Blog | 31 Aug 2021

New business creation is a booster shot for the US job market

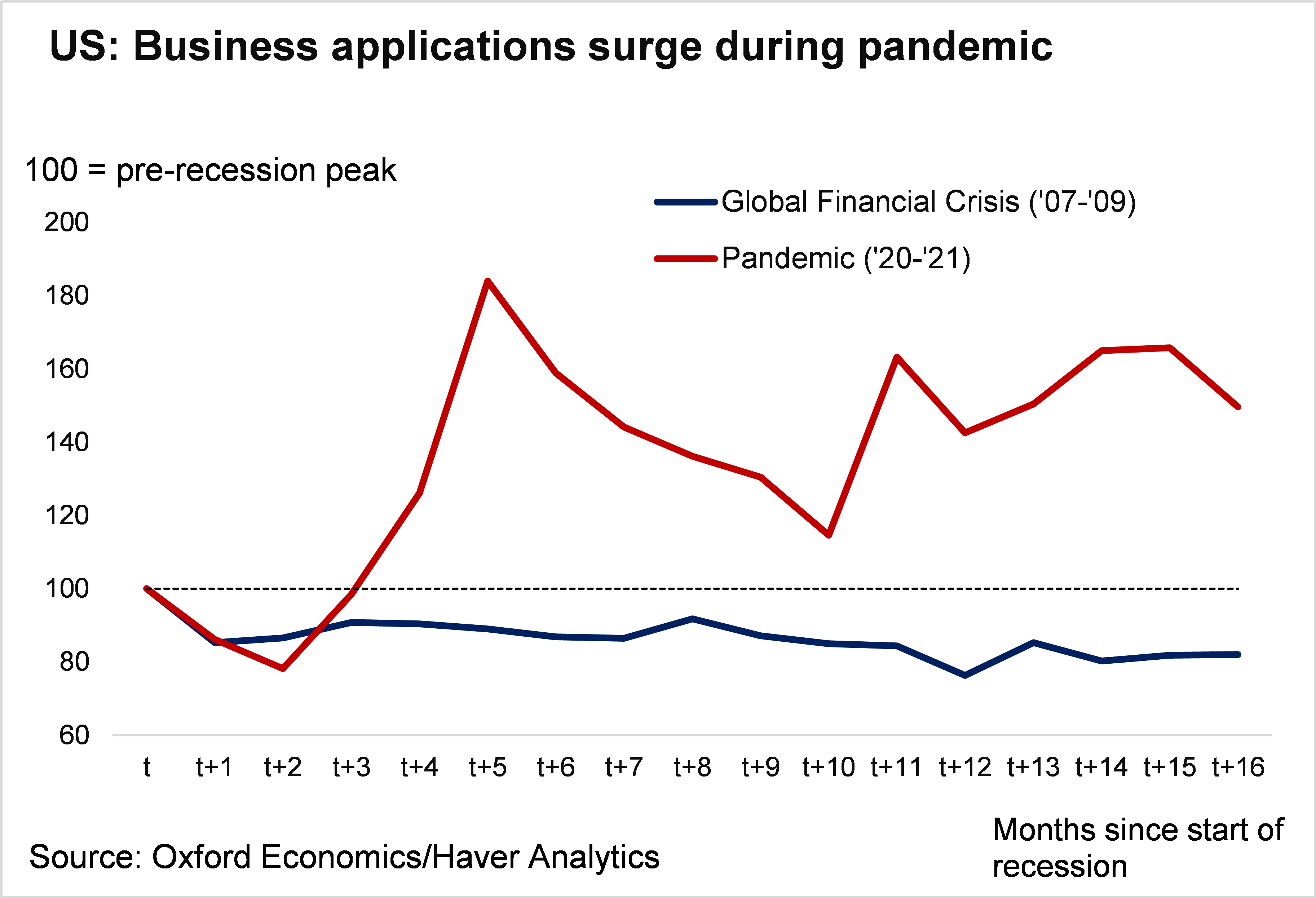

An unexpected bright spot of the pandemic has been a surge in risk-taking by entrepreneurs, igniting a record stretch of business creation over the past 18 months. With the economy still about six million jobs short of its pre-pandemic level, business formation may be one channel through which the labor market gets an added lift as it continues to recover over the coming months.

Research from the Federal Reserve found that roughly 130,000 additional businesses in the US closed their doors in the first year of the pandemic compared with a typical year. While recession years are typically not an ideal time to start a business, the months since last spring’s broad lockdowns have seen the filing of more than 2.4 million new business applications, an astonishing feat considering that only 1.8mn applications were filed in the 16 months prior to the pandemic. Many of these are “high-propensity” business applications—new corporations that plan to hire employees and have provided a first wages-paid date.

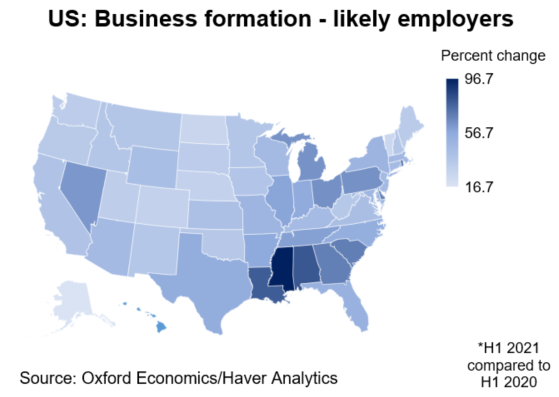

With favorable lending conditions and access to federal stimulus through the PPP, businesses formation bloomed the most in the South and Midwest. Relative to 2019, the strongest growth came from Mississippi (+61%), Georgia (+57%), and Louisiana (+55%), while large states like Illinois (+45%), Florida (+27%), and Texas (+26%) show the breadth of new business formation.

Data from the Kauffman Foundation also paints an encouraging picture of the entrepreneurs who are behind the flood of new businesses. Its “entrepreneurship rate” allows for an average comparison of the surge in business creation by ethnicity, education level and other markers. Data show 380 African American entrepreneurs per 100,000 people in 2020 compared with 240 in 2019, a 58% increase. Entrepreneurship among immigrants rose 34%, from 440 in 2019 to 590 in 2020. Broken down by education status, college graduates saw a 48% increase in entrepreneurship rates while those without a college degree experienced a 24% increase.

Non-store retailers, which include e-commerce and other internet-reliant businesses that have thrived during the pandemic, have accounted for over a third of new business formation since early 2020. While the scale of brick-and-mortar business closures in the retail sector skyrocketed last spring—losing 2.2 million workers in April 2020 alone—other businesses retooled, took advantage of fiscal stimulus, and benefitted from the explosion in online shopping amid lockdowns. Some workers who didn’t rejoin the labor market fell back on enhanced unemployment insurance benefits and took advantage of favorable lending terms to pursue their own startups.

Why is this relevant in the context of the recovery? New business formation has the potential to be a strong source of job creation, a hotbed for innovation and a catalyst for productivity growth. Research estimates that new business payrolls start to show up in employment data roughly 4 to 8 quarters after a business applies for an Employee Identification Number. While not all high-propensity business applications will become employer businesses (research suggests these applications have a slightly less than 50% likelihood), new businesses formed during the early stages of the pandemic may add some bulk to accelerating job gains over the coming months and into 2022.

It remains to be seen whether the encouraging trend in business formation will be sustained as workers find more attractive employment opportunities in a tighter labor market with fewer supply constraints and stronger wage growth. What can be concluded based on the Kauffman data is that the wave of entrepreneurship has come from all corners of the economy, offering hope for a Federal Reserve that is prioritizing a broad and inclusive labor market recovery as part of its response to the pandemic.

Tags:

You may be interested in

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More

Post

Australia: RBA hike by another 25 bps as the fight against inflation continues

The RBA has raised its cash rate target by a further 25 basis points, taking it to 4.1%. Although inflation has peaked, the RBA board is still clearly uncomfortable with its brisk pace.

Find Out More