Research Briefing

| Jan 3, 2024

FOMC minutes: Policymakers flex, markets not impressed

We were a little surprised that Fed officials had not pushed back harder against market expectations for aggressive rate cuts this year, but perhaps they wanted to let the minutes from the December meeting of the Federal Open Market Committee do the work.

What you will learn:

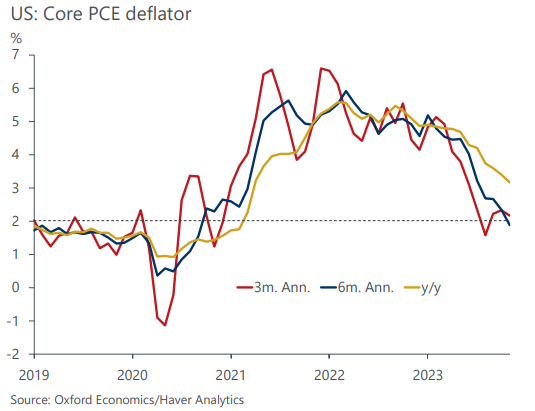

- The minutes were more hawkish than Fed Chair Jerome Powell’s post-meeting presser, as they noted that “several” participants believed that the fed funds rate may remain at its peak longer than anticipated. The Fed is conceivably attempting to guide market expectations that the timing of the first rate hike is still up in the air and likely contingent on incoming data on realized inflation and nominal wage growth (Chart 1). The Fed will be patient during this easing cycle because it cannot declare victory on inflation prematurely.

- The Fed should find take solace in signs that the labor market continues to rebalance, which put downward pressure on nominal wage growth and, by extension, core services inflation. The quits rate, a good predictor of future growth in the Employment Cost Index, fell in November and is below the average seen in 2019. Still, ECI growth for private workers is still running too hot.

- The minutes said that officials “reaffirmed” that it would be appropriate for policy to remain restrictive for some time until inflation is clearly moving down substantially. This is Fed speak for nothing has been decided on when it will likely ease and that the sources of disinflation matter, with services trumping goods. Also, remaining restrictive doesn’t rule out rate cuts, particularly as inflation decelerates, pushing the real fed funds rate higher, all else being equal.

- The minutes do not paint the Fed into a corner as it mentioned that it is possible for the Fed to resume hiking interest rates, but this is unlikely unless inflation reaccelerates, which would require a significant softening in the supply side of the economy this year, primarily through growth in the labor force.

Tags:

Related Services

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More