Ungated Post | 19 May 2020

FocusEconomics ‘Best Economic Forecaster Awards’ ranks Oxford Economics top most consistently over last 3 years

Oxford Economics is proud to announce that it has been ranked top in FocusEconomics’ Best Economic Forecaster Awards more than any other forecaster over the past three years.

Oxford Economics is proud to announce that it has been ranked top in FocusEconomics’ Best Economic Forecaster Awards more than any other forecaster over the past three years.

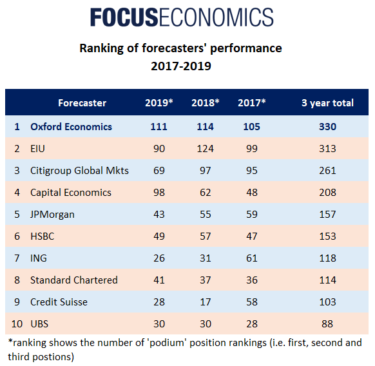

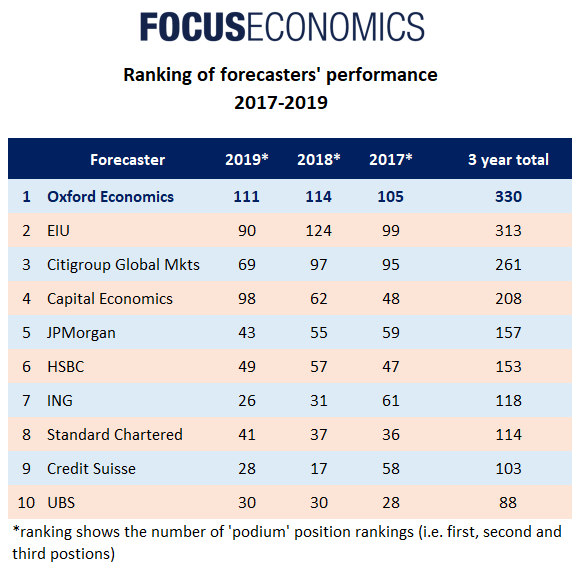

This year Oxford Economics tops the list with 111 top position rankings. Furthermore, over the last 3 years, we have consistently ranked in more top positions than any other forecaster.

The consistent accuracy of our forecasts across countries and time is thanks to our rigorous model based approach to forecasting which combines our market leading Global Economic Model and the experience and on the ground expertise of our global team of macroeconomists.

The FocusEconomics Analyst Forecast Awards are yearly awards that recognise the most accurate economic forecasters for the six key macroeconomic indicators (GDP, Fiscal Balance, Inflation, Interest Rate, Exchange Rate and Current Account) in 89 countries and for 22 commodities.

Tags:

You may be interested in

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More

Post

Australia: RBA hike by another 25 bps as the fight against inflation continues

The RBA has raised its cash rate target by a further 25 basis points, taking it to 4.1%. Although inflation has peaked, the RBA board is still clearly uncomfortable with its brisk pace.

Find Out More