Blog | 15 Nov 2022

Multiple pressures to European real estate means infrastructure drive needs to be rethought

Tom Rogers

Associate Director, Capital Projects and Assets Consulting

At the start of the summer we wrote about pressure on real estate development viability, as a range of factors combine to squeeze rates of return on capital to the point where some developments required unfeasible increases in rental or capital growth to remain viable. The months ahead will see difficult discussions being made around which developments should still go ahead in 2023. And policymakers need to ensure support for post-COVID recovery doesn’t make matters worse.

Figure 1 – Multiple pressures for real estate developers in 2023

The most visible component of the pressures facing developers is the rate of price inflation for construction activity through 2022. Construction costs have risen especially fast due to the sector’s energy intensity, but also due to shortages in materials and labour. October’s S&P Construction PMI survey found construction input price inflation was slowing as some bottlenecks eased. But in level terms costs are going to be appreciably higher going forward than anticipated earlier in 2022. Our latest forecasts indicate the cost of construction activity in key European markets in 2023 will be up to 10 % higher than in our pre-summer forecast.

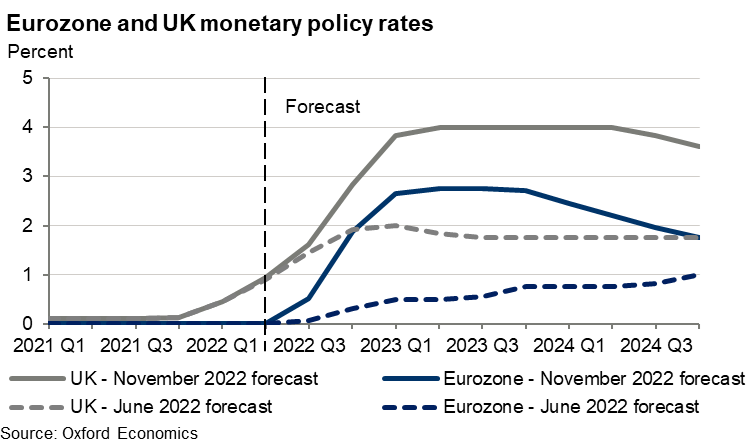

The cost of finance is also rising faster than anticipated a few months ago. In the eurozone, the ECB has signalled a much more rapid tightening of policy in the coming year, with rates expected to be 2% higher through 2023 and 2024 than anticipated a few months ago. Rates in the UK will also be around 2% higher through 2023 than previously expected as the Monetary Policy Committee focusses on protecting the credibility of its inflation target, even at the expense of growth.

On the demand side of the ledger, the combination of worsening price pressures, diminishing real incomes, and a tighter policy outlook mean the economic outlook has deteriorated further in the past couple of months. We revised down our expectation for UK GDP growth in 2023 by 1 percentage point between August and November forecasts, and now anticipate falling activity in the Eurozone late this year and early next. Across Europe the demand outlook for real estate has weakened, and with it developers’ pricing power for both rental and sales prices (especially in real terms). Our real estate service marked down our outlook for property returns substantially in our October release, and the likelihood is of worse price corrections to come.

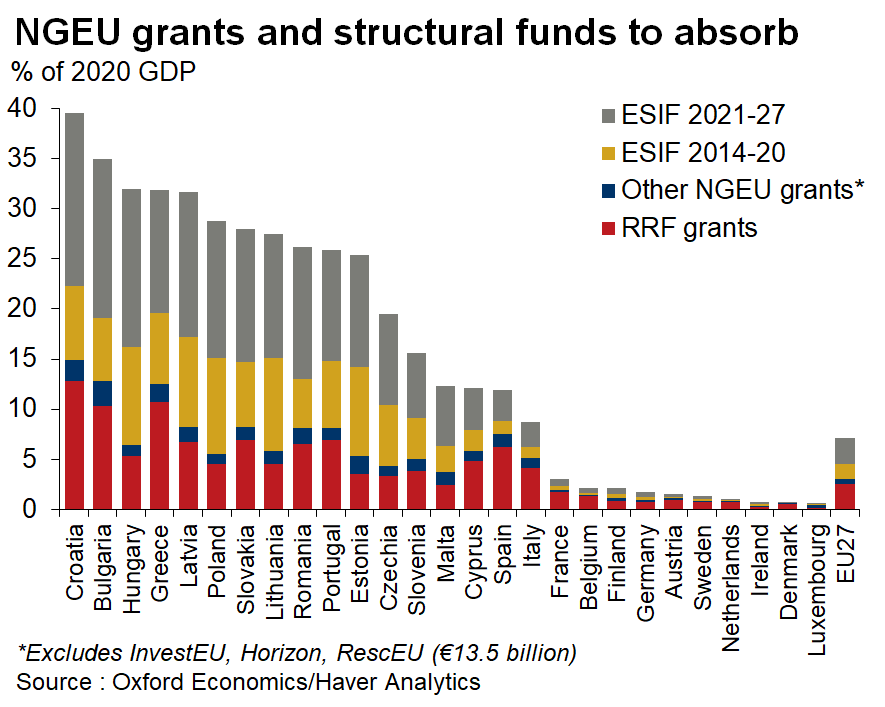

In the months ahead developers will be examining project finances to assess whether rates of return on projects remain viable in light of higher costs, dearer finance, and weakening demand. Some may decide construction needs to be put on hold until costs fall back further, or the economic outlook becomes more certain. And policymakers need to ensure that support for the post-COVID recovery doesn’t aggravate matters further. The EU’s Recovery and Resilience Fund (RRF) is heavily front-loaded in the coming couple of years and will boost demand for scarce construction resources – especially in countries where EU funds amount to 10% or more of GDP. There are plenty of measures the EU can take to ensure supply expands with capacity, but this may require a shift in mindset compared with the original goals of the RRF.

Note: ESIF = European Structural and Investment Funds, NGEU = NextGenerationEU, RRF = Recovery and Resilience Facility.

Author

Tom Rogers

Associate Director, Capital Projects and Assets Consulting

+44 (0) 203 910 8047

Private: Tom Rogers

Associate Director, Capital Projects and Assets Consulting

London, United Kingdom

Subscribe to receive latest real estate economics analysis

Tags:

You may be interested in

Post

Four themes are shaping US real estate markets

This year is set to be a turning point for commercial property markets in the US. A gradual easing of inflationary pressures alongside a steady, if unspectacular, year for GDP and employment growth should help to ease the market through the final leg of the post-Covid adjustment. But there are four important themes market participants will need to understand to navigate the short and medium term successfully.

Find Out More

Post

Australian office sustainability outcomes underpin asset performance

The focus on green office buildings and sustainability is being driven by both government targets to achieve net zero and increasing corporate and investor focus on environmental, social, and corporate governance (ESG) considerations and compliance.

Find Out More

Post

Infographic: Key macroeconomic risks impacting global real estate performance

Continued economic growth will help stabilise commercial real estate yields and values before pricing slowly begins to recover next year. We expect global all-property total returns to average 5.3% per year over 2024-2025 in our baseline scenario. However, there are still upside and downside risks that real estate professionals should watch out for. In this infographic, we outline these risks and their impacts on property value.

Find Out More