Research Briefing

| Jun 26, 2023

Nearshoring – China’s loss is not (yet) Mexico’s gain

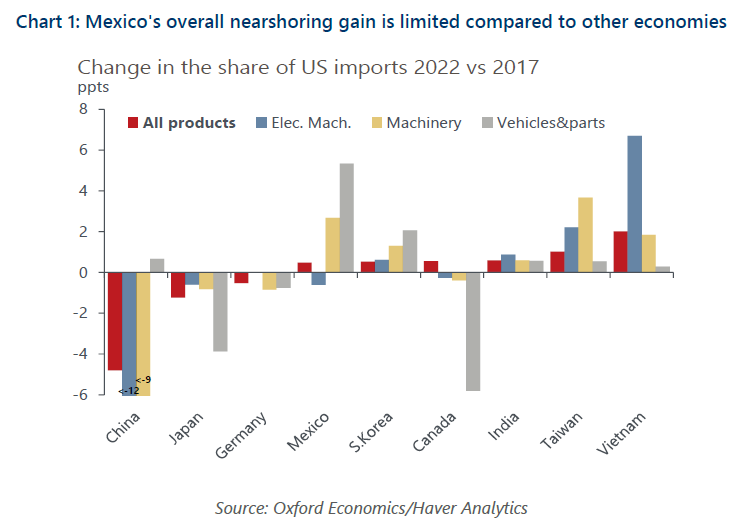

Mexico is the best-positioned emerging market to gain from “nearshoring.” but that does not mean it has seen the greatest benefits. Asian economies and Canada have grown their share of US imports faster than Mexico since the US-China trade decoupling started five years ago.

What you will learn:

- While Mexican exporters may slowly be growing their share in US markets in big manufacturing sectors, that has yet to translate into stronger industrial growth domestically. Instead, smaller sectors such as food & beverages and metals are benefiting the most.

- The strong post-pandemic rebound in Mexican exports and foreign direct investment (FDI) inflows support optimism, but the lack of domestic investment (public and private) prevents the country from taking full advantage of the nearshoring trend. Optimism over medium- to long-term prospects is ignoring the current underperformance of the auto and machinery industries.

Tags:

Related Services

Mexico Forecasting Service

Access to short- and long-term analysis, scenarios, and forecasts for the Mexican economy.

Find Out More

Asian Cities and Regional Forecasts

Key economic, demographic, and income and spending projections to 2035 for more than 400 locations across Asia-Pacific.

Find Out More

Latin America Macro Service

A complete service to help you track, analyse, and react to macro events and future trends across Latin America.

Find Out More