Blog | 28 Jul 2021

Australia’s cyclical factors drive construction cost growth

Although the structural drags on inflation in commodity prices will remain post-COVID, short-term cyclical factors have risen sharply in recent months in Australia. Construction has been a target of the recovery from last year’s COVID recession, both in terms of government policy and spending by households and businesses. At the same time, supply-chain disruptions have hampered the supply of a number of raw materials, resulting in building construction material costs rising rapidly, especially for commodities used in the detached house segment.

On the demand side, ultra-low interest rates, increased savings and the shift to working from home have all boosted the appeal of detached houses across the board, sending detached house approvals soaring after the initial pandemic downturn. With relatively short delivery timelines compared with other build forms and a high activity multiplier, house construction represents a common focus for stimulus. Whilst Canada offered a GST rebate and New Zealand relaxed LVR (loan-to-value ratio) restrictions, Australia’s HomeBuilder program, offering A$25,000 grants to owner-occupiers to build new homes, was the most generous and wide-ranging of the fiscal stimulus in response to the pandemic. These government measures acted to support the already favourable market conditions, supercharging demand in the detached house segment.

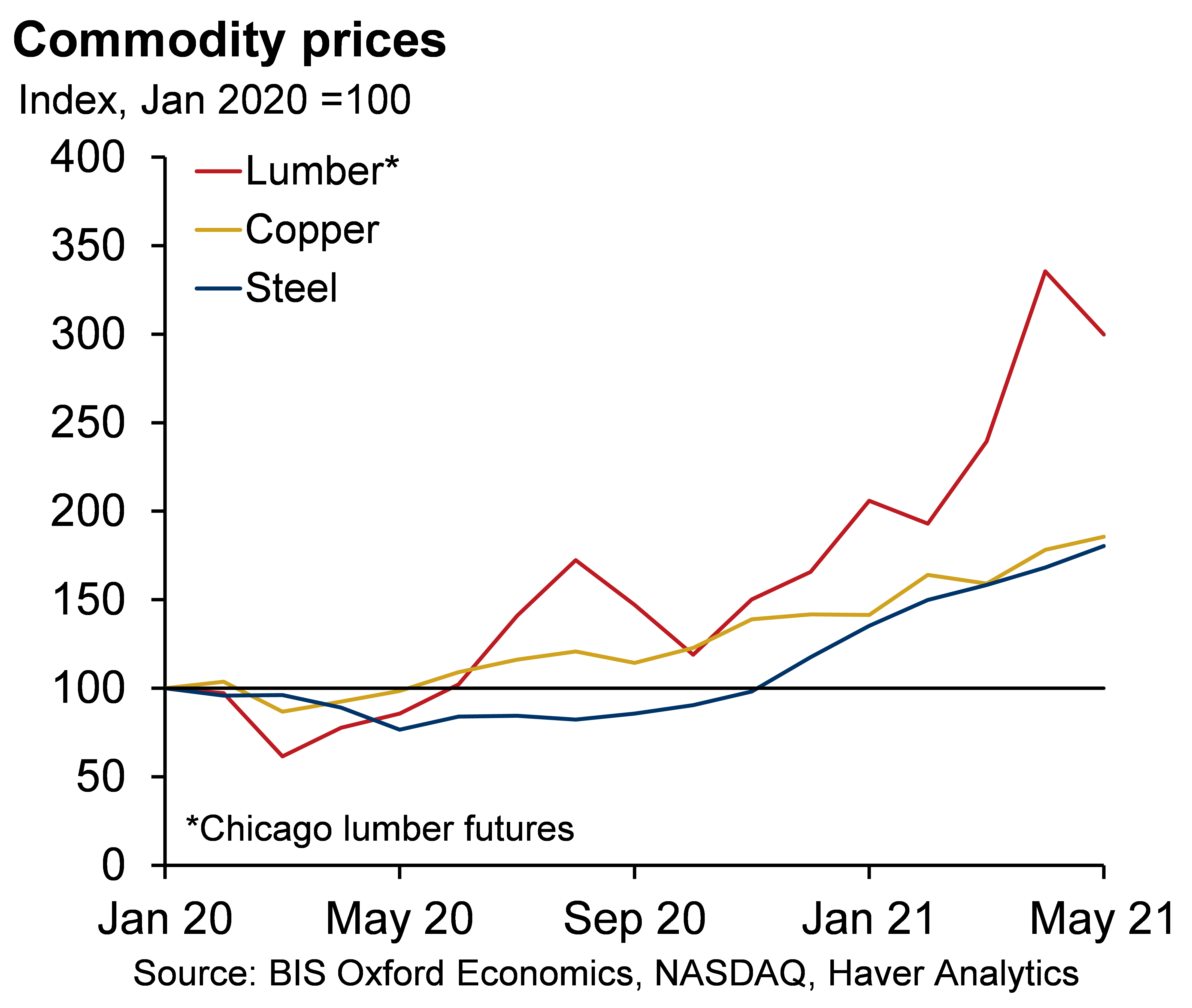

In tandem with strong demand, supply-chain disruption has also played a role in cost inflation. The steel outlook for the global economy was highly uncertain a year ago, and many mills were therefore cautious restarting production. For copper and iron ore, mines in key Latin-American producing regions have been severely affected by the rapid spread of the virus, worker strikes and natural disasters. Whilst iron-ore production has begun to ramp up again, copper typically takes longer to respond to changes in demand.

While the impact of these supply disruptions is already being felt, raw material price changes usually bleed into the market over time. Trade redirects to markets with the highest prices, prompting contracts between builders and suppliers to be updated to reflect the price growth. For many inputs, therefore, the recent surge in raw materials has likely not yet fully flowed through to final construction input prices.

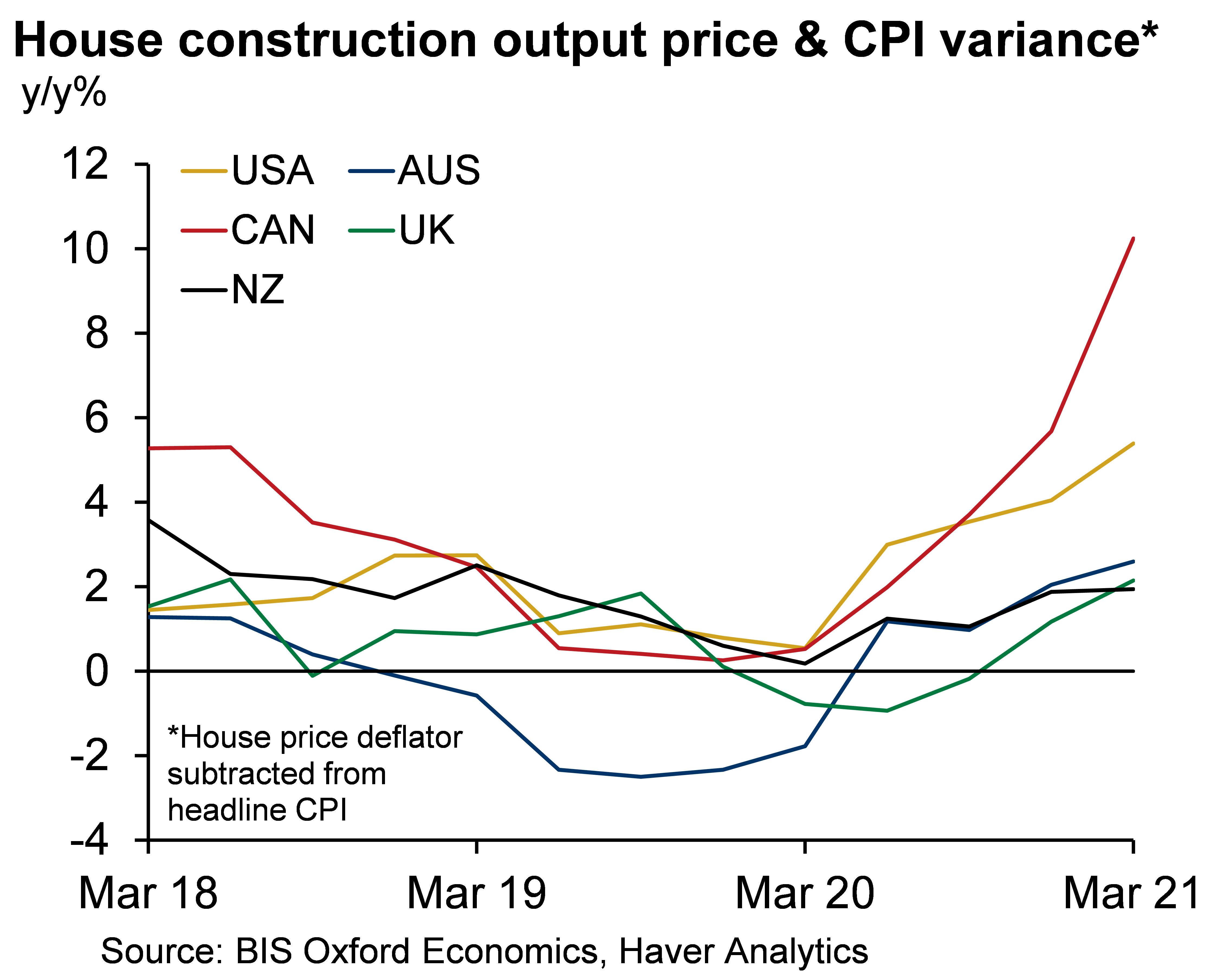

Furthermore, construction costs historically cycle with activity (independent of the outlook in commodity markets), with builders increasing margins when times are good. The trends materialising in demand and supply (along with rising operating margins) have pushed house construction cost inflation well ahead of general price movements in a number of countries. Whilst softer apartment construction and pockets of non-residential building (e.g. offices, accommodation, and retail) may provide some release, previous cycles suggest there is still some time left to run.

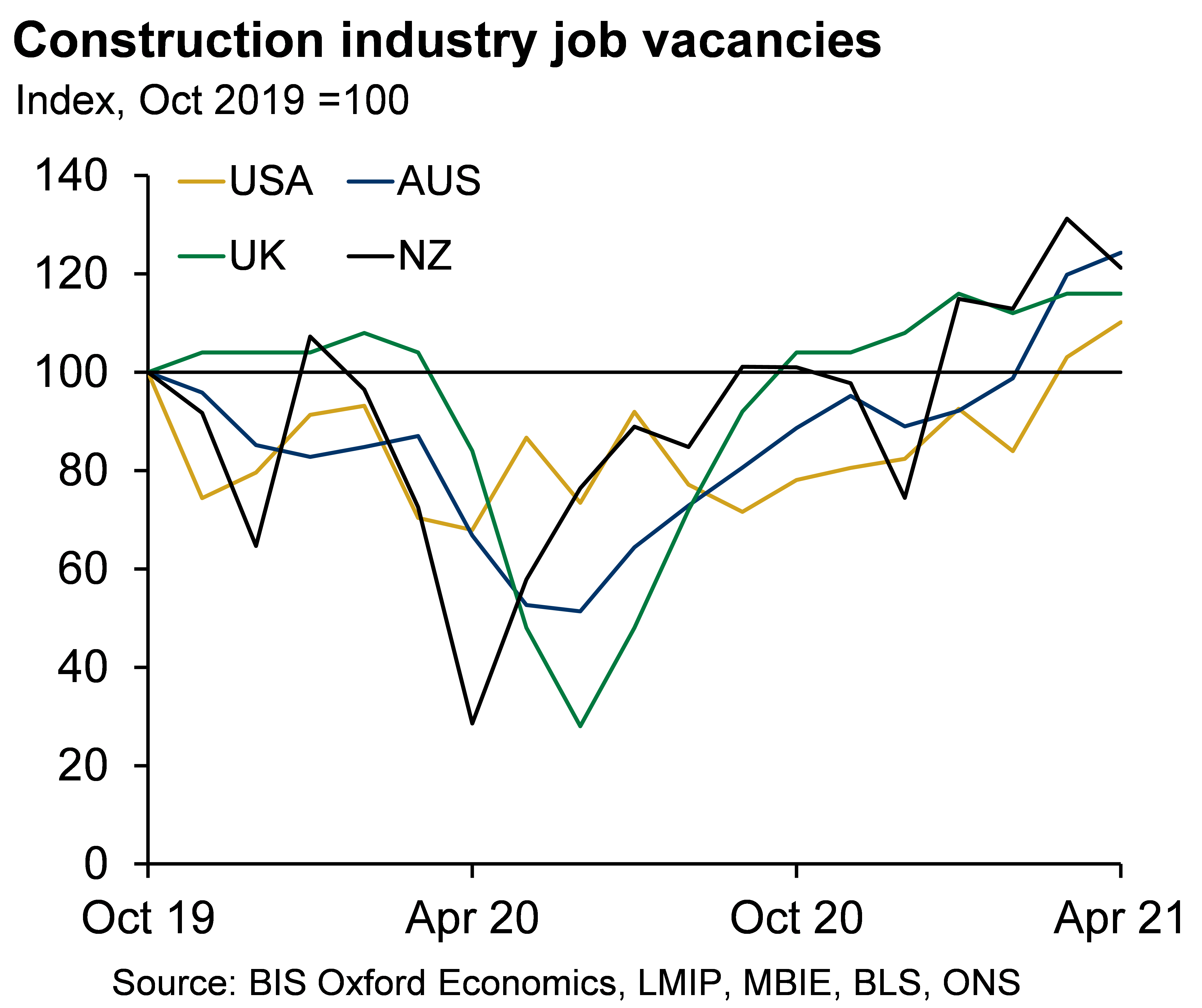

With a rising backlog of work, pressure is also starting to build in the labour market. Job vacancies in the construction sector have shot up off the initial pandemic low, and are now well above pre-crisis levels in sampled countries. The global nature of the construction boom, alongside international border closures, has prevented offshore workers from filling labour shortages over the near term. This is set to place upward pressure on construction wages, which make up a sizeable portion of final build costs.

Overall then, all signs point to an elevated profile for construction costs over the near term. It is important not to misconstrue the broad uplift in commodity prices for structural change. Whilst structural shifts will play out as we move to a greener economy, and some inputs will experience price rebasing over the coming years, cyclical factors are dominating at present.

Looking forward, labour shortages for certain trades are set to worsen as project backlogs increase. Whilst supply chains are repairing and new production capacity is being brought online, supply will continue to struggle to keep pace with demand for some key material inputs. With an eye on house construction, cost growth can be expected to continue running well ahead of headline CPI into 2022, before supply responds and demand abates, turning price movements in the opposite direction.

Tags:

You may be interested in

Post

MENA – Latest Trends

Our blog will allow you to keep abreast of all the latest regional developments and trends as we share with you a selection of our latest economic analysis and forecasts. To provide you with the most insightful and incisive reports we combine our global expertise in forecasting and analysis with the local knowledge of our team of economists.

Find Out More

Post

How Canada’s wildfires could affect American house prices

The Northern Hemisphere is now heading into the 2024 fire season, having just had its hottest winter on record. If it is anything like last year, we can expect to see further impacts on people, nature, and global markets.

Find Out More

Post

Navigating the US Economic and Real Estate Transition

This year is set to be a turning point for commercial property markets in the US. A gradual easing in inflationary pressures alongside a steady, if unspectacular, year for GDP and employment growth should help to ease the market through the final leg of the post-COVID adjustment.

Find Out More