Hong Kong’s weak housing market to only get a reprieve in 2023

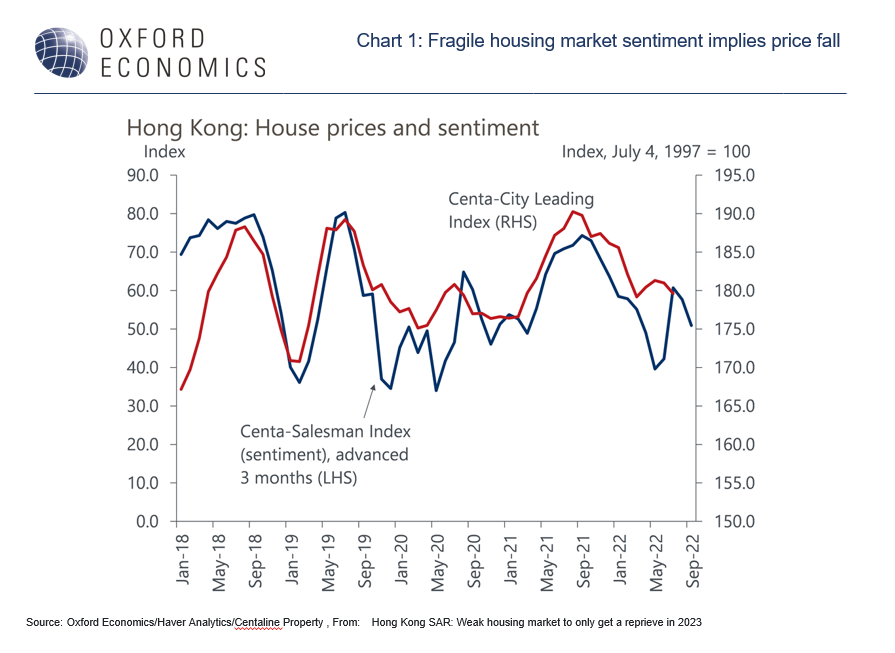

Hong Kong’s housing market sentiment weakened during H1 2022, reflecting a resurgence of Covid infections in Q1 and a weak domestic economic outlook. House prices in the secondary market fell 2.8% in Q2 versus Q4 2021. And this housing market weakness may not be over yet.

What you will learn:

- As an international trade and financial centre in Asia, changes in Hong Kong’s external environment have an

outsized impact on its domestic economy, and hence on its housing market. - We expect residential property prices to fall by about 4% y/y in Q4 2022, mainly due to the gloomy economic outlook. Slow border reopening progress and challenges to the external environment have severely dampened local sentiment.

- Higher mortgage rates will also play a role in deterring lower income households from buying property and weigh on residential property investment demand.

Tags:

Related posts

Post

BoJ to raise its policy rate cautiously to 1% by 2028

We now project that the Bank of Japan will start to raise its policy rate next spring assuming another robust wage settlement at the Spring Negotiation. If inflation remains on a path towards 2%, the BoJ will likely raise rates cautiously to a terminal rate of around 1% in 2028.

Find Out More

Post

Japan inflation to rise to 1.8%, but downside risks are high

Reflecting a surprisingly strong Spring Negotiation result and weaker yen assumption, we have upgraded our baseline wage and inflation forecasts. We now project higher wage settlements will push inflation towards 1.8% by 2027. Uncertainty is high, however.

Find Out More

Post

Australian office sustainability outcomes underpin asset performance

The focus on green office buildings and sustainability is being driven by both government targets to achieve net zero and increasing corporate and investor focus on environmental, social, and corporate governance (ESG) considerations and compliance.

Find Out More