Blog | 28 Apr 2021

Risks and challenges to an “infrastructure-led” recovery

In a recent blog post we highlighted the role that public infrastructure investment can play in leading and sustaining economic recovery. Spending on “well chosen” productive infrastructure projects (where long-term economic benefits exceed costs) not only lifts domestic demand and employment in the short run, but also offers competitiveness and productivity benefits, effectively raising the long-term “speed limit” for economic growth.

Against these benefits, however, there are significant challenges and risks associated with targeting an “infrastructure-led recovery” from the COVID-19 recession.

Most critically, can the work be delivered on time, securing spill-over benefits to the broader economy? In Australia, BIS Oxford Economics has crunched the numbers. For every dollar spent on infrastructure construction, nearly another two dollars of economic activity are generated through indirect and induced impacts. Yet this assumes that there is spare capacity in the market (particularly in terms of skills and materials) to deliver on this spending, that those needed resources can be procured and delivered efficiently, and that there are simply enough “productive” projects that can be brought on quickly.

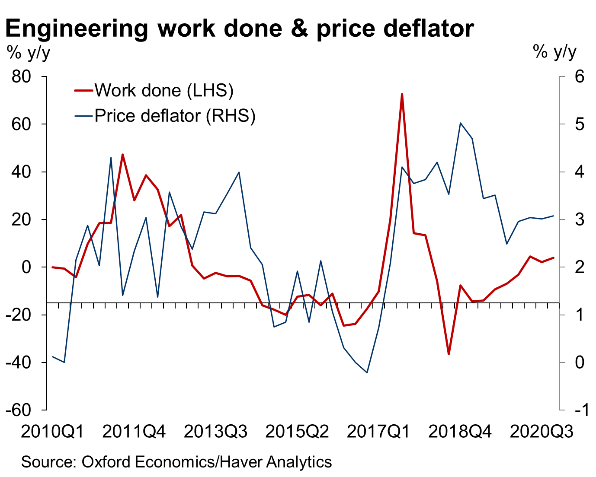

On all of these points, we have reservations. For an infrastructure-led recovery, the private and public sectors need to have the right mix of skills to procure and deliver projects. In Australia, much of the forecast upswing in infrastructure work is concentrated in highly complex projects involving overbuilding dense urban areas. Our research for the road and rail sectors shows that the private sector desperately needs more signalling and electrical engineers, tunnelling, and civil expertise (supervisors and forepersons) to meet this challenge. Public sector agencies need more engineering expertise to be “informed purchasers” of infrastructure services—particularly under-resourced local governments that may be the focus of a further infrastructure push. An eventual recovery in private building activity will also provide strong competition for building trades on public sector projects; in previous upturns costs and work done have moved together, suggesting that capacity constraints could bite in the future.

On all of these points, we have reservations. For an infrastructure-led recovery, the private and public sectors need to have the right mix of skills to procure and deliver projects. In Australia, much of the forecast upswing in infrastructure work is concentrated in highly complex projects involving overbuilding dense urban areas. Our research for the road and rail sectors shows that the private sector desperately needs more signalling and electrical engineers, tunnelling, and civil expertise (supervisors and forepersons) to meet this challenge. Public sector agencies need more engineering expertise to be “informed purchasers” of infrastructure services—particularly under-resourced local governments that may be the focus of a further infrastructure push. An eventual recovery in private building activity will also provide strong competition for building trades on public sector projects; in previous upturns costs and work done have moved together, suggesting that capacity constraints could bite in the future.

The success of an infrastructure push depends on having productive projects “ready to go.” In its latest Infrastructure Priority List, Infrastructure Australia noted the need to increase focus on regional projects that support pandemic-induced population shifts as well delivering on Australia’s transition away from fossil-fuel electricity generation. The focus on regional areas adds a further layer of complexity—do industry and government have the capacity and capability to begin work straightaway in remote areas? Here, extending broad-based maintenance and capital works programs may be more effective than large projects.

Ultimately, the success or failure in delivering on Australia’s “infrastructure-led” recovery may come down to several measurable factors: (i) how many sustainable jobs are actually generated and filled in the construction sector and more broadly across the economy; (ii) can the government deliver immediate increases in work done given the challenges faced; and (iii) will shortages in skills, plants and materials see increased spending flowing through to higher costs rather than higher activity? Over the last two decades, strong cycles in construction activity in Australia have coincided with large growth in construction costs.

We will soon find out if the next cycle succumbs to the same fate.

Tags:

You may be interested in

Post

2024 Insights: Australian Construction & Infrastructure

Calendar 2024 marks a turning point in the construction and infrastructure industry in Australia. While construction activity is expected to fall slightly in aggregate terms, there is also a shift in infrastructure priorities from transport to utilities, social building and resources infrastructure which will present regional challenges.

Find Out More

Post

Insight Forecast: Gain insights into the North American construction market

Oxford Economics and ConstructConnect produce forecasts for US and Canadian construction starts as part of ConstructConnect’s Insight Forecast. These forecasts include 34 building categories in the US and 23 categories in Canada, and the US and Canada national and regional data segmented by state, MSA (CMA), and county level. With these changes in the market dynamics, prudent forecasts help businesses to make informed decisions, and ultimately help support the wider economy.

Find Out More

Post

Weakness in construction and its related sectors show the impact of interest rate hikes

Ever since the onset of advanced economies’ campaign of interest rate hikes in December 2021 there has been a lively debate about the impact and efficacy of tighter monetary policy in terms of reducing inflation and slowing growth. While inflation has indeed fallen across the world, the relative economic resilience in the United States in particular, which has raised interest rates significantly more than the eurozone, has raised questions about if and how much interest rates are actually depressing activity.

Find Out More