Blog | 15 Aug 2022

Food, inflation, and regime stability in Africa

Pieter Scribante

Political Economist, Oxford Economics Africa

Supply chain and trade disruptions resulting from the Covid-19 pandemic exposed the inherent fragilities associated with relying on imports to meet domestic food needs. Food insecurity can very quickly become a concern in net-food-importing countries. With the war in Ukraine disrupting international trade and pressuring global food supplies, the World Food Programme (WFP) and the Food and Agriculture Organization (FAO) have sounded the alarm of increasing risks of hunger, famine, and starvation, with developing countries the most vulnerable.

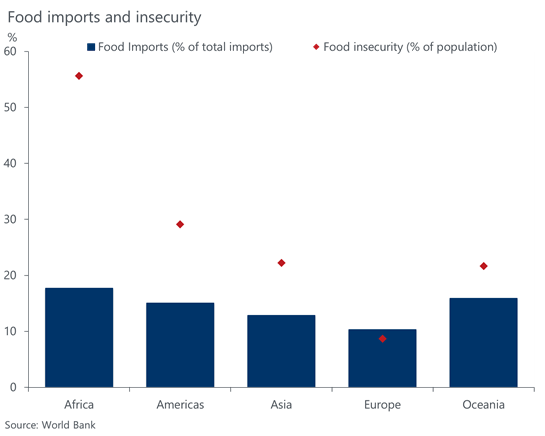

In Africa, food imports accounted for an average of 18% of the continent’s import profile in 2019. While this is in line with the rest of the globe, and only slightly above that of Oceania (16% of total imports), food insecurity is far more prevalent in Africa. According to the World Bank, an average of 55.6% of households in Africa experienced some level of food insecurity in 2019, far above the second-most vulnerable region, the Americas (29.1% of households). This is especially worrying given Africa’s fast-growing population and high vulnerability to climate change, both which threaten food security further.

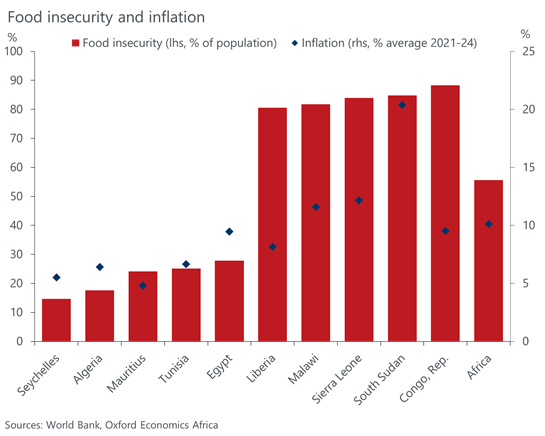

There are important macroeconomic considerations associated with food insecurity in Africa. First fiscal deficits in food-insecure countries tend to be wider and expenditures more volatile as spending is often directed towards emergency food aid or subsidies at the expense of long-term development spending. Second, the volatile nature of food prices mean that inflation tends to be higher in food-insecure and net-food-importing countries. Finally, economic growth and development tend to lag in food-insecure countries. While the causality does run both ways (weak economic growth increases food insecurity, and vice-versa), countries with inadequate food supplies and higher food insecurity are more prone to fall into low-growth traps.

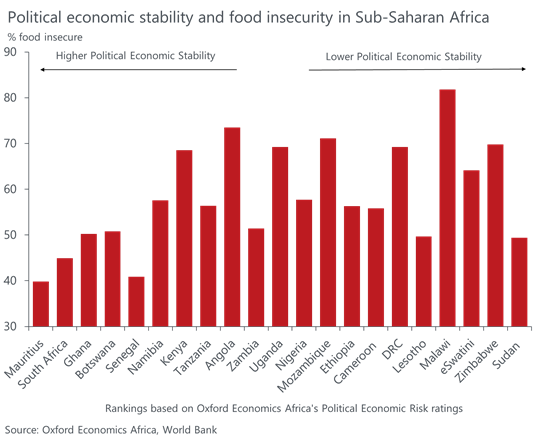

The political economy of regime stability and food security is vital in Africa. The two are highly linked, as countries with secure food supplies are less prone to violence and unrest, and have lower levels of political economic risks. Before Sudan’s former President, Omar Al-Bashir, was ousted in 2019, the country experienced droughts and an agricultural downturn that reduced food supplies and led to growing food insecurity, rising inflation and protests. Mr. Al-Bashir survived the Arab Springs, civil war, several coups attempts and the loss of 75% of Sudan’s oil reserves when South Sudan seceded in 2011, but his 30-year reign came to an end following months of demonstrations by dissatisfied and hungry protestors.

The political fallout of rising prices and food insecurity have started to show in the form of protests in countries that are normally very stable, like Mauritius and Morocco, while other countries such as Egypt have postponed plans to scrap food subsidies. Countries with higher political economic fragility, like Eswatini, Zimbabwe and Sudan, are more exposed to the inherent vulnerabilities of food insecurity and are at high risk of unrest and protests if food supplies decline and prices rise. However, the political salience of food security means that even more stable countries, particularly Ghana, Kenya and Tunisia, run the risk of unrest if food security deteriorates in coming months.

Author

Pieter Scribante

Political Economist, Oxford Economics Africa

+27 (0) 21 863 6200

Pieter Scribante

Political Economist, Oxford Economics Africa

Paarl, South Africa

Pieter is a political economist at Oxford Economics Africa, first joining the firm in 2019. He holds an MSc in Political Science and Political Economy from the London School of Economics (LSE) and is the principal analyst for Nigeria and Mauritius. Pieter specialises in macroeconomics and political-economic risk analysis.

Tags:

You may be interested in

Post

Easter Egg-onomics

The cause of Easter egg inflation of 50% or more this year is largely explained in the latest paper from our Africa team on one of the key countries at the start of the supply chain, those producing the raw ingredient.

Find Out More

Post

Africa: Radical Faye looks strong in Senegal’s presidential election

The first round of Senegal's presidential election will take place on Sunday, March 24. The race is unpredictable, given the dramatic backdrop to it. In this Research Briefing, we set out the main dynamics relating to the election and refresh our political scenarios.

Find Out More

Post

The long-term outlook for Northern African cities

North African cities are forecast to experience some of the fastest rates of employment and population growth over the long term. GDP growth is also forecast to be near the top of the global pack, just trailing behind sub-Saharan Africa.

Find Out More