Ungated Post | 08 Feb 2018

Business optimism over global outlook strongest for two years – OE survey

Companies’ spirits boosted by buoyant world trade and US fiscal stimulus measures as fears over North Korea tensions and China slowdown retreat.

Businesses are increasingly positive about prospects for the world economy, with optimism over the global outlook at its strongest for two years, according to Oxford Economics’ latest survey of global risk perceptions among clients and business contacts, including some of the world’s largest companies.

Optimism over prospects has grown over the boost to global growth from buoyant trade and the recent US fiscal measures, while at the same time fears over US-North Korea tensions as well as European populism have faded.

The rise in companies’ spirits comes as global markets have been jolted by nervousness over increased inflation risks amid expectations of strengthening world economic activity – although the survey was taken before the equity market turmoil of this week.

Compared with three months ago, more survey respondents judge that there to have been an increase in the probability of a sharp increase in global growth (33%) than see a sharp slowing (25%). This marks a level of optimism not seen since the inception of the survey two years ago.

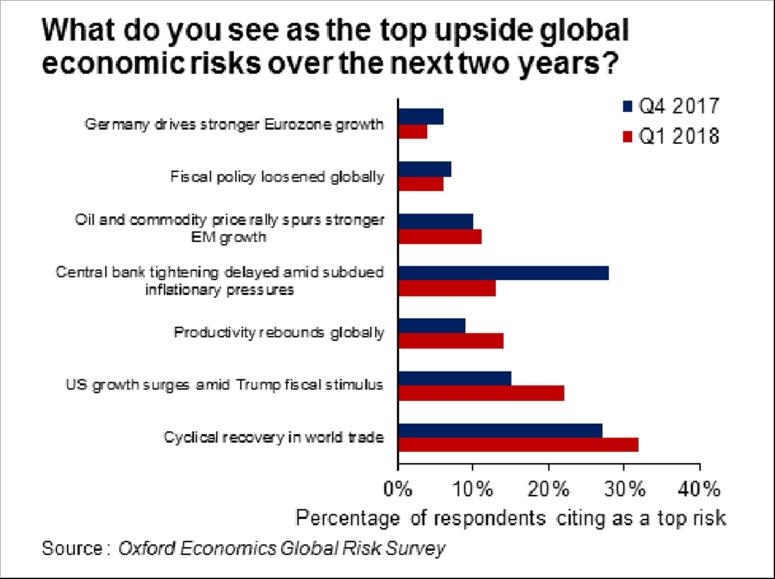

Survey respondents cite the ongoing recovery in world trade as the key potential upside for the global economy, with some 33% of respondents identifying this is the most important upside risk to prospects.

Optimism was also buoyed by the US fiscal measures with more than a fifth of respondents (22%) citing a surge in US growth following the stimulus as the biggest upside risk. This marked a notable recovery after a sharp weakening of those expectations in recent surveys amid previously increased worries over whether the Trump Administration and US Congress would deliver promised measures.

Business concerns over other major risks have eased markedly, meanwhile. Geopolitical worries have fallen to their lowest level since early 2017, and fears over the Chinese economy’s outlook have declined to the lowest since the survey began in Q1, 2016. Only 1% of respondents now view rising EU populism as the top risk for the global economy, although this remains significant concern.

In the medium-term, looking five years ahead, concerns over so-called ‘secular stagnation’ with major economies stuck in a pattern of low or no growth have also fallen to the lowest levels in 18 months, from 44% to just 12%.

However, respondents still judge that risks to global growth are slightly skewed to the downside, amid increased market fears and persistent concerns over US trade policy and protectionism.

US protectionism and market turmoil are seen as the key downside risks for businesses over the next two years. Both are cited as the top downside risk by more than a quarter of respondents (27% and 26% respectively), and as a top-three risk by more than three-fifths of respondents.

While fears over US trade policy echo the findings of past surveys, the rise in market concerns is the sharpest for any downside risk over the past year. Comments highlight central bank policy tightening as a key potential trigger for market disruption.

In the medium-term, protectionism is viewed as a “very significant” risk by 39% of respondents, up from 31% in our Q4 2017 survey. More than a third of respondents also cite debt levels and asset prices as key worries, with these concerns at their highest levels since the survey’s inception in early 2016.

* The quarterly Oxford Economics Global Risk Survey canvasses the views of Oxford Economics’ clients (including some of the world’s largest companies) and other business contacts. Collectively, the participating companies employ around 5 million employees and have a turnover in the region of US $2½ trillion. The latest survey was conducted following the passage of the US tax cut plan through Congress and against a backdrop of rallying stock markets, signs of continued strength in the global economy and increasing Fed rate hike expectations.

Tags:

You may be interested in

Post

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More