Blog | 06 May 2021

Overtourism poses long-term questions for cities and their residents

George Bowen

Senior Economist, Cities & Regions

In a recent blog post, Will over-tourism be a problem again?, Eva McGrath-Olivan noted that while the increasing scale of pre-pandemic tourism contributed significantly to global economic growth and development, some popular city destinations were starting to experience what many of their residents regarded as over-tourism. In the most favoured quarters of cities such as Barcelona, wealthy tourist visitors have been blamed by locals for rapid rises in rents and prices, forcing residents to relocate to other parts of the city—or elsewhere entirely. Similar criticisms have been made in many other cities, both in Europe (Berlin and Amsterdam, for example) and around the world (such as San Francisco—although in that city the issue is entangled with the impact of high-paying tech companies on the housing market). In some cities, protestors have taken to the streets.

One view might be that this is not a new phenomenon. Like gentrification, over-tourism has been a facet of city development for centuries. What makes these recent developments different—and much more challenging—is the arrival of online rental platforms. A decade ago, such platforms were far more limited in scope, used mainly by a few local residents who rented out their apartments to tourists for a few weeks a year while they themselves went on holiday. But today’s platforms are global in their reach and have millions of users who can not only book easily but share their reviews, experiences and ratings of the properties they rent. This has led to a dramatic and fundamental change in the market: In a 2016 submission to the European Commission, the European Holiday Homes Association said that short-term rentals in Europe provided 20 million beds—twice the number of hotel beds.

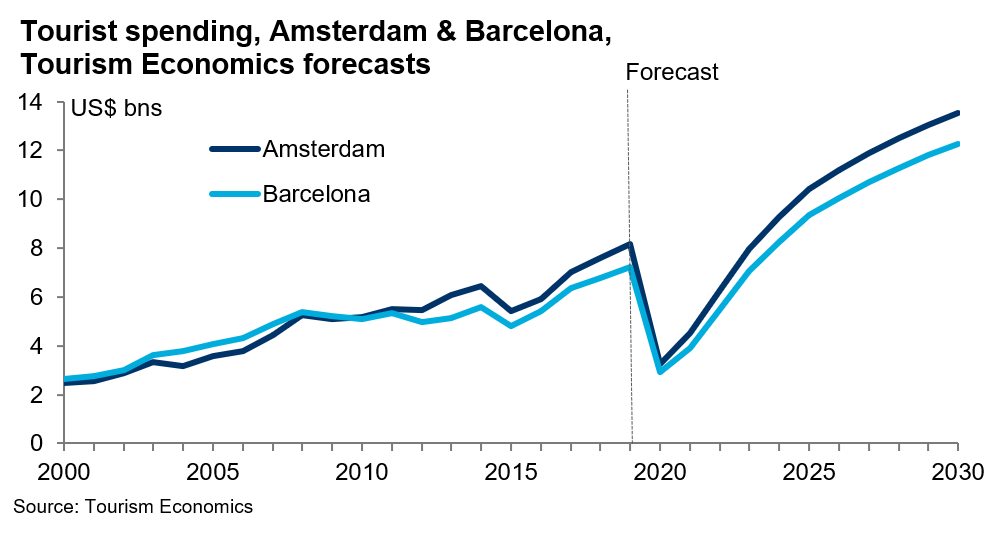

This change is without historical precedent. In the face of global buying power, many local communities feel they don’t stand a chance. Especially when their city governments, keen to see greater prosperity, have somewhat ambivalent views. Should they protect residents, or welcome the dramatic rise in tourist dollars that seems likely to occur as Covid-related restrictions ease (and as this chart illustrates)?

There’s an old answer to this sort of problem—introduce or tighten rent controls for existing tenants, and improve protection against eviction. But would it work? Economists are mostly sceptical of rent controls, pointing to negative consequences. It is argued that merely proposing rent controls could lead to an immediate surge in tenant evictions before the regulations could come into effect. Homes might be allowed to stand empty in lieu of renting them to residents who would be hard to evict. And many landlords would spend little on property maintenance in the hope that tenants would leave, to be replaced by tourists at much higher rents.

These arguments by economists have mostly convinced national and city governments. So, a wide range of cities are looking for other ways to regulate the online platform-based rental market. But as the visitor economy picks up, resistance to any regulations are likely to come from local businesses, decimated by the pandemic, at least as much as from the platform rental companies. In the post-pandemic world, the debates are likely to be intense and increasingly widespread.

Tags:

You may be interested in

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More

Post

Australia: RBA hike by another 25 bps as the fight against inflation continues

The RBA has raised its cash rate target by a further 25 basis points, taking it to 4.1%. Although inflation has peaked, the RBA board is still clearly uncomfortable with its brisk pace.

Find Out More