Three forces shaping growth, inflation, and markets in 2023

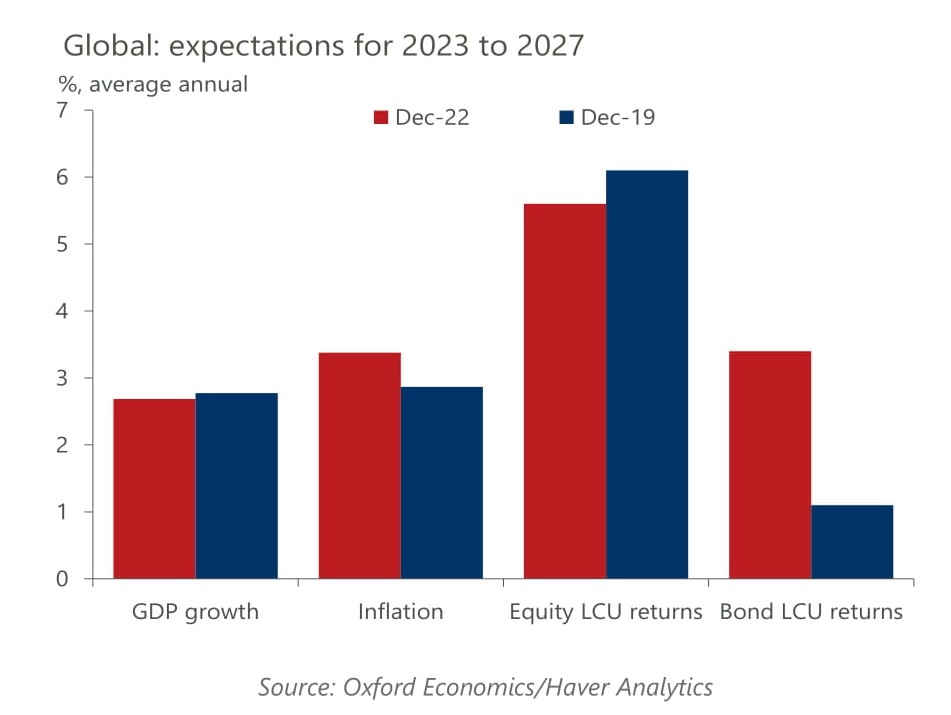

Since the pandemic, our view of the medium-term outlook has shifted to become more pessimistic on inflation and equity market returns while maintaining our overall thesis that the world economy will eventually be characterised by low growth and low inflation once again.

Three very different forces are shaping the three key regions of the global economy. Excess demand in the US, the Russia-Ukraine conflict’s impact on Europe, and China’s broken growth model are each powerful forces in their own right. Judging their combined impact and timing is difficult, adding to the uncertainty and volatility in the global outlook.

We believe some other trends are more certain to materialise than others. Global growth is undoubtedly set to weaken materially over the medium term, ending the decade at an underwhelming pace of less than 2.5% annually. Despite demand growth struggling in 2023 in particular, inflation is set to remain higher and more volatile than the post-financial crisis decade due to supply disruptions and geopolitical tensions.

Unlike the past decade, financial market returns will struggle to defy the gravitational pull of a weak economy. The key difference this time is higher interest rates and falling demand for safe assets from the official sector. Without the discount rate impetus, the reality of weak earnings will weigh on equities, while fixed income returns will improve thanks to the weak real economy.

Tags:

Related Posts

Post

FOMC minutes: Policymakers flex, markets not impressed

We were a little surprised that Fed officials had not pushed back harder against market expectations for aggressive rate cuts this year, but perhaps they wanted to let the minutes from the December meeting of the Federal Open Market Committee do the work.

Find Out More

Post

A weaker dollar hinges on better global growth prospects

The dollar will continue to be supported by a high carry and the relative resilience of the US economy. Even the recent loosening of financial conditions – itself based on the pullback in yields and a more flexible Fed – have only partially dented the USD bullish trend.

Find Out More

Post

Disinflation will force ECB to cut rates earlier than expected

One of our key macro calls for 2024 is our view that eurozone inflation will be lower than what the market and what the ECB expects.

Find Out More