Ungated Post | 10 Nov 2017

Fear of Trump policy errors, N Korea tensions keep businesses fearing a slowdown

Businesses remain fearful over risks of major economic upsets that could trigger a global slowdown – despite the present upswing in world growth, according to our latest quarterly survey of global corporate risk perceptions. Business fears over tensions between the US and North Korean and over potential US policy errors emanating from the Trump Administration have persisted since the summer, even as world growth has strengthened.

The anxieties among firms are aggravated by heightened European political concerns over populism in the EU amid the ongoing crisis in Catalonia, Northern Italy referendum votes and recent election results in Germany, Austria and the Czech Republic.

Our survey was completed by 170 business contacts and canvasses views our clients, including some of the world’s largest businesses, and other business connections in our wider network. Collectively, the participating companies employ around 5 million people and have a turnover in the region of $2.5 trillion.

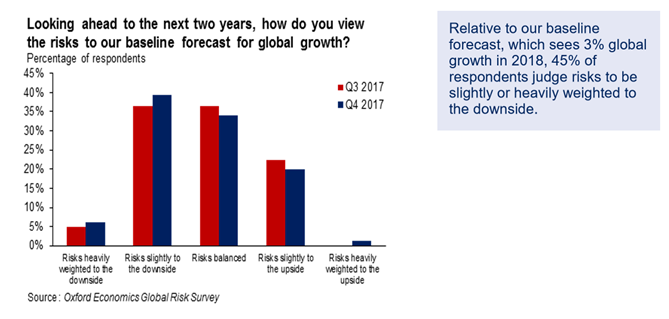

Respondents remain particularly concerned over the risk of global economic slowdown. This quarter’s results showed that twice as many respondents (45%) judge that risks to global growth (based on our OE forecast baseline) are of a weaker rather than a stronger outcome. Only 21% believe the balance of risks is of a stronger outcome than our baseline forecast.

Compared with three months ago, more respondents judge the probability of a sharp slowing in global growth to have increased (29%) than the probability of a sharp pickup (23%).

But the survey also highlights a key upside risk to economic prospects – that low inflation will allow central banks to delay further interest rate and policy tightening.

As in the previous survey, near-term downside concerns about the outlook are dominated by the potential for policy errors to drive the US into recession and fears over the potential economic fallout from geopolitical tensions, including between the US and North Korea. In the Q4 survey, US policy errors and geopolitical tensions are viewed as a top risk by 30% and 28% of respondents respectively (36% and 27% in the previous quarter). These two concerns were seen as a top 3 risk by more than 60% of respondents.

At the same time, concerns have increased over populism in the EU. Three months ago, 21% of respondents judged EU populism to be a top 3 downside risk but this figure has jumped to 39% in the latest survey. Meanwhile, fears over the potential for financial market turmoil to weigh on the global economy have abated over the past three months.

Read the full report: https://oxecon.co/2zCcsjM

Tags:

You may be interested in

Post

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More