Blog | 12 Oct 2021

COP26: What ‘net zero’ means for ports

COP26—the 2021 United Nations Climate Change Conference—will bring together countries with the aim of achieving net-zero carbon emissions by mid-century. Reaching this target presents businesses with challenges and opportunities that will need to be integrated into their strategic planning and long-term investment decisions.

We recently examined the implications of ‘net zero’ for UK ports on behalf of the UK Major Ports Group, with the results presented at the London International Shipping Week. Our long-term forecasts for UK cargo volumes—consistent with the Climate Change Committee’s (CCC) central scenario for achieving net zero by 2050, as well as Oxford Economics’ baseline projections for the economy—illustrate the scale of the shifts underway.

Declining liquid bulk volumes

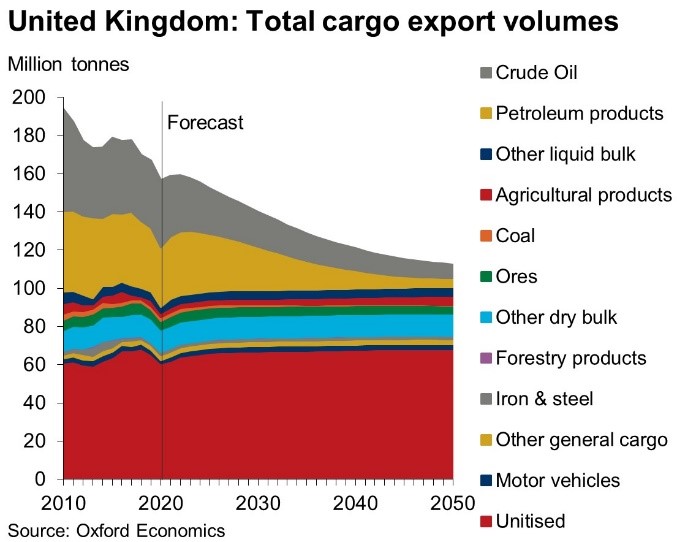

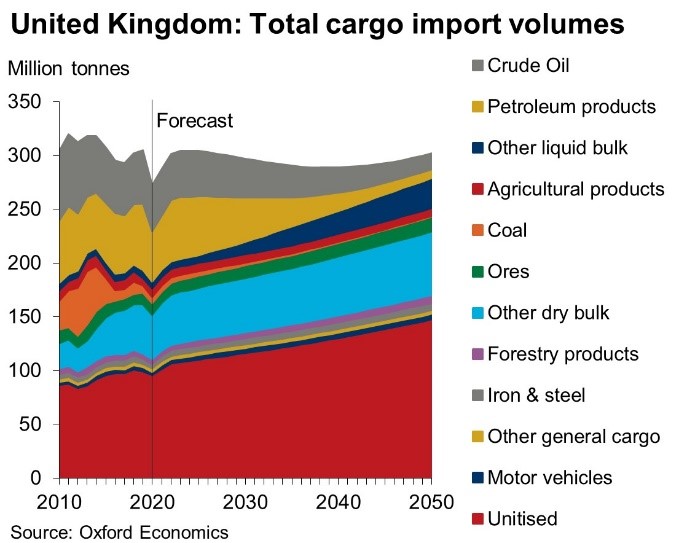

In 2050, total UK cargo throughput will be 12% lower (-57m tonnes) than 2019 levels. Moreover, UK ports will see a shift in the types of goods they handle, shaped by a move away from liquid bulk (fluids typically transported in tankers), which currently accounts for around 40% of total cargo volumes.

The decline in liquid bulk volumes reflects the gradual elimination of fossil fuels in vehicles and energy production. Falling demand for petroleum will reduce imports, while exports are also likely to suffer as domestic refineries come under pressure from the ongoing decline in UK oil production and slowing demand from major trading partners that are also decarbonising their economies. The demise of oil-refinery capacity would have a knock-on impact on UK chemical exports, which are derivative refinery products. Together, these developments indicate liquid bulk imports in 2050 could be down by almost 60% compared to 2019 levels, while exports could fall by around 75%.

‘First mover’ opportunity in hydrogen

Tempering the decline in petroleum products would be a rise in ammonia imports. The CCC expects that 14% of the UK’s hydrogen demand will be imported—it is likely that this will be in the form of ammonia (which can be converted to hydrogen), as it is more cost effective to transport over long distances. We project ammonia imports will reach 20 million tonnes by 2050, although an opportunity clearly exists for UK ports to capitalise on the opportunities offered by this new energy vector by becoming ‘first movers’ in hydrogen production, import/export, and storage.

The main growth area will be imports of unitised cargo (cargo transported aboard a ship in containers or wheeled vehicles), reflecting the growth of the UK economy and demand for building materials, general manufactures, and food. By contrast, unitised export tonnage will be flat, indicative of the dwindling share of manufacturing in the economy and shift toward higher value but lower volume products.

Our projections represent a potential future. The outlook will be heavily influenced by still-uncertain government decarbonisation policies and the decisions of UK ports themselves. Opportunities to offset the loss in volume from liquid bulk may exist in the repurposing of existing infrastructure and/or investments in new technologies.

What is clear is that ports that fail to plan for the green economy face a difficult future, while those who re-orient toward alternative cargo types can future-proof their business models and unlock growth.

Tags:

You may be interested in

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More

Post

Australia: RBA hike by another 25 bps as the fight against inflation continues

The RBA has raised its cash rate target by a further 25 basis points, taking it to 4.1%. Although inflation has peaked, the RBA board is still clearly uncomfortable with its brisk pace.

Find Out More