Blog | 29 Mar 2022

Why China is crucial for the recovery in global international tourism

International travel is expected to begin the long road to recovery this year, notwithstanding the risks posed by the war in Ukraine and associated escalation in fuel prices. Tourism Economics’ baseline projections are for global international arrivals in 2022 to recover to around 40% below 2019 volumes, well above the trough of the past two years. Full recovery of 2019 global international travel is currently expected in 2025.

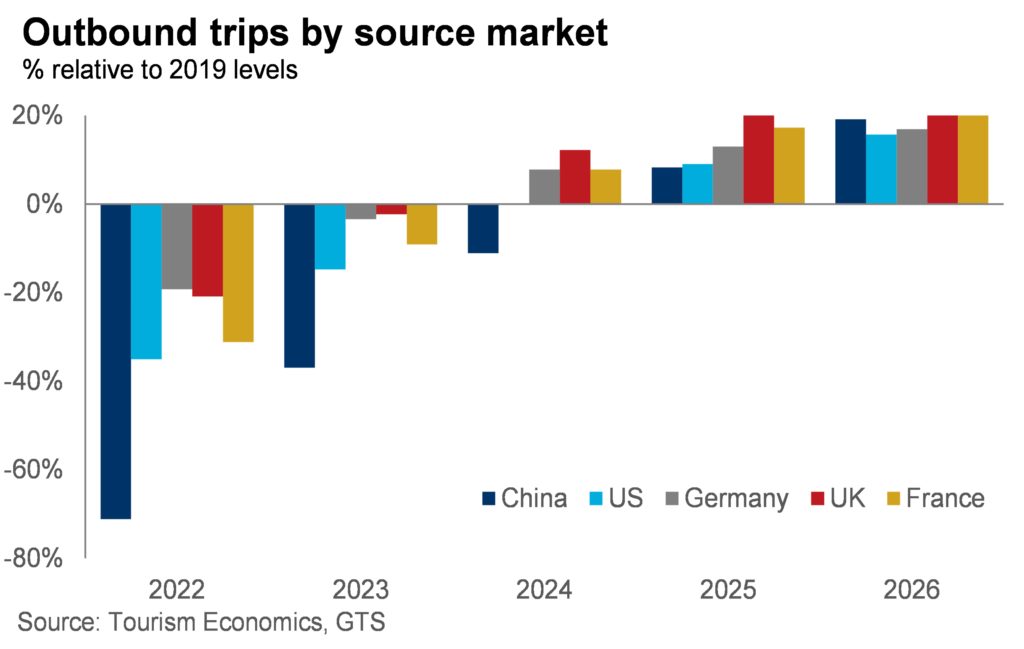

China, the world’s largest outbound market for spending in 2019, is expected to stay largely closed to international travellers until the second half of 2022, as part of their strict and ongoing “covid-zero” policy. While primarily targeted at inbound travel, entry restrictions also affect returning residents and therefore limit departures. As a result, outbound travel from China is expected to recover much more slowly than the other four largest pre-pandemic international source markets in 2022 and in 2023.

The pace of China’s reopening is of significant concern to the global tourism industry, given the country’s crucial role in supplying international travellers (almost 12% of spending and 8% of visitors worldwide in 2019). China was also a key driver of growth in the decade prior to the pandemic, accounting for one-quarter of the increase in international travel spending from 2010 to 2019 and 15% of the growth in visitors.

Baseline expectations are for China’s outbound recovery to catch up with the relative recovery of the other four largest source markets by 2026 and outpace them in subsequent years. This catch-up—and general long-run outlook in later years—is driven by expected growth in household income, higher propensity among the Chinese population to travel, and a significant increase in the number of middle-class households. However, a manifestation of downside risks could weaken Chinese outbound tourism (such as geopolitical tensions or prolonged isolation) and would jeopardise the international tourism recovery for all destinations worldwide.

For example, in a severe downside scenario where outbound Chinese visitors in 2026 remain 50% lower than 2019 volumes (rather than the baseline growth projection), significant additional growth would be needed elsewhere to realise the same global recovery of one-fifth more international travellers. If spread across all other markets, the required increase would be an extra 6%-7% for each and every market—at least an additional one-third on top of expected growth. For one market in isolation to compensate for China’s weakness is highly unfeasible—an increase five times the volume of the baseline uptick would be needed from the US, four times the size for Germany or the UK, and almost 40 times the baseline increase for India.

Such a scenario is unlikely, though not impossible, and demonstrates how crucial China is to global international tourism. While destinations in APAC are most reliant on Chinese visitors, all regions are subject to the risk of dampened growth in Chinese outbound. China drove growth in all destinations prior to the pandemic and will remain a crucial part of recovery and long-run expansion.

Tags:

You may be interested in

Post

Wheat prices soften in 2024, but risks tilted to the upside

Households have been grappling with sharply higher food bills over the past couple of years because of rocketing agricultural commodity prices, which have contributed to sharply higher inflation globally. Key amongst these agricultural commodities is the price of wheat, which is especially important in much of the developed world.

Find Out More

Post

The EV market and its role for battery metals prices

Battery metals prices have collapsed in 2023. Oversupplied markets for these metals added to the downward pressure stemming from investors’ concerns about the Chinese EV outlook.

Find Out More

Post

MENA – Latest Trends

Our blog will allow you to keep abreast of all the latest regional developments and trends as we share with you a selection of our latest economic analysis and forecasts. To provide you with the most insightful and incisive reports we combine our global expertise in forecasting and analysis with the local knowledge of our team of economists.

Find Out More