BoK’s monetary policy to tighten even as hiking cycle ends

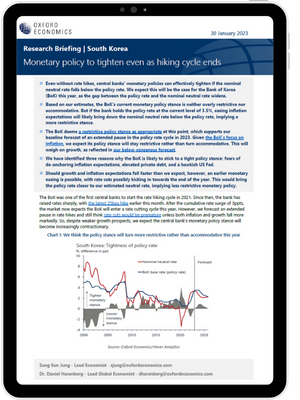

Even without rate hikes, central banks’ monetary policies can effectively tighten if the nominal neutral rate falls below the policy rate. We expect this will be the case for the Bank of Korea (BoK) this year, as the gap between the policy rate and the nominal neutral rate widens.

What you will learn:

- Based on our estimates, the BoK’s current monetary policy stance is neither overly restrictive nor accommodative. But if the bank holds the policy rate at the current level of 3.5%, easing inflation expectations will likely bring down the nominal neutral rate below the policy rate, implying a more restrictive stance.

- The BoK deems a restrictive policy stance as appropriate at this point, which supports our baseline forecast of an extended pause in the policy rate cycle in 2023. Given the BoK’s focus on inflation, we expect its policy stance will stay restrictive rather than turn accommodative. This will weigh on growth, as reflected in our below-consensus forecast.

- We have identified three reasons why the BoK is likely to stick to a tight policy stance: fears of de-anchoring inflation expectations, elevated private debt, and a hawkish US Fed.

Tags:

Related Resouces

Post

The macro impact of the AI boom in Taiwan and South Korea

The launch of ChatGPT in November 2022 made 2023 a leap forward for artificial intelligence (AI). The big battle for the future AI winners heated up and many tech companies revealed their future investment plans during the latest earnings season. A global race to build the most powerful AI chips has begun, which will potentially revolutionise the global tech sector.

Find Out More

Post

How politics could affect APAC economics in a busy 2024 – a primer

Our view is that the flurry of elections across Asia this year generally do not look like high-risk events for investors.

Find Out More

Post

Three key idiosyncrasies in Asian trade and why they matter

Idiosyncrasies in recent Asian trade data suggest that country-specific factors are becoming more influential and causing some countries' exports to buck cyclical trends. If that continues, the fortunes of regional exporters will diverge further in 2024, though we still think the overall export trend will be subdued.

Find Out More