Blog | 10 Sep 2021

Why the era of low-cost travel is not necessarily over

Simon Kyte

Senior Economist, Tourism Economics

The cost of travel has fallen over the past two decades, with global average spending per international trip across all destinations down 17% in 2019 from its 2000 level in real prices. This has been enabled in part by cheaper air fares that have resulted in an increase in not only the volume of trips but also the proportion of shorter trips and weekend city breaks. But in the midst of a pandemic, with fewer travelers and rising costs, could the era of low-cost travel be over?

The most notable argument in support of this is that airlines will inevitably need to charge higher fares to survive. As McKinsey notes, carriers that were not bailed-out by governments have had to borrow heavily; those repayments will be made more challenging by declining credit ratings and higher financing costs. Meanwhile, the increased share accounted for by short-haul leisure—at the expense of business and premium class—will eat into profits and leave airlines little choice but to raise prices.

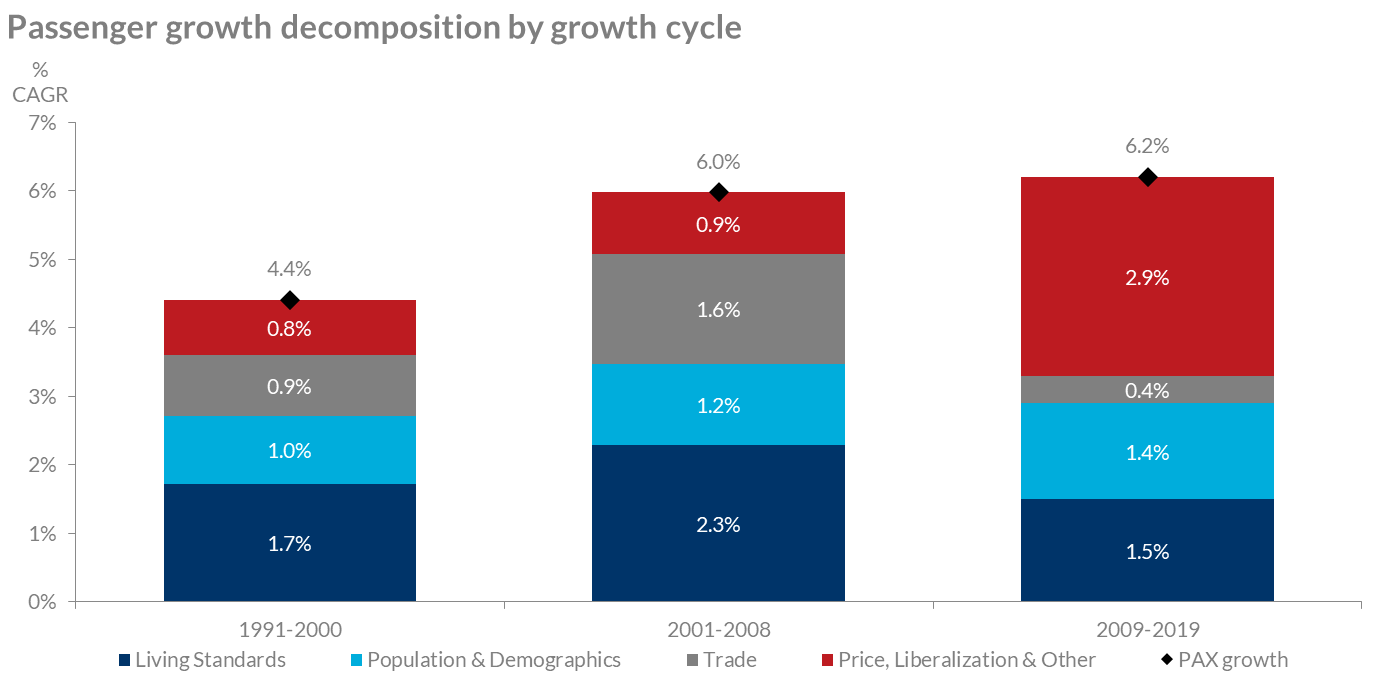

Prices have been declining since the dawn of the commercial air travel industry, alongside changes in products, markets becoming more liberalised and destination country visa regimes less stringent. Over the past three decades low-cost carriers have transformed business models, especially for shorter-haul air journeys. Discounting and market liberalization have driven the most recent growth cycle, accounting for nearly half of the passenger growth in the decade to 2019 with a notably weaker share from both living standards growth and trade than in previous cycles—see Tourism Economics/IATA’s Air Passenger Forecasts. This in part included some modal shift to air as well as growth in short-haul travel at the expense of domestic travel.

Given the significant role of discounting in the past decade, the key question is whether airlines will increase their fares to compensate for recent losses. The logic supporting an increase in prices might sound convincing, but so far the evidence is limited. Government support has covered some losses by airlines. Although this has been weighted strongly in favour of national flag carriers, even low-cost carriers have tended to survive and are planning “business as usual.” Comparatively normal flight schedules are returning, including some notable transatlantic announcements (such as from Jet Blue), meaning that competition should remain healthy, limiting price increases. However, there is greater uncertainty about the market and price environment outside intra-European and transatlantic routes, with longer-haul travel generally expected to recover more slowly.

Concerns about environmental sustainability are also a consideration. New taxes, restrictions (such as limits on internal flights when a suitable rail alternative is available) and consumer preferences for cleaner travel could put upward pressure on prices, as could new requirements around cleaner fuels and operating activities. However, it is striking that there remain very few examples of new restrictions or higher fees of this sort.

While there are plenty of reasons why travel prices may increase, the evidence is not definitive. Lower prices may not stimulate growth to the same extent as in the past ten years, but it appears unlikely that the age of low-cost travel is fully over.

Tags:

You may be interested in

Post

Promising trends signal optimism for the hotel sector

The global travel recovery took great strides in 2023, with some destinations already reporting a full recovery back to pre-pandemic levels. Trends continue to suggest further growth in tourism activity going into this year, signalling optimism for the hospitality sector going forward. But risks stemming from inflation, geopolitical tensions and climate change will persist.

Find Out More

Post

High satisfaction generates loyalty in the cruise industry, but experiences vary across segments and destinations

Tourism Economics’ latest cruise industry research briefing based on research among active cruisers identified strong underlying satisfaction with cruise experiences globally as nearly 90% rated their last cruise as good or very good.

Find Out More

Post

The important role of location and port appeal on cruise selection

Based on research conducted in Q4 2023 among active cruisers from five key markets, consumers demonstrated a strong preference to undertake cruises within their own global region.

Find Out More