Blog | 30 Nov 2021

Local shopping centres prove pandemic resilient in Australia — but will it last?

The meteoric rise of online shopping has been a hallmark of consumer spending during the pandemic. But all is not lost with Australia’s brick-and-mortar retail. With people spending more time at home, neighbourhood shopping centre turnover (including local supermarkets and pharmacies) has actually risen—at an estimated 4%-5% pa—in contrast to the steep drop in large-center turnover.

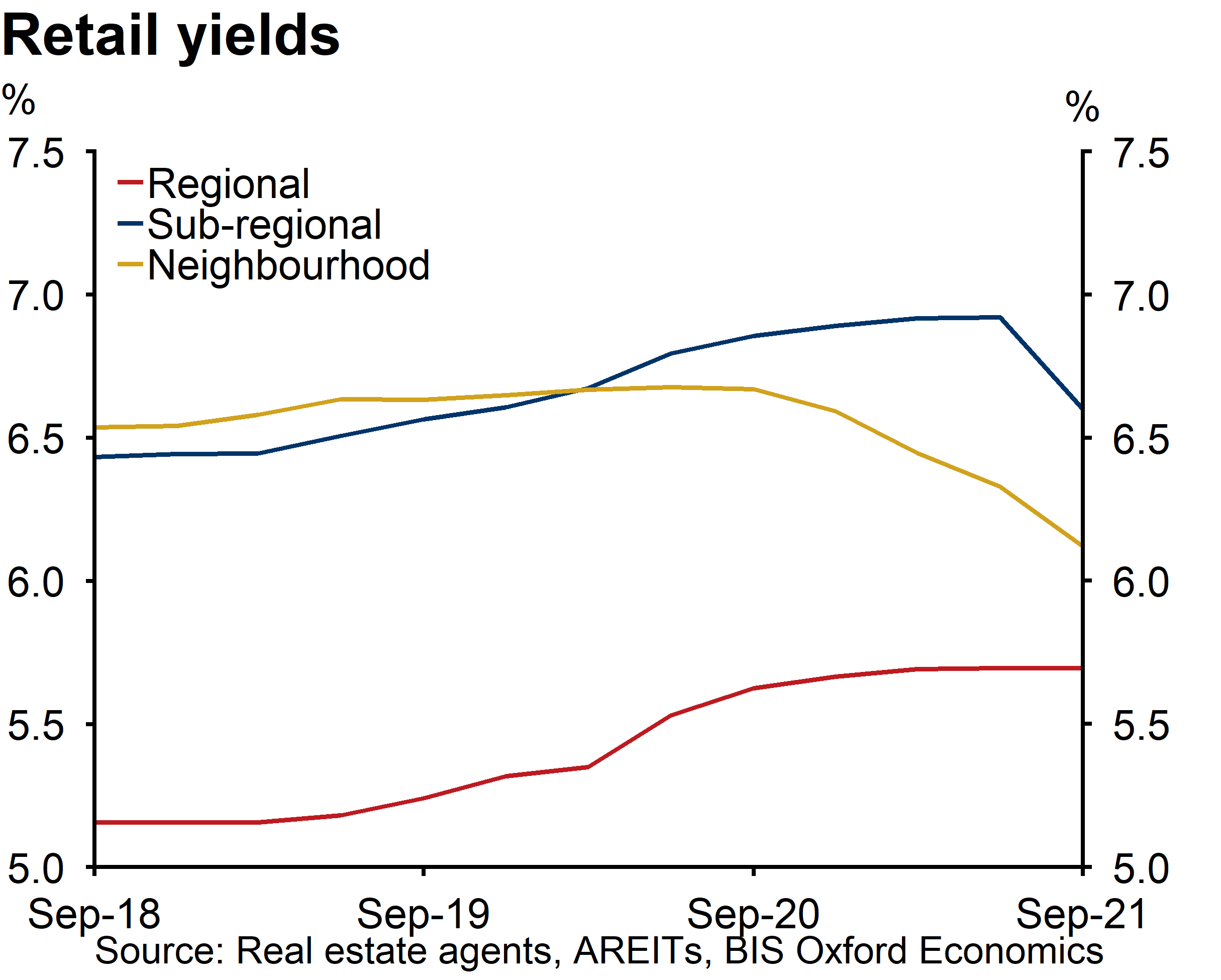

Investors are taking notice: capital inflows have grown so significantly that for the first time on record the average investment yield on neighbourhood centres is firmer (lower) than on sub-regional centres (those with at least one discount department store but lacking a department store). And while neighbourhood centres still carry a risk premium over regional centres (those with at least one department store), the gap has narrowed to around 40 basis points (bps), a record low. The reason? Investors believe that centres whose incomes are tied to anchor supermarkets are a safer bet in these turbulent times and offer a better defence against shifts in future shopping patterns.

While it’s long been argued that shopping centres that offer basic essentials tend to outperform in periods of economic weakness or recession, there was scant evidence to back this up prior to the pandemic. The prevalence of ‘mum and dad’ retailers in local shopping centres, and high vacancy rates during the recession of the 1990s and the 2008 global financial crisis offset any benefit local centres might have enjoyed from turnover growth.

What’s different today? First, the impact of lockdowns and other restrictions has been stark. Net operating income (NOI) at regional and sub-regional centres across Australia has fallen sharply due to lost income from vacancies as well as rental abatements. Indeed, in jurisdictions such as Victoria the NOI profile is distinctly W-shaped.

Neighbourhood centres, though, witnessed less of a downturn. Taken together with their stronger yield profile, neighbourhood centres have outperformed: during the pandemic, total returns at local shopping centres fell less than 5%, compared with -10% to -20% at their larger counterparts. And in the past year, they’ve more than tripled the roughly 3% return of larger regional centres, in contrast to previous downturns.

Looking ahead, it’s useful to consider the state of the retail market pre-pandemic. Larger shopping centres were already dealing with department store and discount department store anchor tenants shrinking floorspace, as well as struggling specialty retailers (particularly those selling clothing). These challenges were the result of shifts in consumer spending patterns—the movement toward experiences and away from “things”—and growing competition from the online sector. Market rents were already declining and underperforming in regional and sub-regional centres compared with local centres since 2018. This trend arguably has yet to play out.

As neighbourhood centres attract more institutional ownership, we’re likely to see more national retailers migrating toward local centres, providing insulation against vacancies in tough times. Meanwhile, given their exposure to shifting spending patterns and online retailing, larger centres risk continued underperformance. While some are pivoting to non-retail uses, this is a costly undertaking (and a topic for another day). There are arguments to be made in favour of neighbourhood centres continuing to edge ahead of the pack. But it remains to be seen whether the market has priced retail yields correctly.

Tags:

You may be interested in

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More

Post

Australia: RBA hike by another 25 bps as the fight against inflation continues

The RBA has raised its cash rate target by a further 25 basis points, taking it to 4.1%. Although inflation has peaked, the RBA board is still clearly uncomfortable with its brisk pace.

Find Out More