Unprecedented mix of challenges hurts APAC’s 2023 outlook

Asian economies are no strangers to economic setbacks. Over the last 25 years there have been three significant shocks: the Asian Financial Crisis (AFC) of 1997-1998, the bursting of the Dotcom Bubble in 2001, and the Global Financial Crisis (GFC) in 2008. Asian economies bounced back smartly each time. Even as structural scars remained, growth returned quite quickly and was sustained. However, this time is likely to be different.

What you will learn:

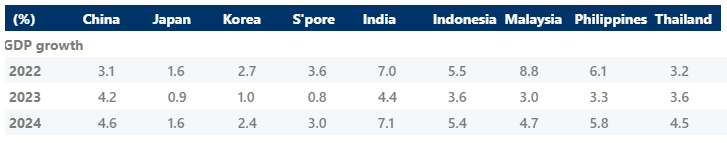

- Asia economies face an unprecedented combination of headwinds, including a global growth slowdown, China posting a lower growth rate than we have seen since reforms started over 40 years ago, the Fed raising rates and effectively forcing Asian central banks to follow, and higher oil prices.

- Looking to 2023, we think external environment will weigh heavily on the export-focussed region. Consumption demand is likely to be hampered by a need to rebuild savings. Investment will take time to improve. Governments have limited fiscal space to counter a renewed downturn.

- We forecast continued US dollar strength, meaning Asian currencies will remain weak. Pressure on currencies and supply-led domestic inflationary pressures will likely result in policy rates remaining high across the region.

Tags:

Related Resouces

Post

How Asia’s supply chains are changing | Techonomics Talks

Global supply chains have continued to expand, despite talk of deglobalization and nearshoring. US and Japan have started to de-couple from China, but other G7 countries grow more dependent on Chinese inputs. Several "hotspots" are emerging across Asia with multiple winning formulas.

Find Out More

Post

Singapore Business Awards 2024

We're delighted that Oxford Economics has been announced as the Most Innovative Global Economic Forecasting Specialists 2022.

Find Out More

Post

The long-term trends shaping global city consumer markets

Our long-term income and consumer spending forecasts reveal the high-potential urban consumer markets of the future. We identify four key trends underpinning shifts across global urban consumer markets over the coming decades.

Find Out More