Blog | 07 Jun 2023

Australia: RBA hike by another 25 bps as the fight against inflation continues

Sean Langcake

Head of Macroeconomic Forecasting, OE Australia

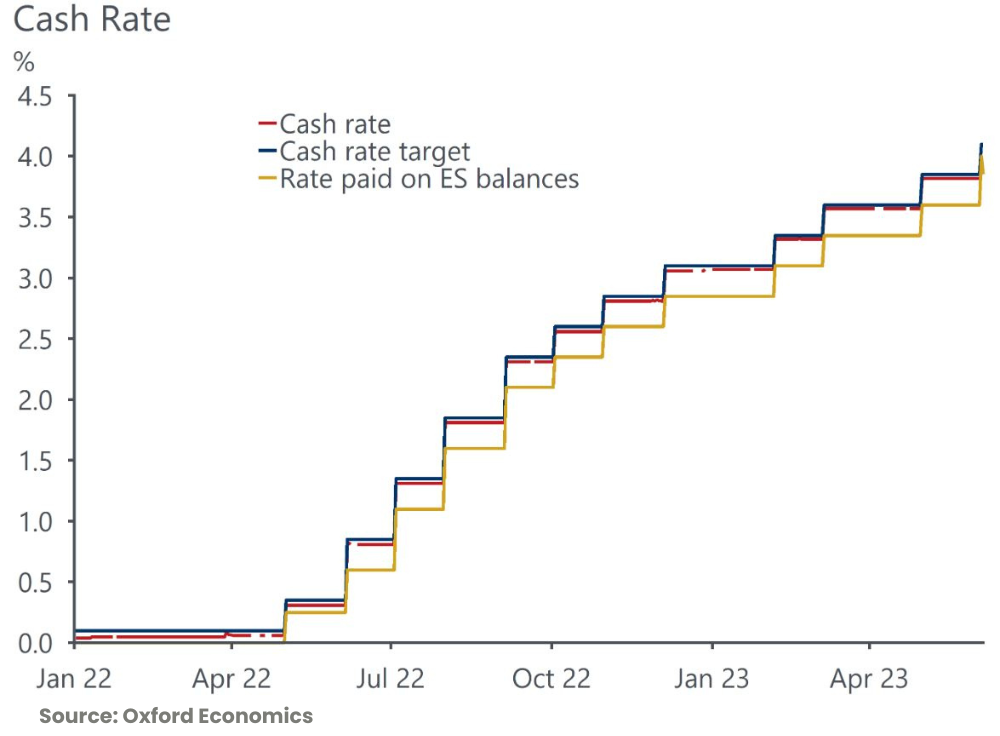

- The RBA has raised its cash rate target by a further 25 basis points, taking it to 4.1%. Although inflation has peaked, the RBA board is still clearly uncomfortable with its brisk pace. The board is very attuned to the lessons from other advanced economies where services and core inflation have proven to be stubbornly high. Moreover, although wage growth is still controlled, absent an improvement in productivity growth further upside surprises to the inflation outlook are likely.

- The cash rate has now reached our forecast peak. Still, it remains unclear just how quickly the RBA wants to see inflation come back down. They have noted that today’s decision will provide ‘greater confidence’ that inflation will fall in a reasonable timeframe. This argument is likely to remain valid for some time, which leaves the door open to more rate hikes in the coming months.

Oxford Economics Australia notes that the flow of new information over the past month was mixed. The labour market appeared to slacken a little and there is further evidence that household spending is being reined in, with retail volumes contracting over Q1. But wage growth is relatively brisk and looks set to increase further due to the low level of the unemployment rate and the relatively large award wage increase granted by the Fair Work Commission. The current pace of wage inflation is broadly consistent with the RBA’s target range, contingent on an improvement in productivity growth. This is a material condition as productivity growth has persistently disappointed for some time. Tomorrow’s national accounts will provide a valuable data point on productivity, but irrespective of the Q1 outturn, the RBA will remain concerned about the pass-through of faster wage growth to CPI inflation.

The accompanying board statement was relatively light on the details of new information to hand. Rather, it re-emphasised the deleterious impacts of high inflation. Today’s policy change is aimed at giving the market greater confidence that inflation will return to the target range sooner. This is a shift in language from earlier this year when the RBA struck a more dovish tone and even paused the hiking cycle in April. The board will continue to put some weight on the performance of the labour market and real economy. But they appear increasingly uneasy with their forecast for a protracted period of above-target inflation.

Tags:

You may be interested in

Post

BIS Oxford Economics to be rebranded as Oxford Economics Australia

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Policy-makers bet on construction to escape COVID economic shock

The construction sector did not escape the coronavirus-induced economic downdraft unscathed. Activity at the global scale fell 1.4% in 2020, with much steeper declines in countries that imposed harsher restrictions. But things are changing.

Find Out More

Post

The Future of Australian Infrastructure: Australia’s Global Competitiveness

The current investment in Australian infrastructure is barely keeping pace with demand. To meet future demand we will need to invest more but also, crucially, build and operate major assets more efficiently.

Find Out More