Research Briefing

| Sep 8, 2022

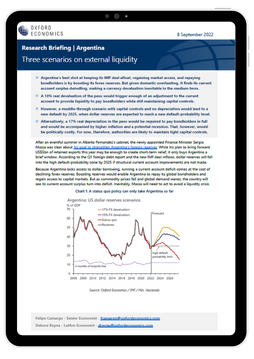

Three scenarios on external liquidity for Argentina

Argentina’s best shot at keeping its IMF deal afloat, regaining market access, and repaying bondholders is by boosting its forex reserves. But given domestic overheating, it finds its current account surplus dwindling, making a currency devaluation inevitable in the medium term.

What you will learn:

- A 10% real devaluation of the peso would trigger enough of an adjustment to the current account to provide liquidity to pay bondholders while still maintaining capital controls.

- However, a muddle-through scenario with capital controls and no depreciation would lead to a new default by 2025, when dollar reserves are expected to reach a new default-probability level.

- Alternatively, a 17% real depreciation in the peso would be required to pay bondholders in full and would be accompanied by higher inflation and a potential recession. That, however, would be politically costly. For now, therefore, authorities are likely to maintain tight capital controls

Tags:

Related Services

Service

Latin American Cities and Regions Service

Forecasts for key economic, labour market and industry variables for major business centres in Latin America.

Find Out More

Service

Latin America Macro Service

A complete service to help you track, analyse, and react to macro events and future trends across Latin America.

Find Out More