Blog | 30 Apr 2021

Working from home: have we got ahead of ourselves?

James Bedford

Senior Economist

There has been extensive debate about the future of work after the coronavirus pandemic. At the heart of this is the uncertainty over the extent to which people will work from home (WFH), and whether office working is a thing of the past. Announcements by blue-chip corporates stating they will move to WFH-only policies have attracted big headlines. Meanwhile, academics and HR professionals are busy pontificating on the best design for WFH policies so firms can continue to benefit from creative collaboration, onboarding and training new staff members, and effective performance monitoring.

But the facts may tell a different story—at least in the UK: Last week the Office for National Statistics released data on the extent to which people employed in the UK had worked from home in 2020. Almost two-thirds of all employees (64%) did not work from home at any point last year (which includes those who were furloughed). Some 18% had worked from home recently, 10% had occasionally, and only 8% mainly did. This total of 36% of the employed population that did some work at home in 2020 was an increase of only 9 percentage points compared with 2019. So while the coronavirus pandemic has driven an increase in the proportion working from home, the change is much less than the press attention suggests.

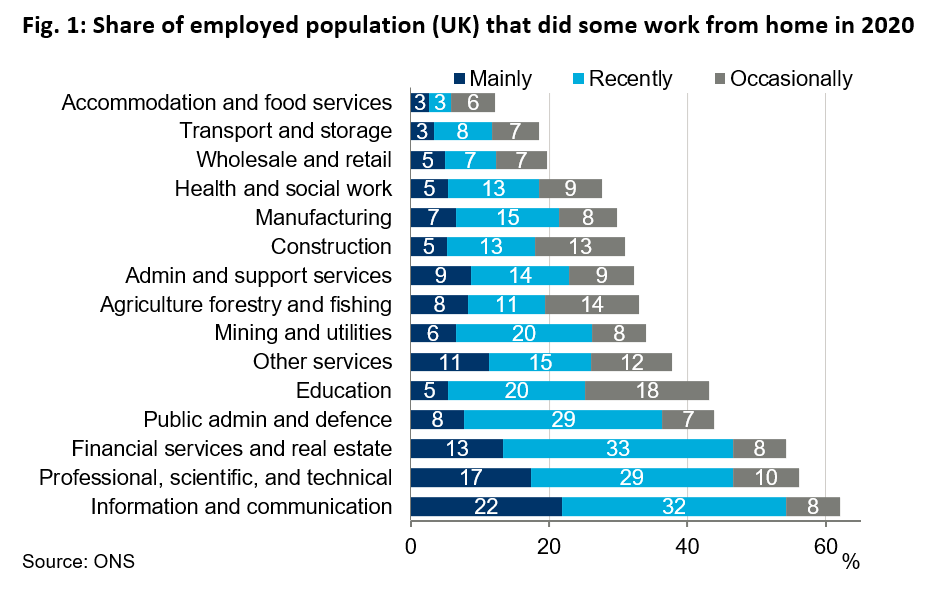

Of course, the ability to work from home is not shared equally across the labour market. Analysis of the data shows professional service sectors have seen the most homeworking. Those employed in the information and communication sector were the most likely to have worked from home, with 62% doing so at some point in 2020 (Fig. 1). This was followed by 56% of those working in professional, scientific, and technical activities. The industries with the lowest prevalence of homeworking tend to be those that are customer-facing, such as accommodation and food services at 12%, and wholesale and retail at 20%.

Of course, the ability to work from home is not shared equally across the labour market. Analysis of the data shows professional service sectors have seen the most homeworking. Those employed in the information and communication sector were the most likely to have worked from home, with 62% doing so at some point in 2020 (Fig. 1). This was followed by 56% of those working in professional, scientific, and technical activities. The industries with the lowest prevalence of homeworking tend to be those that are customer-facing, such as accommodation and food services at 12%, and wholesale and retail at 20%.

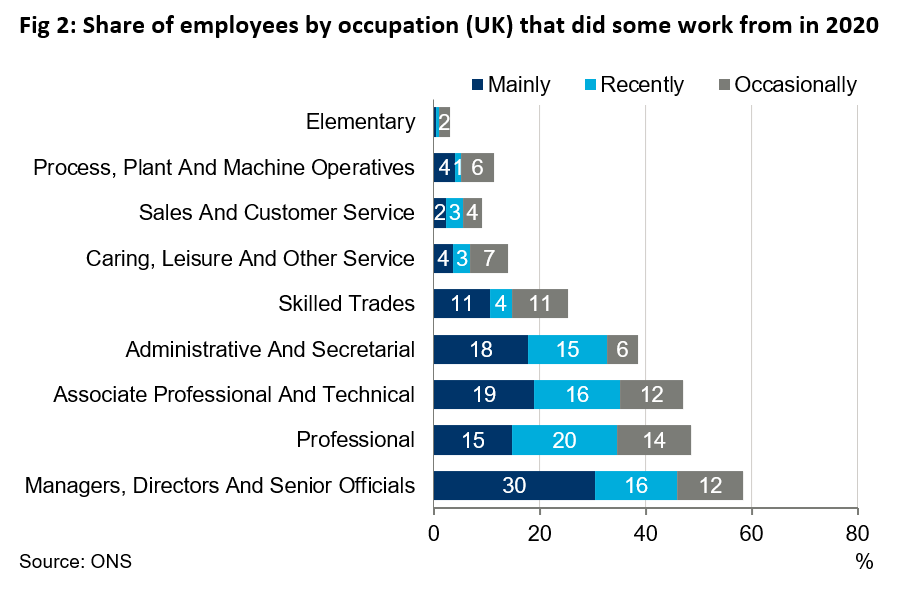

This was mirrored by a greater incidence of people in high-skilled occupations working from home in 2020. People in high-skilled occupations best suited to head office and professional roles were more likely to have worked from home during the pandemic (Fig. 2). In contrast, there was little uptake in homeworking from those in customer service and elementary occupations (such as labourers, cleaning staff, and supermarket shelf fillers).

This was mirrored by a greater incidence of people in high-skilled occupations working from home in 2020. People in high-skilled occupations best suited to head office and professional roles were more likely to have worked from home during the pandemic (Fig. 2). In contrast, there was little uptake in homeworking from those in customer service and elementary occupations (such as labourers, cleaning staff, and supermarket shelf fillers).

To the extent that the move to WFH in 2020 has implications for the future, it seems likely to be concentrated in metropolitan areas and cities, where these sectors and head offices tend to be located. But these roles only make up a minority of jobs. ONS data show that out of the 32.4 million in employment in the UK at the end of last year, only 7.7 million—fewer than a quarter—worked in the five key WFH sectors of ICT, finance, support services, real estate, and professional, scientific and professional activities. Even among that minority, take-up will not be universal: this month Goldman Sachs said it wanted staff back at their desks “as soon as possible.”

Tags:

You may be interested in

Post

Geographic allocation alpha makes a comeback in CRE investment

While we expect that sector selection will still be an important component to generating alpha in commercial real estate investment, we think the thematic drivers that are likely to support outperformance over the next decade will require more emphasis on selecting for geography.

Find Out More

Post

Assessing the work-from-home impact on US office demand

The work-from-home movement has proven it has staying power. As a main driver of the structural shift in the office sector, the disruption from increased work from home is having a lasting impact on office performance. Office net operating income yields will expand significantly this year and we project office capital values will fall by 16.4% in 2023 and by 2.1% in 2024.

Find Out More

Post

Home working and remote rural places: Evidence, problems, and a proposal

Over the last year and a half, many office workers have decided they can work from almost anywhere with a desk, a decent internet connection, and enough space. People say they are just as productive at home as when they are in the office. If so, then maybe rural towns and villages can now compete with the big city, when it comes to productive desk-based working. Perhaps cities will no longer be the great drivers of growth?

Find Out More