Why neutral rates have risen and why it matters

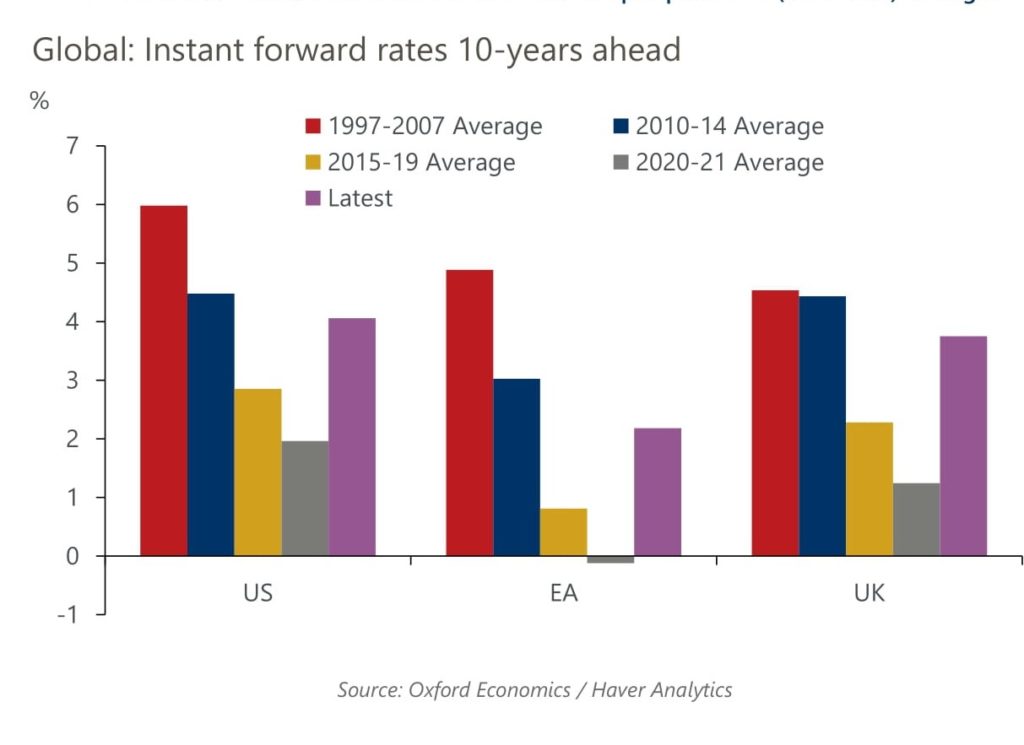

Long-term forward rates have risen markedly in the US, Eurozone, and UK over the last year, and are well above pre-pandemic (2015-2019) averages.

The main driver for this rise in the nominal neutral rates is probably an underlying increase in inflation expectations and consequent increase in nominal pay growth. Meanwhile, the key forces behind the long-term decline in neutral real rates – productivity, demographics, global capital flows – are still in play.

Inflation expectations may remain elevated for some time, reflecting the scarring from the current high inflation rates and an increase in inflation volatility compared to the exceptionally low volatility in the 20 years before the pandemic.

We think it’s likely that the neutral level of nominal interest rates in the coming years will be above the pre-pandemic lows, but still below levels in the pre-global financial crisis period. Uncertainty over both the neutral level of nominal policy rates and the stability of inflation expectations is adding to the challenges facing central banks, making it harder for them to stabilise real activity in line with potential.

Tags:

Related Posts

Post

More pain still to come from the mortgage payment shock | Canada Up Close

Total mortgage payments surged after the Bank of Canada began aggressively hiking interest rates in early 2022. In this month’s video, Callee Davis, Economist, discusses why we believe there is more pain still to come from the mortgage payment shock in Canada.

Find Out More

Post

BoJ to raise its policy rate cautiously to 1% by 2028

We now project that the Bank of Japan will start to raise its policy rate next spring assuming another robust wage settlement at the Spring Negotiation. If inflation remains on a path towards 2%, the BoJ will likely raise rates cautiously to a terminal rate of around 1% in 2028.

Find Out More

Post

More pain still to come for Canada from the mortgage payment shock

Mortgage payments have soared since the Bank of Canada began aggressively hiking interest rates in early 2022, and there is more pain to come as borrowers continue to renew their mortgages this year.

Find Out More