Blog | 12 Mar 2021

How Australia is building its recovery

Australia’s moniker as the lucky country, as mentioned in a previous blog post, has held through the pandemic and is now translating into an economic recovery. Its federal and state governments have gone hammer and nail on funding public infrastructure in response to the pandemic and related economic downturn, and this approach may offer important practices for other countries to follow as they begin to recover from COVID-19.

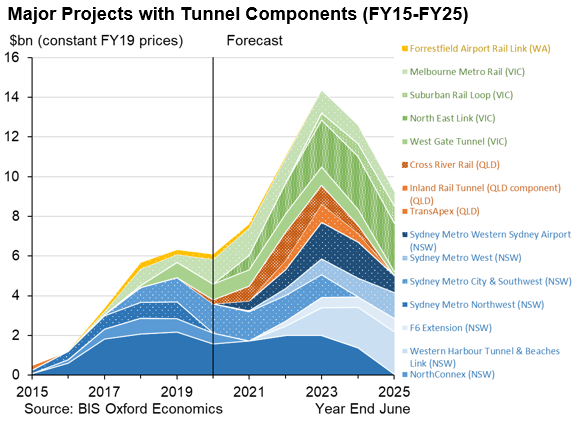

Infrastructure is generally regarded as a key mode of fiscal stimulus, since it directly supports construction jobs and provides public assets that improve future productivity. A significant number of projects were already in the planning stages across Australia before the pandemic—this is highlighted by the imminent rise in demand for tunnelling services due to major new road tunnels and metro rail lines to be constructed in Australia’s largest cities, which are fuelling a conveniently timed transport construction boom. In fact, there have been concerns around the ability of Australia’s market for contractors to complete the pipeline of work, set to peak in 2023.

While the construction pipeline is sizeable, these large projects can take time to ramp up. Because of that, the government’s fiscal response has put a greater focus on ‘shovel-ready’ infrastructure and regional development as shorter-term channels for stimulus. These projects are attractive because they are easy to launch and their benefits are far-reaching.

While the construction pipeline is sizeable, these large projects can take time to ramp up. Because of that, the government’s fiscal response has put a greater focus on ‘shovel-ready’ infrastructure and regional development as shorter-term channels for stimulus. These projects are attractive because they are easy to launch and their benefits are far-reaching.

A key benefactor of this strategy is Australia’s maintenance market. As part of a $1.8 billion package to boost local council funding, the federal government announced the new Local Roads and Community Infrastructure (LRCI) Program. In the latest federal budget, the program was extended by an additional $1bn, making the package worth around 6% of annual local government revenues. This is expected to drive a near-term boost in road maintenance activity.

Furthermore, support was added by the state and federal governments to prop up housing construction, the most substantial measure being the federal government’s HomeBuilder program. The program provides grants of AUD$25,000 for building contracts and led to a spike in building approvals at the end of 2020. This support has cushioned what was becoming a downturn in residential building and has helped accommodate some of the shifting preferences away from apartments. A rebound in housing demand and prices has also reinforced the sector as the economy and labour market have started to recover from the pandemic.

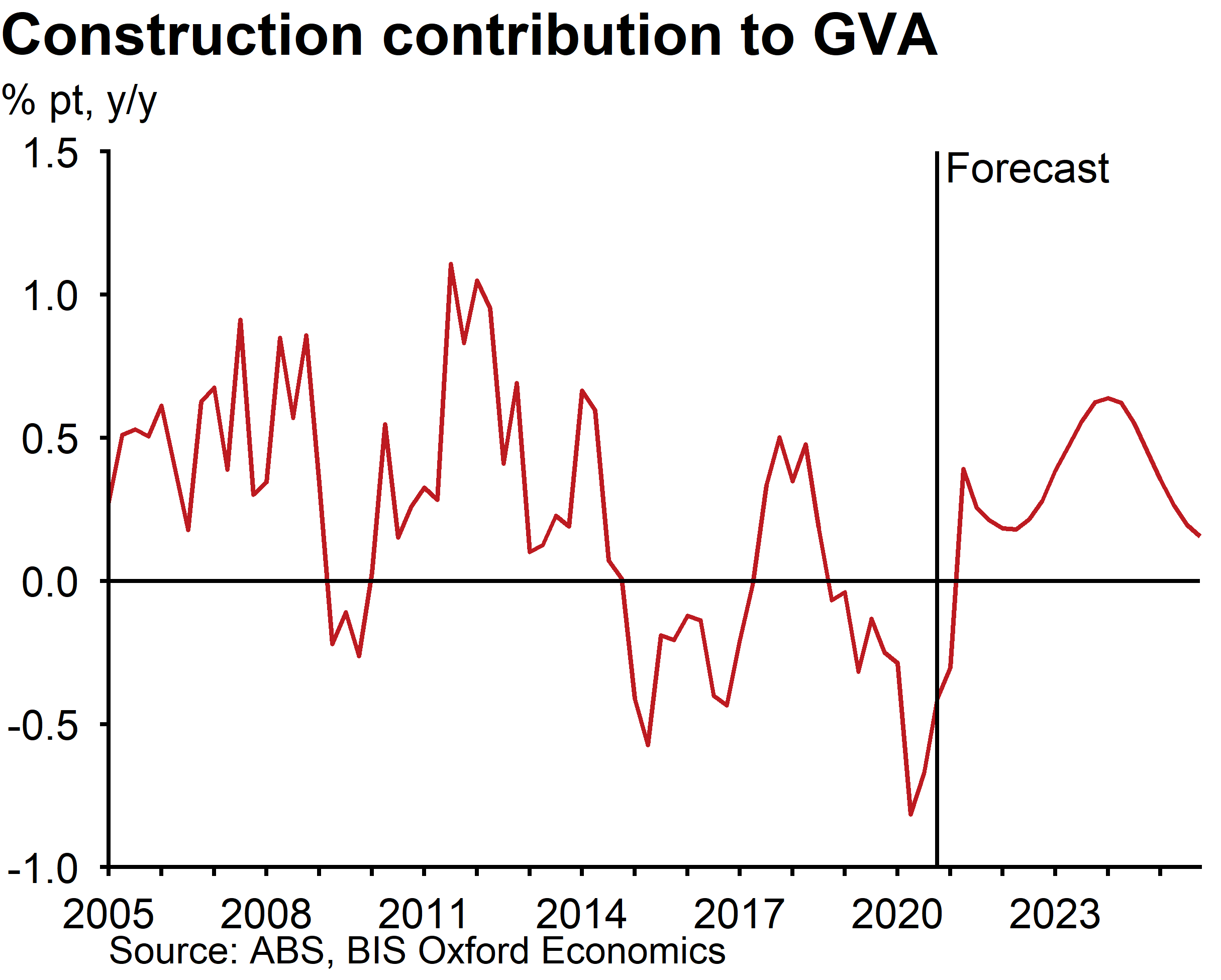

Construction currently accounts for just over 9% of total employment, and this is likely to increase over the coming years. The construction industry’s contribution to annual GVA growth in Australia is forecast to peak at 0.6% in 2023-24, which would be the highest since the mining investment boom of the first half of the 2010s. Short-term policies like HomeBuilder have formed the bridge to recovery, but medium-term growth will be driven by the transport pipeline and renewed building investment.

The construction-led recovery has been well-advanced by some lucky circumstances but further fuelled by a recovery in housing demand. This is likely to see a very high level of construction activity across residential, non-residential and civil engineering, which will demand an elevated proportion of Australia’s workforce. The Australian experience shows the complementarity between short-term and medium-term growth strategies—and that even with a large, well-established construction pipeline, maintenance activity, local government funding and incentives to building investment have played important roles in the overall response.

The construction-led recovery has been well-advanced by some lucky circumstances but further fuelled by a recovery in housing demand. This is likely to see a very high level of construction activity across residential, non-residential and civil engineering, which will demand an elevated proportion of Australia’s workforce. The Australian experience shows the complementarity between short-term and medium-term growth strategies—and that even with a large, well-established construction pipeline, maintenance activity, local government funding and incentives to building investment have played important roles in the overall response.

Tags:

You may be interested in

Post

The socio-economic impact of TikTok in Australia

This report provides the results of our economic modelling of TikTok’s economic contribution to the Australian economy, as well as the findings of survey research into TikTok’s users and Australian businesses. It looks at the real world impacts users report as well as the diversity of TikTok’s online communities.

Find Out More

Post

Australian office sustainability outcomes underpin asset performance

The focus on green office buildings and sustainability is being driven by both government targets to achieve net zero and increasing corporate and investor focus on environmental, social, and corporate governance (ESG) considerations and compliance.

Find Out More

Post

Indian and Australian cities to outpace rivals over 2024-28

We forecast Indian cities to outpace the rest of APAC in terms of GDP growth over the medium term (2024-28). Southeast Asian cities such as Ho Chi Minh City and Jakarta will come close to matching Indian cities and will outperform Chinese ones. Among advanced APAC cities, we expect that Australian ones will fill the top two positions in terms of medium-run GDP growth.

Find Out More