Exploring the plausible ‘What Ifs’ to our 2023 China GDP forecast

On the back of China’s recent consumption outperformance, we now expect the economy to grow by at least 5.5% in 2023. Market forecasts vary considerably, reflecting differences in assumptions around policy risk, the health of and outlook for the property sector, and the size and longevity of the reopening consumption boost.

What you will learn:

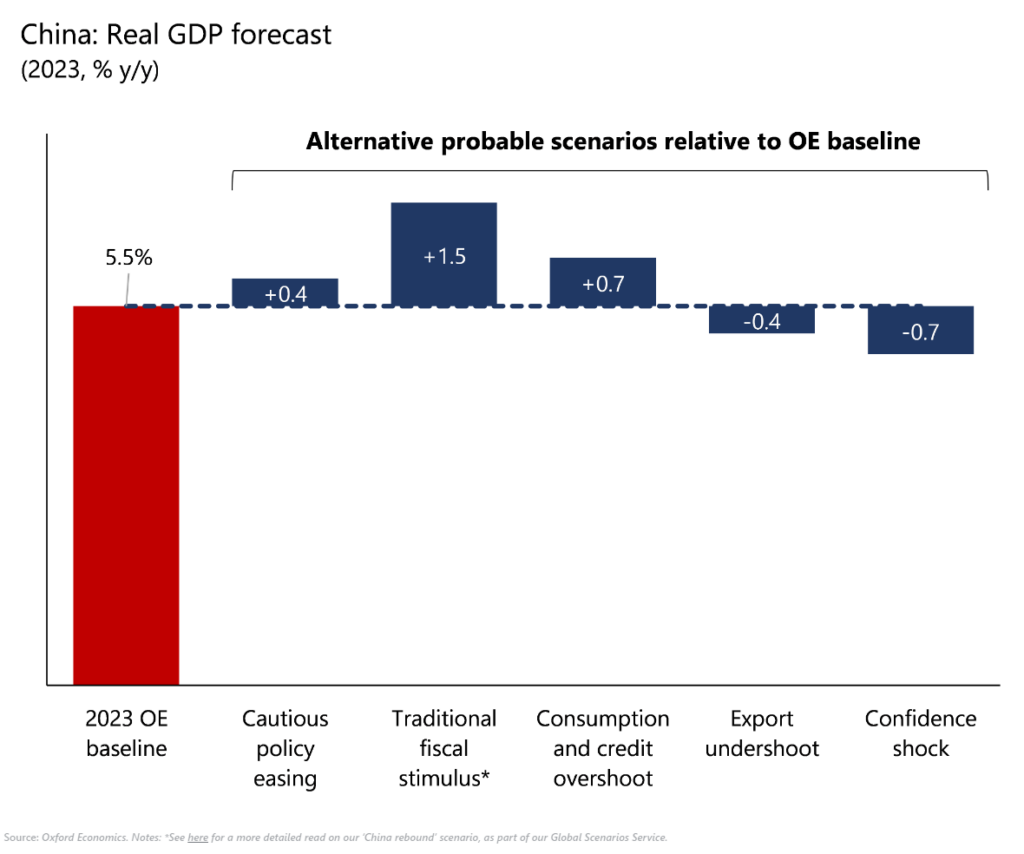

- As a thought experiment, we analysed five probable alternative scenarios using our Global Economic Model to gauge both the upside and downside risks to our 2023 outlook for China, and find a variance of around -0.7ppts to 1.5ppt to our 5.5% baseline growth forecast.

- Our analyses also demonstrate the clear limitations of policy easing, which in our downside scenarios prove insufficient to fully offset growth headwinds.

- In our base case and notwithstanding the eventual fading of a post-Covid consumption boost, growth in 2023 should comfortably exceed the official growth target. The unusual combination of a strong organic growth and still-significant economic headwinds (particularly towards H2) means that China’s monetary and fiscal policy stance could stay on hold for longer.

Tags:

Related posts

Post

How Asia’s supply chains are changing | Techonomics Talks

Global supply chains have continued to expand, despite talk of deglobalization and nearshoring. US and Japan have started to de-couple from China, but other G7 countries grow more dependent on Chinese inputs. Several "hotspots" are emerging across Asia with multiple winning formulas.

Find Out More

Post

China decoupling – how far, how fast?

Economic decoupling from China is ongoing, but the latest evidence suggests that, especially outside the US, the process is gradual and piecemeal. Trade decoupling may be slowly spreading from the US to other advanced economies, however surveys suggest foreign investors' attitudes to China improved slightly in 2023, though they are still more negative than a few years ago.

Find Out More

Post

Promising trends signal optimism for the hotel sector

The global travel recovery took great strides in 2023, with some destinations already reporting a full recovery back to pre-pandemic levels. Trends continue to suggest further growth in tourism activity going into this year, signalling optimism for the hospitality sector going forward. But risks stemming from inflation, geopolitical tensions and climate change will persist.

Find Out More