Research Briefing

| Feb 1, 2023

China: Emerging green shoots in Spring, but not out of the woods

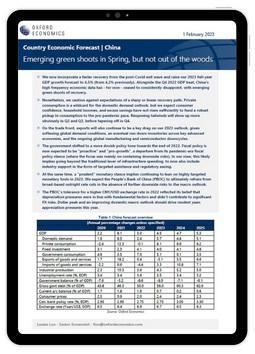

We now incorporate a faster recovery from the post-Covid exit wave and raise our 2023 full-year GDP growth forecast to 4.5% (from 4.2% previously). Alongside the Q4 2022 GDP beat, China’s high frequency economic data has – for now – ceased to consistently disappoint, with emerging green shoots of recovery.

What you will learn:

- Nonetheless, we caution against expectations of a sharp or linear recovery path. Private consumption is a wildcard for the domestic demand outlook, but we expect consumer confidence, household incomes, and excess savings have not risen sufficiently to fund a robust pickup in consumption to the pre-pandemic pace.

- On the trade front, exports will also continue to be a key drag on our 2023 outlook, given softening global demand conditions, an eventual run-down inventories across key advanced economies, and the ongoing global manufacturing and semiconductor downcycles.

- The government shifted to a more dovish policy tone towards the end of 2022. Fiscal policy is now expected to be “proactive” and “pro-growth”, a departure from its pandemic-era fiscal policy stance (where the focus was mainly on containing downside risks). In our view, this likely implies going beyond the traditional lever of infrastructure spending, to now also include industry support in the form of targeted assistance and regulatory easing.

Tags:

Related Services

Service

China Cities and Regional Forecasts

Quarterly updated data and forecasts for 286 cities and 30 provinces across China.

Find Out More

Service

Asian Cities and Regional Forecasts

Key economic, demographic, and income and spending projections to 2035 for more than 400 locations across Asia-Pacific.

Find Out More