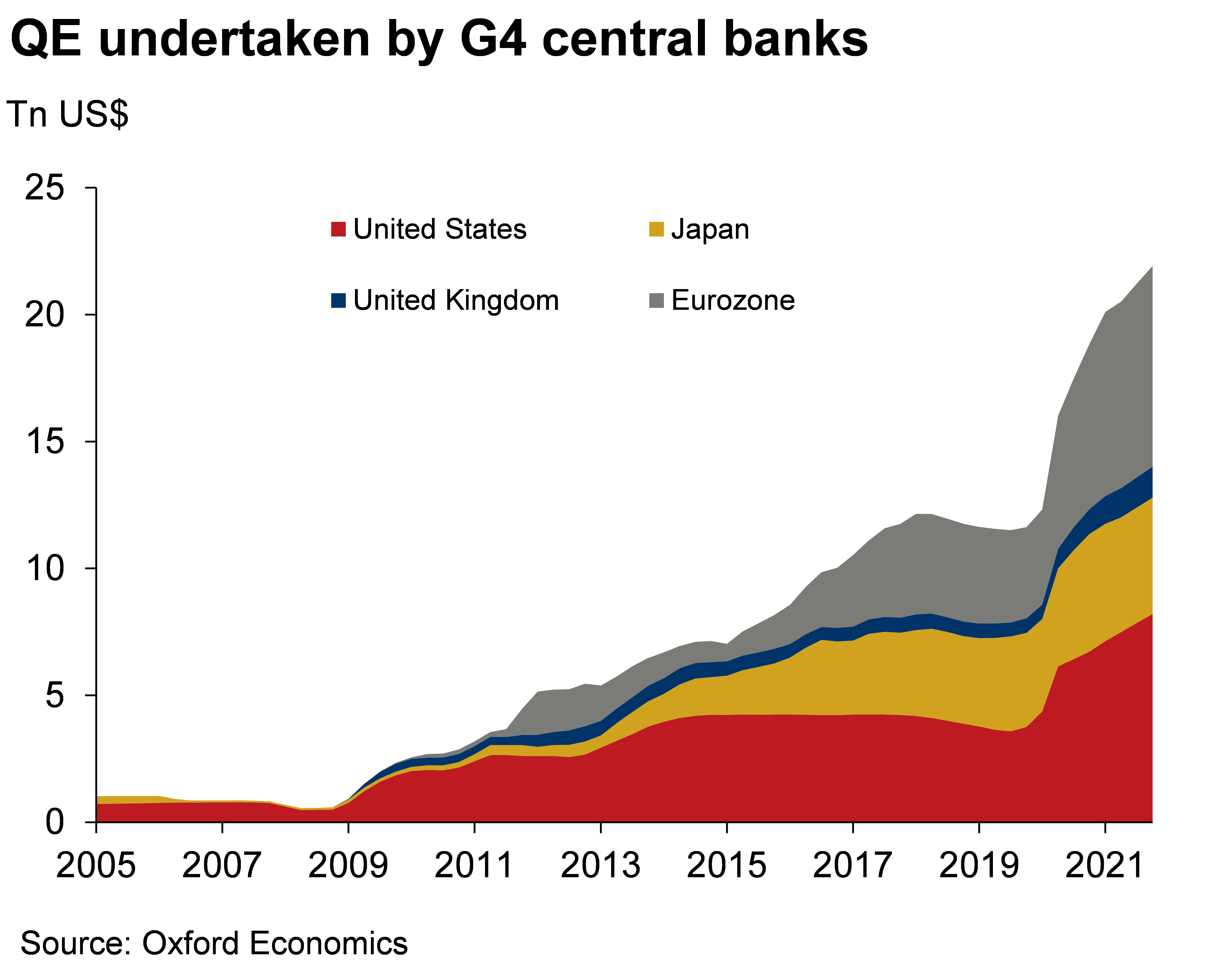

The financial market volatility that has already marked the early stages of the COVID-19 economic recovery underscores how much the financial system and investor base have become hooked on central bank support. In this context, non-standard monetary policy and quantitative easing (QE) have become so much a part of central banks’ regular tool kit that it is debateable whether the sobriquet “non-standard” still applies. While undoubtedly a key part of central banks’ armoury to fight financial crises and fulfil their role as a lender of last resort, when sustained persistently into the medium term, QE has a number of distinctly negative side effects that raise the question of how central banks exit from QE—and whether ultimately the cure is worse than the recession it was meant to forestall.

The Great Financial Crisis, for example, can be thought of as essentially a crisis of liquidity. A given debt service ratio implies that a given volume of debt can be sustained by sufficiently optimistic income expectations. If those income expectations collapse, the volume of debt becomes (almost instantly) unsustainable, initiating a downward spiral of asset sales as loans are foreclosed and losses realised. Arguably, the main purpose of QE is to act as a circuit breaker, interrupting the downward spiral and buying time to inflate future income expectations again, to the point where debt can once more be sustainably serviced.

QE does this by lowering long-term interest rates, which typically lowers the return on safe assets (often held by older and poorer people) while creating incentives for firms and households to take on even more debt (which often benefits people at the top of the income distribution). QE boosts asset prices, potentially increasing both equity and bond prices beyond what might be sustainable in the absence of QE. The stock of bonds residing on central bank balance sheets typically increases the stock of government debt that is sustainable. Hence, it is hard to see how central banks could reduce their bond holdings without it affecting debt sustainability in the most indebted countries.

QE does this by lowering long-term interest rates, which typically lowers the return on safe assets (often held by older and poorer people) while creating incentives for firms and households to take on even more debt (which often benefits people at the top of the income distribution). QE boosts asset prices, potentially increasing both equity and bond prices beyond what might be sustainable in the absence of QE. The stock of bonds residing on central bank balance sheets typically increases the stock of government debt that is sustainable. Hence, it is hard to see how central banks could reduce their bond holdings without it affecting debt sustainability in the most indebted countries.

The challenge for central banks is how to step away without the sky falling in. In many ways, the trick is to withdraw support at the same pace that earnings and income expectations rise, thus sustaining asset prices. That is a very narrow path for policy to follow, however, and there is a risk that central banks will make a mistake in either direction: either not tightening fast enough or being too quick to withdraw stimulus.

There are two aspects of this story that suggest the exit from the current round of pandemic-driven QE may be anything other than smooth. First, by encouraging an aggressive search for yield, the demand for bonds risks becoming increasingly binary. Given the pervasive environment of low yields, the capital losses implied by rising yields could present pension funds with problems. With yields now at rock bottom, it’s hard to see how they can do anything other than rise in the future, potentially tiggering a rush for the exit as the global economy starts to recover.

The pandemic has made this dynamic even more volatile by further boosting indebtedness and precipitating even more central bank easing. But the seeming infallibility of QE surely has its limits. Increasingly, the stock of debt the central banks have purchased have a material bearing on countries’ debt sustainability. Given the potential for a permanently lower income trajectory after the pandemic, it’s hard for example to see how central banks can ever stop purchasing the government bonds of the most indebted countries. This suggests a future of persistent ongoing QE in which asset prices are almost completely dependent on central bank policy. How central banks can step away from this is increasingly politicised house of cards will arguably be the one of the most pressing problems after the pandemic.

Tags:

You may be interested in

Post

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More

Post

MENA – Latest Trends

Our blog will allow you to keep abreast of all the latest regional developments and trends as we share with you a selection of our latest economic analysis and forecasts. To provide you with the most insightful and incisive reports we combine our global expertise in forecasting and analysis with the local knowledge of our team of economists.

Find Out More

Post

BoJ to raise its policy rate cautiously to 1% by 2028

We now project that the Bank of Japan will start to raise its policy rate next spring assuming another robust wage settlement at the Spring Negotiation. If inflation remains on a path towards 2%, the BoJ will likely raise rates cautiously to a terminal rate of around 1% in 2028.

Find Out More