Blog | 15 Apr 2021

In emerging markets, the world is even less flat

In his recent blog post, Richard Holt explored whether Covid-19 will lead to a permanent flight from the cities as people and their employers make permanent their favourable pandemic experiences—thus taking a job once located in a major city to a quieter area with lower housing costs and a more relaxed lifestyle. While he could imagine that people in their 30s and 40s will move out of large cities like London to an even greater degree than before (and advertises Bordeaux!), Richard does not expect the pandemic to lead to a major reorganization of work and living patterns, as the pull of big city life will remain.

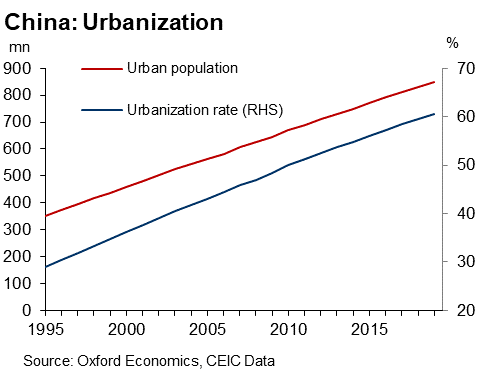

In most emerging market (EM) economies, it is even less likely for people to leave urban areas on a large scale, as the quality of life tends to be so much better there than in the rural areas where they come from. Take China, where hundreds of millions of people have migrated to cities in recent decades, drawn by higher incomes and better infrastructure and public services such as health and education. While infrastructure and services in the countryside have improved over time, the gap with cities remains vast. Indeed, since the outbreak of Covid-19 in February 2020, the number of people that have moved out of the large cities has remained small.

Of course in several ways China is not representative of what is happening in EMs. For one, in various EMs, the economic damage caused by the pandemic and government lockdowns has been significantly larger than in either advanced countries or China. India is a case in point: many millions of people tried to return home to their place of origin when the government imposed a lockdown of urban economies in end-March 2020, and many of them have not returned to the cities—yet. But as the Indian post-pandemic recovery matures, most of those people will likely be keen to return to metropolitan areas, if they have the choice.

Of course in several ways China is not representative of what is happening in EMs. For one, in various EMs, the economic damage caused by the pandemic and government lockdowns has been significantly larger than in either advanced countries or China. India is a case in point: many millions of people tried to return home to their place of origin when the government imposed a lockdown of urban economies in end-March 2020, and many of them have not returned to the cities—yet. But as the Indian post-pandemic recovery matures, most of those people will likely be keen to return to metropolitan areas, if they have the choice.

It is hard to generalize. Significant numbers of Indian white-collar workers enjoy remote working and some may end up living outside the largest cities because of their experience during Covid-19, similar to their British peers. But, generally speaking, in most EMs the charm of living in the countryside, or even in smaller cities, is less convincing than in advanced economies, making it less likely that large numbers of people will be keen to leave the big cities permanently.

Tags:

You may be interested in

Post

MENA – Latest Trends

Our blog will allow you to keep abreast of all the latest regional developments and trends as we share with you a selection of our latest economic analysis and forecasts. To provide you with the most insightful and incisive reports we combine our global expertise in forecasting and analysis with the local knowledge of our team of economists.

Find Out More

Post

Trumponomics – the economics of a second Trump presidency | Beyond the Headlines

The 2024 US Presidential Election is less than seven months away. In this week’s Beyond the Headlines, Bernard Yaros, Lead Economist, outlines two scenarios for the US economy if former President Donald Trump returns to the White House and Republicans sweep Congress.

Find Out More

Post

Global Trade Education: The role of private philanthropy

Global trade can amplify economic development and poverty alleviation. Capable leaders are required to put in place enabling conditions for trade, but currently these skills are underprovided in developing countries. For philanthropists, investing in trade leadership talent through graduate-level scholarships is an opportunity to make meaningful contributions that can multiply and sustain global economic development.

Find Out More