Ungated Post | 22 Feb 2018

China’s consumers shake the (retail) world

Chinese consumer market to overtake America’s by 2034. “Let China sleep, for when she wakes, she will shake the world.” The cautionary words of Napoleon have echoed ever more powerfully as China’s economic and political power has burgeoned over recent decades.

And with the seismic impact of the world’s most populous nation set to resonate ever more strongly than ever in coming years, in few areas of life will those reverberations be felt more than in the rise of China’s consumers as a global force.

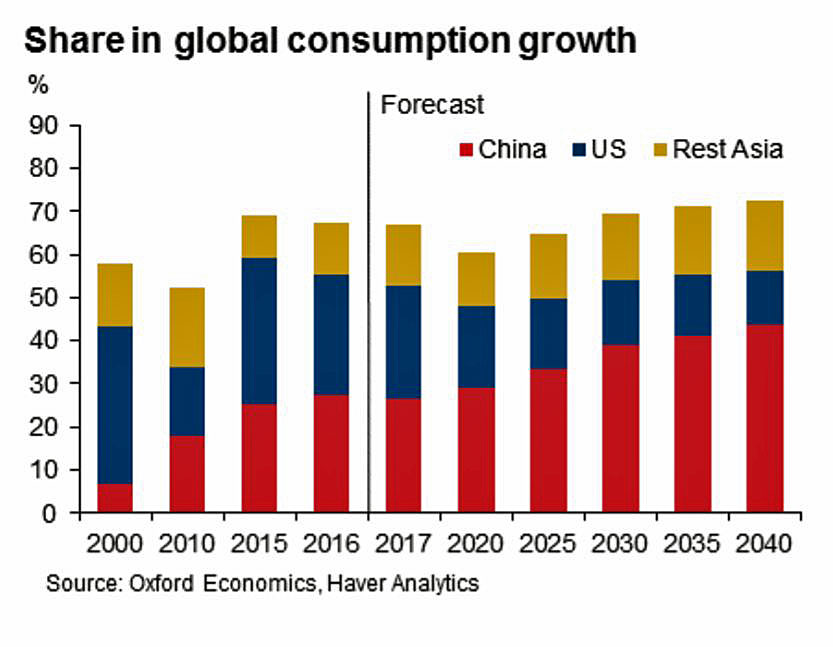

The magnitude of some of the numbers is startling. As recently as 2000, China contributed just 7% of the annual growth in consumer spending worldwide. By last year, China accounted for more than a quarter of consumption growth. And by 2040, our projections show that China will contribute 44% of the global figure – three-and-a-half times the expected contribution of the US, and 2.7 times more than the combined contribution of the whole of the rest of Asia.

China’s consumer market is set to expand by about 12% every year (in US dollar terms) to reach a value of $8.4 trillion by 2022.

The increase in the scale of consumer demand over just these five years is twice the current total size of UK consumer spending. And while a decade ago China’s consumer market was only one-sixth the size of that in the US, by now it is already one-third the size.

Outstripping the American consumer

We expect China to overtake the US as the world’s largest consumer market by 2034. In our new analysis of these potent trends, we identify several key driving forces.

Central to the growing global power of the Chinese consumer is a shift in spending patterns as rising living standards and household incomes see swelling numbers of Chinese shift from spending on necessities to buying ever-increasing amounts of discretionary goods and services, and increasingly, luxuries.

The changing appetites of China’s consumer can be seen in a drop in the share of spending on basic items including food and clothing from two-thirds in 1992 to 37% as of 2016. And the scope for this trend to continue is emphasised by the comparable figures of 30% in Japan, and just 18% in the US.

The flip-side is that the share of Chinese consumer spending on transport, communications, healthcare, recreation and education is climbing markedly with rising demand for big-ticket items, such as household appliances, cars and luxury products.

A growing appetite for luxury, travel – and healthcare

Chinese consumers spent over $75 billion on personal luxury goods in 2016, representing almost a third of the global luxury market (up from only this was 12% in 2008), and with the share expected to rise to 44% by 2025, according to consulting firm McKinsey.

And alongside increasing discretionary spending, China’s consumer demand is also become steadily more service-orientated. From 30% of spending in the early 1990s, consumption of services has risen to 55% (on 2016 data) with growth particularly pronounced in healthcare, education, recreation, travel and tourism.

China’s rapidly ageing population and increasing rates of chronic diseases are putting strains on the country’s healthcare system, leading wealthier consumers to purchase private sector alternatives.

Travel and tourism are also growing apace. Even with only 10% of China’s population holding valid passports, Chinese travellers accounted for 22% of international tourism revenues in 2016 – up sharply from just 3% a decade ago. And domestically, the number of trips since 2000 rose by nearly six-fold to 4.4 billion trips in 2016 – a figure expected to rise to 6.4 billion by 2020.

And a strong taste for tech

A third driving force propelling the Chinese consumer is rapid embrace of new technologies and online purchases. Last year alone, online retail sales (of goods and services) grew by a remarkable 39% year-on-year to $1 trillion – more than twice the value of US sales and nearly half of all global online retail sales.

Last year marked the first year in very many that Chinese household consumption’s contribution to overall growth in China significantly outstripped the contribution from capital investment.

Yet while there is no question of the escalating importance of Chinese consumers domestically and globally as an economic and social phenomenon, we also believe it is still premature to conclude the China is embarked on a long-awaited transformation from an investment- and export-driven economy into one led by consumption.

Consumer spending growth has remained relatively stable compared to that of investment, and consumption’s contribution to GDP growth exceeded that of investment last year largely because investment was weak. So in spite of its very rapid growth, household consumption still lacks the muscle to drive China’s economy on its own, and China remains quite dependent on investment to sustain growth.

Find out more: read our full research briefing on China’s consumers here.

Tags:

You may be interested in

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More

Post

Australia: RBA hike by another 25 bps as the fight against inflation continues

The RBA has raised its cash rate target by a further 25 basis points, taking it to 4.1%. Although inflation has peaked, the RBA board is still clearly uncomfortable with its brisk pace.

Find Out More