Real Estate Economics Service

We help you understand the implications of macroeconomic, geopolitical, financial and climate developments on private and public real estate performance.

in this page:

Overview

Today’s real estate market is complex, shaped by a confluence of economic shifts, financial volatility and policy changes. Our Real Estate Economics Service helps you connect the dots between economic trends and your on-the-ground real estate investment decisions, providing a clearer view of market risks and opportunities.

What’s Included?

The most comprehensive independent real estate forecasting service, combining proprietary real estate supply data with model-backed insights on demand drivers.

Real estate data and forecasts

Our forecasts are powered by Oxford Economics’ Global Economic Model, ensuring they always reflect macroeconomic fundamentals such as growth, inflation, interest rates and employment.

- Monthly market forecasts: Forecasts to 2060 for office, retail, industrial, residential and hotels, covering 142 markets, refreshed monthly. Indicators include total return, income return, capital growth, rental growth, yields and building stock, REIT price and total return index.

- Scenario forecasts: Narrative-driven scenarios to assess upside and downside risks, from tariffs and interest rate shifts to geopolitical shocks.

- Historical data: NCREIF and MSCI historical data can be integrated directly into our platform for clients with mutual subscriptions, providing a single view of past and future CRE performance.

- 32 countries

- 100 cities

- 5 sectors

- 8 indicators

Real estate market reports

Our economists and CRE experts produce independent commentary to that helps you navigate the real estate market outlook and sharpen your narratives.

- Research Briefings: Thematic analysis on key trends shaping real estate, from demographics and AI to construction and climate transition risk.

- Data insights: Commentary on key data releases impacting CRE in Europe, the UK and the US.

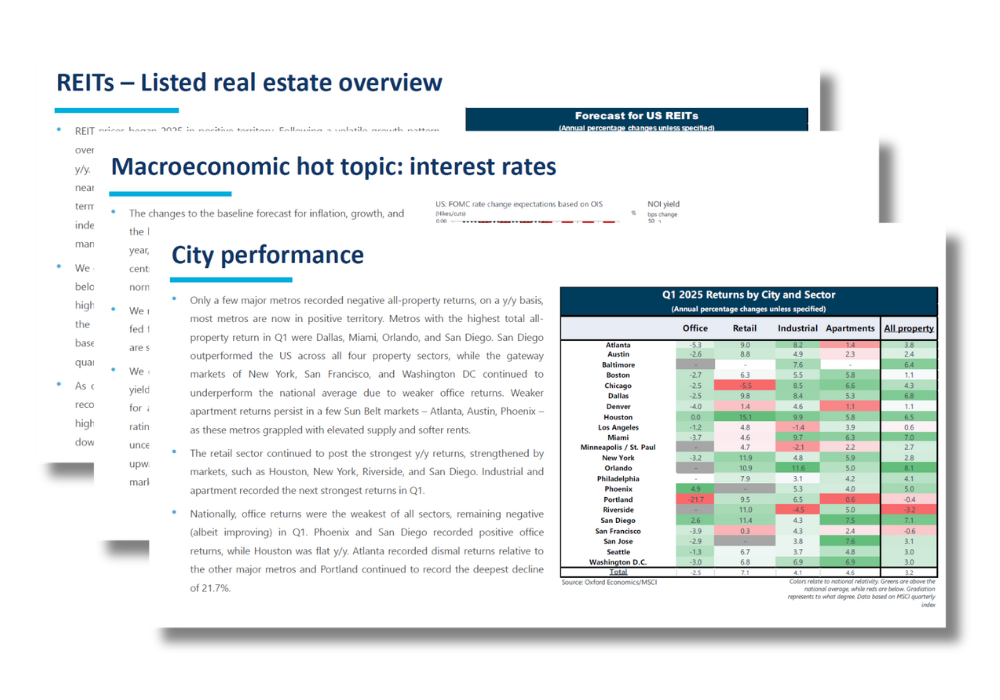

- Quarterly CRE reports: In-depth analysis of major economies and real estate markets, including sector outlooks and capital market trends.

- Quarterly chartbooks: Visual summaries of key forecasts with commentary on macroeconomic drivers, demographics, climate, finance, capital market, REITs and more.

Platform and tools

Our platform makes it easy to access, explore and apply our forecasts and insights directly into your workflow.

- Data access: Our databank, API, data feeds and Excel plug-in make it easy to work with our datasets in the format you need.

- Dashboard: An intuitive interface to compare markets and sectors and visualise key indicators in a few clicks.

- Research resources: Research portal and AI Assistant help you navigate analysis and extract narratives for reporting and presentations.

- Expert support: Access our global team of experts in macroeconomics and real estate, ready to provide timely guidance.

- API

- Data feed

- Excel plug in

Why Oxford Economics

Our economists and CRE experts produce independent commentary to help you navigate the real estate market outlook and sharpen your narratives.

Model-backed forecasts

Powered by our proprietary models, we link macroeconomic drivers directly to city-level real estate performance, ensuring forecasts are grounded in market fundamentals. Updated monthly.

Global consistency

We apply one consistent methodology across all markets, backed by cutting edge data analytics. This gives you reliable like-for-like comparisons across countries, cities and sectors, creating a cohesive global view instead of fragmented local snapshots.

Beyond on the ground surveys

By combining geospatial data, AI and machine learning, we map building stock across cities with greater accuracy and objectivity than current market measures, giving you supply insights that are consistent and scalable.

Truly independent insights

We are independent of real estate brokerage and investment activity. Our forecasts are impartial, unbiased and designed to tell you what is really happening in the market and the trends that matter most.

Benefits

- See how changes in growth, interest rates or government policy filter through to city-level real estate markets.

- Pinpoint markets with the strongest rental growth and return potential across short, medium and long horizons, powered by our award-winning forecasts.

- Compare performance consistently across countries, cities and sectors using a globally standardised real estate dataset.

- Test how economic and policy shocks could affect rents, yields and returns with our model-backed scenarios.

- Stay ahead of market developments and anticipate turning points in demand, pricing and capital flows with independent, unbiased analysis from our team of experts.

Latest insights

Client testimonial

The Real Estate Economics Service allows us to link the top-down economic outlook, drivers and risks, with our market-level forecasting and return expectation setting. This allows us to be more strategic about our allocations and how to build & maintain a well-diversified portfolio.

As an active international lender for commercial real estate, the expansion of Oxford Economics’s Real Estate Economics Service to include analysis and forecasting of real estate markets is a real gain and represents an addition to the comprehensive service we have been benefitting from for many years

Oxford Economics is synonymous with high quality macroeconomic research. A compelling reason for us to subscribe to its Real Estate Economics Service.

Request a demo

Request a demo to experience our Real Estate Economics Service firsthand. Fill out the form with your details, and our team will contact you shortly to schedule your personalised session.

We are committed to protecting your right to privacy and ensuring the privacy and security of your personal information. We will never share your details with third parties, and you can unsubscribe at any time.