Blog | 03 Nov 2021

E-commerce’s COVID boost is a wake-up call for policymakers

James Lambert

Director of Economic Consulting, Asia

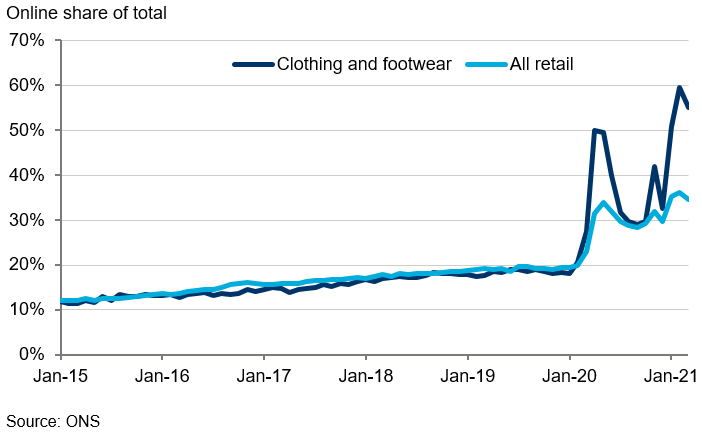

The digital economy has reached a watershed moment in the wake of the COVID-19 pandemic. From major retailers to start-up entrepreneurs, the internet is now the primary tool for businesses to understand their markets and to sell their goods and services. The figure below shows the impact on one sector—clothing and footwear—in the UK.

But there is a growing danger that policymakers will miss the window to exploit the economic growth potential this shift represents because they have such a poor grasp of what is going on in the digital economy.

The digital transformation of the last 18 months is striking because the digital laggards are finally getting onboard. Organisations that were reluctant to adopt digital solutions, from small family businesses to big banks, realised they could no longer postpone the inevitable.

This acceleration in e-commerce matters because it is the gateway to a host of productivity enhancing digital spillovers. E-commerce fuels a virtuous cycle of innovation, as “big data” feed new ideas and applications in artificial intelligence.

Yet governments risk missing these benefits because of a grave lack of understanding of the scale of e-commerce activity and the operations of the digital economy. As the late management consultant Peter Drucker is reputed to have said: “If you can’t measure it, you can’t manage it.”

There is an urgent need to upgrade official statistics. While they can account for traditional aspects of the digital economy such as hardware and telecoms equipment, they paint a woefully inadequate picture of the more dynamic, fast-growing trends, such as digital intermediary platforms, cloud-based digital service providers, and digital content providers.

When policymakers are blind to the value generation and jobs growth in these dynamic sectors, it limits their ability to support digital entrepreneurs and tech start-ups and ultimately leads to a loss of competitiveness for local businesses. R&D investment strategies are ill-informed, regulators cannot track their effectiveness, and digital entrepreneurs and tech start-ups are not given the space and support that would help get them off the ground.

If governments are serious about leveraging the digital economy to fuel economic growth, they need to upgrade their understanding of what is taking place within it. This is no mean feat, but it starts with quite simple changes to the questionnaires in established statistics collection instruments, such as annual business, labour force, and household surveys.

The modern digital economy begs new questions about ICT capital expenditure, the money businesses are spending on digital services, the share of sales via digital platforms, and the skills composition of the workforce. This would lead to valuable insights into the scale and trajectory of the digital economy.

The US Bureau of Economic Analysis has constructed a digital satellite account to measure the US digital economy, including robust statistics on e-commerce activity, digital infrastructure, and the provision of digital services. In August 2021, the digital ministers of the G20 reaffirmed their pledge to “harness the potential of digitalisation for a resilient, sustainable and inclusive recovery.” There is a path forward, but these words are scarcely—or only extremely slowly—translated into action.

Businesses are riding the wave of digitalisation, propelled by an acceleration in e-commerce in the past 18 months. The longer-term economic recovery will depend on successfully leveraging the power of the digital economy. Governments that cannot build the statistical foundation to do that will see their economies fall behind those that can.

This piece is an edited version of an article that ran in Fortune magazine on 23 September 2021.

Tags:

You may be interested in

Post

How Asia’s supply chains are changing | Techonomics Talks

Global supply chains have continued to expand, despite talk of deglobalization and nearshoring. US and Japan have started to de-couple from China, but other G7 countries grow more dependent on Chinese inputs. Several "hotspots" are emerging across Asia with multiple winning formulas.

Find Out More

Post

Unlocking opportunities for small and disadvantaged businesses

On behalf of Amazon, Oxford Economics has assessed the impact of a scenario in which federal agencies can claim credit for purchases made with small and disadvantaged businesses across all online marketplaces.

Find Out More

Post

TikTok: Helping grow small and midsized businesses and deliver value for consumers across the United States

Starting in late May 2023, Oxford Economics, in collaboration with TikTok, initiated a study to better measure the economic value of the TikTok platform to local communities across the US. As part of the research, we surveyed 1,050 SMBs that use TikTok, and 7,500 TikTok users to learn how businesses and users interact with the app and leverage the economic and social opportunities it provides.

Find Out More