Recent Release | 19 May 2021

Chipping In: The U.S. Semiconductor Industry Workforce and How Federal Incentives Will Increase Domestic Jobs

Economic Consulting Team

Oxford Economics

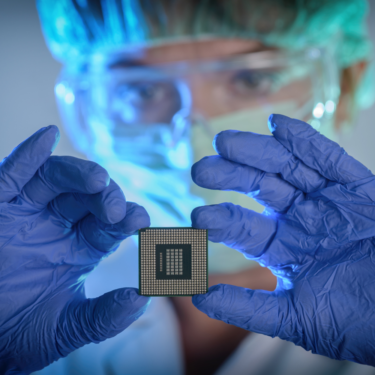

With its origins in the latter part of the 20th century, the semiconductor industry has grown to become one of the most important segments of the global economy. Today, semiconductors are found in nearly every electronic device, including phones, cars, and appliances. Semiconductors enable nearly every industry, reflected by global sales of over $440 billion in 2020 alone.

Today, semiconductor companies are producing more chips than ever before. The success and growth in computers and software have subsequently helped to drive growth in the semiconductor industry. The U.S. semiconductor industry is substantial, directly contributing $246.4 billion to U.S. GDP and directly employing over 277,000 workers in 2020. However, the economic contribution of the semiconductor industry extends far beyond fabrication facilities (fabs) or research facilities where its products are designed and manufactured. The strong demand for all types of chips facilitates the need for a broader domestic support ecosystem including manufacturing equipment, materials, design services, testing labs, and R&D activity. This ecosystem creates activities that generate additional economic value throughout the U.S. economy.

For this study, Oxford Economics has quantified the economic contribution of the U.S. semiconductor industry by using an economic impact analysis at the national level in the U.S. This technique highlights the importance of the semiconductor industry to the U.S. economy in terms of jobs, wages, and GDP.

About the team

Our Economic Consulting team are world leaders in quantitative economic analysis, working with clients around the globe and across sectors to build models, forecast markets and evaluate interventions using state-of-the art techniques. Lead consultants on this project included:

Related Services

Post

The economic impact of abandoning the WTO

Oxford Economics have been commissioned by the International Chamber of Commerce (ICC) to provide an independent assessment of the economic impact of WTO dissolution. This report details our findings and the assumptions underpinning our analysis.

Find Out More

Post

The economic impact of the sports activities of public service media

This study shows how the sports activities of public service media supported €4.5 billion of GDP and 57,000 jobs across 31 European countries in 2022. The report also highlights wider economic benefits of public service media sports coverage, such as the way in which it leverages sponsorship income for sports bodies.

Find Out More

Post

Global Trade Education: The role of private philanthropy

Global trade can amplify economic development and poverty alleviation. Capable leaders are required to put in place enabling conditions for trade, but currently these skills are underprovided in developing countries. For philanthropists, investing in trade leadership talent through graduate-level scholarships is an opportunity to make meaningful contributions that can multiply and sustain global economic development.

Find Out More