Blog | 25 Aug 2021

Construction’s productivity problem requires technology-based solutions

Toby Whittington

Lead Economist

The construction sector has been one of the most resilient areas of the economy during the pandemic. As many other areas of the economy had to suspend operations, the construction sector benefitted from the fact that most work takes place outside (meaning less onerous distancing restrictions) and because much construction work is viewed as essential for a functioning economy.

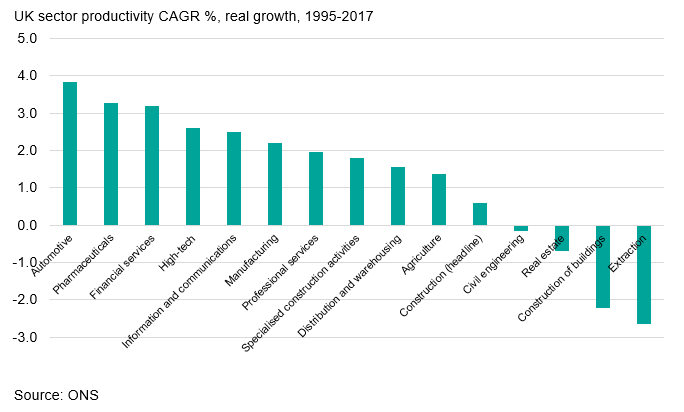

But as the world emerges from the pandemic, perhaps the most important issue facing the construction sector will be productivity—or lack thereof. Productivity in construction has generally lagged other sectors over the past 30 years. Unlike the manufacturing sector, which has seen consistent productivity growth since 1990 as new efficiency-enhancing techniques have been rolled out on the factory floor, the nature of the building process means similar efficiency improvements are much harder to implement in the construction sector. Each new building is a standalone project rather than another unit of output on a continuous factory production line. The high levels of differentiation across building construction limits the amount of repeatable efficiency savings that can take place. This has meant that construction has remained relatively labour intensive, a point that has made this sector so vulnerable to labour supply shortages, particularly in western countries.

New technologies are emerging that will need to be adopted if the global construction sector is to improve its poor productivity performance. Over the next decade countries will increasingly look to prefabricated construction as a pillar in national homebuilding strategies. Unlike traditionally built houses, prefabricated homes will benefit from economies of scale in the manufacturing process and significantly alleviate the labour constraints currently facing construction markets in many countries.

The use of 3D printing and robotics will also be central to addressing construction’s productivity problem. Though still in its infancy, there have been successful examples of 3D-printed buildings around the world, and the technology offers numerous advantages over traditional building methods. Foremost among these advantages is speed—a recent example of a 46-square-metre concrete barracks being erected in under 40 hours by a US military team points to the potential of the technology. And the degree of automation, with programmable design and robotics, will reduce the need for labour input and help to offset labour constraints.

Beyond enhancing productivity, introduction of these new technologies will help reduce the sector’s carbon emissions output. 3D printing requires low energy input and offers a leaner approach—specific parts can be custom-made as they’re needed rather than pre-ordered in bulk, resulting in reduced waste. This will be important going forward as the construction sector seeks to reduce its carbon footprint; data from the UK shows average construction sector emissions growing by 0.2% per year over the last 15 years. By contrast, manufacturing, through the implementation of efficiency saving techniques, managed to reduce emissions by an average of 3% per year over the same time period.

Over the next decade, we expect these productivity-enhancing measures will increasingly become part of the construction process. The UK government has mandated that 25% of all new affordable housing must be modular, which will likely be necessary if the government is to meet its stated ambition of 300,000 new homes per year. Currently, less than 10% of UK new builds contain modular elements, compared with 20% in Germany and 85% in Sweden. Furthermore, 3D printing technology is to see increased use across the construction sector, from homebuilding to major infrastructure projects such as with the HS2 project.

If the construction goals of developed countries are to be met, then inevitably the implementation of these new technologies will be paramount. Globally, we expect to see construction firms increasingly implementing these new technologies into their operations in order to meet the construction challenges of the next decade.

Tags:

You may be interested in

Post

How Canada’s wildfires could affect American house prices

The Northern Hemisphere is now heading into the 2024 fire season, having just had its hottest winter on record. If it is anything like last year, we can expect to see further impacts on people, nature, and global markets.

Find Out More

Post

Navigating the US Economic and Real Estate Transition

This year is set to be a turning point for commercial property markets in the US. A gradual easing in inflationary pressures alongside a steady, if unspectacular, year for GDP and employment growth should help to ease the market through the final leg of the post-COVID adjustment.

Find Out More

Post

Downside risks remain amid a more balanced outlook in our Q1 IFRS 9 and CECL scenarios

Despite the upgrade to our global economic outlook since December 2023, the Q1 update of our IFRS 9 and CECL scenarios services sees a more balanced assessment of the risks to the global economy over the next two years.

Find Out More