Blog | 28 Oct 2021

Why Canada needs a 10%-15% house price correction

Tony Stillo

Director of Canada Economics

Rock-bottom mortgage rates and a pandemic-driven shift in buyer preferences have triggered a burst of housing demand that has run hard against a severe lack of supply, causing house prices to explode. Meanwhile, investors, house ‘flippers,’ and speculators, which according to the Bank of Canada account for over 20% of home purchases, have aggravated the severe demand-supply imbalance catapulting home prices nearly 40% higher than pre-pandemic levels.

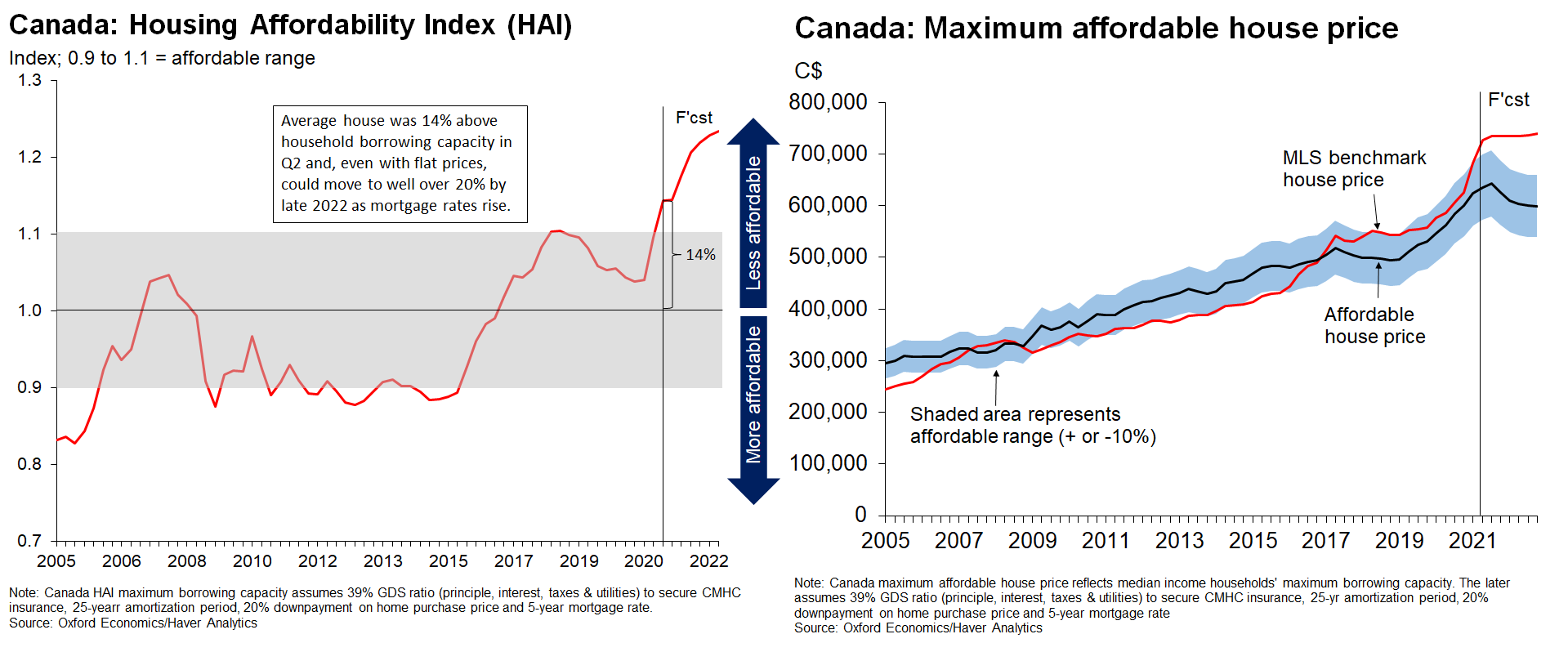

Based on our Housing Affordability Index, sky-high prices have pushed the average Canadian home 14% above what median-income households can afford—a three-decade high. And it’s likely to worsen. Even with plateauing house prices in our baseline forecast, we expect rising mortgage rates will push house prices more than 20% above affordability for the typical Canadian household by the end of 2022.

Past experience suggests housing can remain unaffordable for years, but eventually prices realign to household borrowing capacity. Toronto homes in 1990 cost a staggering 60% more than what average-income households could afford, and it took five years of falling interest rates, lower house prices, and rising incomes to make a typical Toronto home affordable for locals.

Now, with mortgage rates expected to rise from their historic lows, making housing affordable again will come from either much stronger growth in household income, which appears unlikely, or from lower prices. While we can’t ignore the risk that the price bubble could burst, we believe a crash is unlikely considering the government’s generous stimulus, abundant underlying demand, and a resumption of high immigration.

Instead, we think the economy is sufficiently well-positioned for the government to implement policies to engineer a managed correction to nominal house prices of around 10%-15%. We think a drop of this magnitude would realign prices with domestic fundamentals.

How to do it? During Canada’s recent federal election, all the major parties proposed surprisingly similar solutions. In our view some key initiatives in the Liberal’s housing plan could provide a quick boost to supply while also lowering price expectations:

- A speculation and house-flipping tax could change views about future home-price appreciation, like British Columbia and Ontario’s non-resident speculation taxes introduced in 2016 and 2017, respectively. It could also prompt multiple-properties owners, who continue to account for more home purchases than first-time buyers in Ontario, to sell.

- A two-year ban on foreign ownership, as proposed by the Liberals, would be a good first step. But a permanent ban would best help realign home prices with domestic fundamentals. While Australia only restricts foreigners from purchasing existing homes, Canada should also prohibit foreign buying of new builds, given domestic challenges in developing new housing.

- The planned national tax on non-resident-owned vacant homes and its extension to vacant land in urban areas could prompt the quick listing of unused properties, while ensuring existing residential dwellings owned by foreigners remain available as rentals.

- A government commitment of C$600 million to support the conversion of empty office and retail space into housing could quickly add needed housing in urban areas and also alleviate the pandemic-driven jump in commercial property vacancies.

- While laudable, measures that will directly boost demand, such as plans to allow 30-year mortgages or to enhance the First-Time Home Buyers Tax Credit, should be shelved for now.

The recent surge in house prices has put the dream of home ownership out of reach for many Canadians. To help those not already on the property ladder, action is needed. And fast.

Tags:

You may be interested in

Post

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More