Geographic allocation alpha makes a comeback in CRE investment

While we expect that sector selection will still be an important component to generating alpha in commercial real estate investment, we think the thematic drivers that are likely to support outperformance over the next decade will require more emphasis on selecting for geography.

What you will learn:

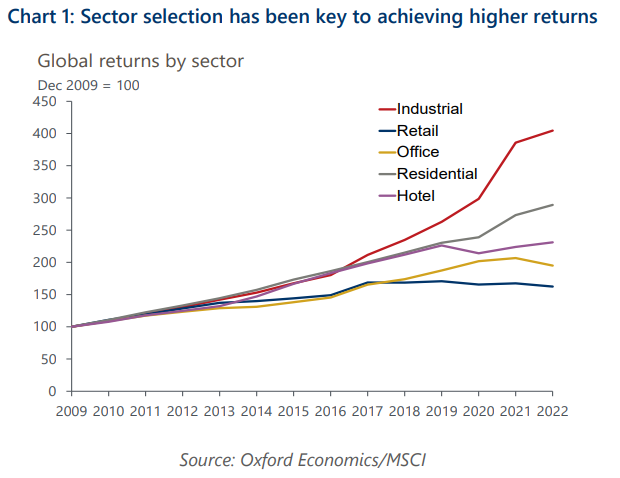

- Generating alpha over the past five-seven years has favoured those who have allocated correctly for sectors, rather than for geography. This shift away from geographic allocation is rooted in the recognition that structural drivers supporting outperformance have been more pronounced at a sectoral level.

- The significance of sector selection in CRE markets cannot be overstated. Notably, returns across sectors have exhibited notable disparities, particularly since 2016. For instance, global industrial returns have outperformed both the office and retail sectors every single year since 2011. At a country level, disparities in returns have been far more uniform.

- Now, though, the thematic drivers of these outperformances are changing. The industrial sector will see headwinds associated with deglobalisation and tailwinds from energy dynamics; the office sector will experience a contrasting set of effects from the work-from-home phenomena; and demographic shifts will play an ever-increasing role in both residential and retail markets.

Tags:

Related Posts

Post

Amid disruption, what can US office learn from retail?

We examined the disruption of generative AI at the US county level. We identified several metros – Atlanta, Denver, New York, San Francisco, and Washington DC – that had at least one county with the highest percent of displaced workers from AI.

Find Out More

Post

Four themes are shaping US real estate markets

This year is set to be a turning point for commercial property markets in the US. A gradual easing of inflationary pressures alongside a steady, if unspectacular, year for GDP and employment growth should help to ease the market through the final leg of the post-Covid adjustment. But there are four important themes market participants will need to understand to navigate the short and medium term successfully.

Find Out More

Post

Promising trends signal optimism for the hotel sector

The global travel recovery took great strides in 2023, with some destinations already reporting a full recovery back to pre-pandemic levels. Trends continue to suggest further growth in tourism activity going into this year, signalling optimism for the hospitality sector going forward. But risks stemming from inflation, geopolitical tensions and climate change will persist.

Find Out More