Ungated Post | 07 Aug 2020

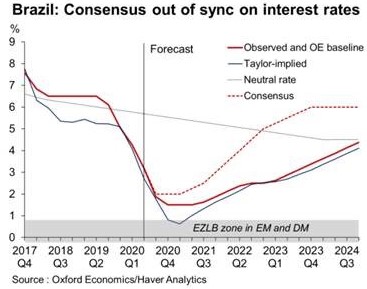

Chart of the week: Why ending the easing cycle in Brazil now would be a mistake

Innes McFee

Managing Director of Macro and Investor Services

This week the Banco Central do Brasil (BCB) lowered the Selic rate to 2.00%. Although our baseline scenario is for further rate cuts in the coming months, our Taylor rule suggests that rates should go even lower, between zero and 1%. We continue to believe the BCB will eventually be forced to cut rates again in the coming months and it won’t need to hike by as much as markets currently price in.

Tags:

You may be interested in

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More

Post

Australia: RBA hike by another 25 bps as the fight against inflation continues

The RBA has raised its cash rate target by a further 25 basis points, taking it to 4.1%. Although inflation has peaked, the RBA board is still clearly uncomfortable with its brisk pace.

Find Out More