Research Briefing

| Nov 16, 2022

US Labor Market Not Cooperating with the Fed

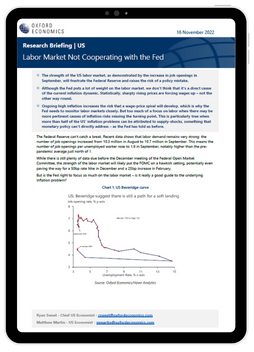

The strength of the US labor market, as demonstrated by the increase in job openings in September, will frustrate the Federal Reserve and raises the risk of a policy mistake.

What you will learn:

- Although the Fed puts a lot of weight on the labor market, we don’t think that it’s a direct cause of the current inflation dynamic. Statistically, sharply rising prices are forcing wages up – not the other way round.

- Ongoing high inflation increases the risk that a wage-price spiral will develop, which is why the Fed needs to monitor labor markets closely. But too much of a focus on labor when there may be more pertinent causes of inflation risks missing the turning point. This is particularly true when more than half of the US’ inflation problems can be attributed to supply-shocks, something that monetary policy can’t directly address – as the Fed has told us before.

Tags:

Related Services

Service

US States and Metro Service

Forecasts, scenarios and analysis for US states, metropolitan statistical areas and counties.

Find Out More

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More