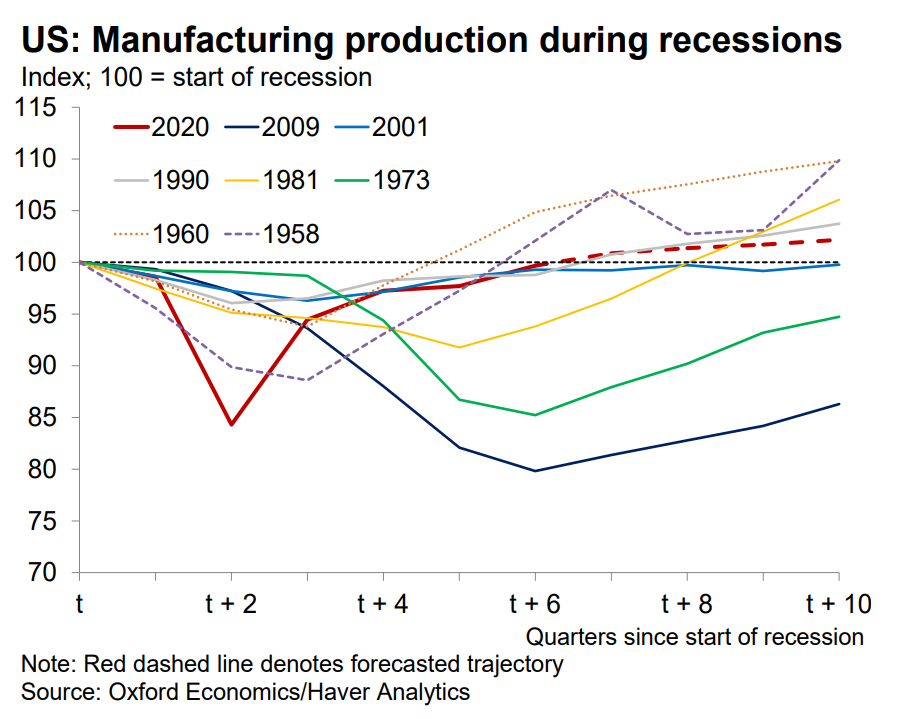

US | The changing face of manufacturing’s rebound in 2021

US manufacturing activity is currently above pre-coronavirus levels, marking

the fastest and strongest recovery in the past 60 years. A durable goods snapback in the latter half of 2020 powered the rebound, while nondurables

recovered more slowly. With manufacturing output now above its pre-recession level, we anticipate the recovery dynamics will flip this year, with growth in nondurables taking the lead.

What you will learn:

- Robust demand for automobiles and computers and electronics supported manufacturing’s rapid comeback in H2 2020.

- Looking ahead, nondurable goods will lead the manufacturing sector’s recovery in 2021. Chemicals, food and beverage, and petroleum and coal will be the main sources of growth.

- With more than half of states having recouped their pandemic-induced losses by the end of 2020, we expect all states to make up their losses by Q2 2021.

Tags:

Related Services

Post

Battery raw material prices to recover

Battery raw materials prices bottomed out last quarter and we think a sustained recovery is looming. Midstream EV battery manufacturing activity has picked up again and inventories have returned to historical levels, suggesting upstream demand for raw materials will also bounce back.

Find Out More

Post

Demographics are set to propel niche property types in the UK

As the UK population ages, time-use data suggest that the property sectors with structural tailwinds will be those that provide space for activities related to home entertainment, eating and drinking, socialising, events, leisure, hobbies, and sports/exercise.

Find Out More