Research Briefing

| Sep 8, 2022

Energy price guarantee to cap inflation, temper recession

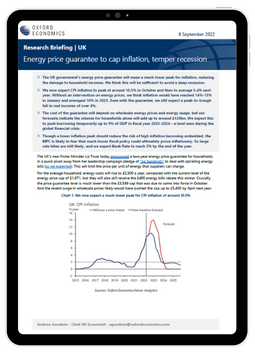

The UK government’s energy price guarantee will mean a much lower peak for inflation, reducing the damage to household incomes. We think this will be sufficient to avoid a deep recession.

What you will learn:

- We now expect CPI inflation to peak at around 10.5% in October and then to average 5.4% next year. Without an intervention on energy prices, we think inflation would have reached 14%-15% in January and averaged 10% in 2023. Even with the guarantee, we still expect a peak-to-trough fall in real incomes of over 4%.

- The cost of the guarantee will depend on wholesale energy prices and energy usage, but our forecasts indicate the scheme for households alone will add up to around £120bn. We expect this to push borrowing temporarily up to 9% of GDP in fiscal year 2023-2024 – a level seen during the global financial crisis.

- Though a lower inflation peak should reduce the risk of high inflation becoming embedded, the MPC is likely to fear that much looser fiscal policy could ultimately prove inflationary. So large rate hikes are still likely, and we expect Bank Rate to reach 3% by the end of the year.

Tags:

Related Services

Service

European Cities and Regions Service

Regularly updated data and forecasts for 2,000 locations across Europe.

Find Out More

Service

European Macro Service

A complete service to help executives track, analyse and react to macro events and future trends for the European region.

Find Out More

Service

Macro and Regulatory Scenarios

Our models, forecasts, and datasets can be customised to fit the unique needs of your organisation.

Find Out More