Blog | 21 Dec 2021

Five trends that will dominate industry in 2022

Kiki Sondh

Economist

Global industry emerged strong in early 2021, following a lacklustre performance the year before. But with a right jab from renewed restrictions, a left hook from deepening supply chain disruptions, and an uppercut from pent-up consumer demand—it has taken a bit of beating recently. So what’s in store for 2022?

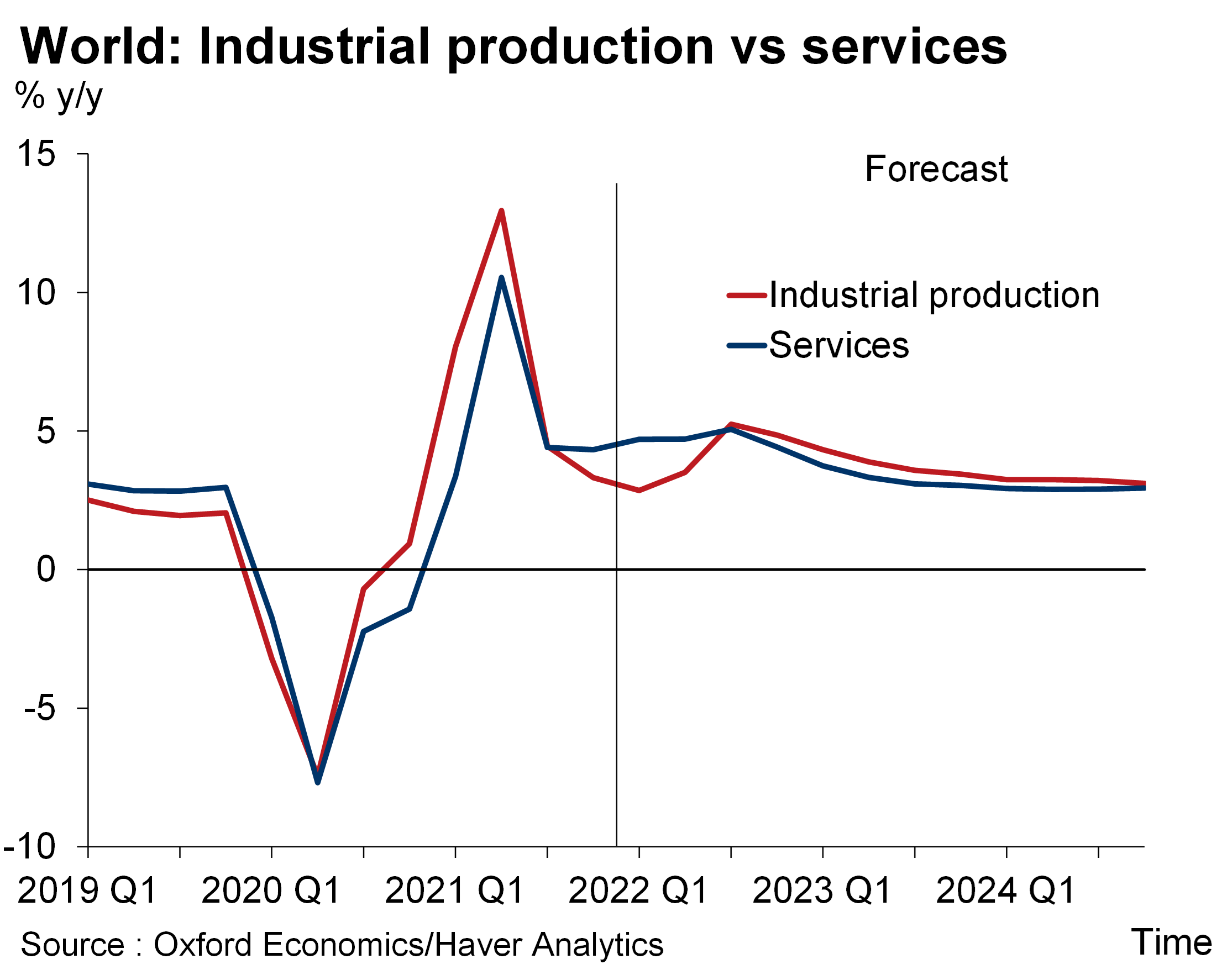

- Services will outpace industry early in the year. Industrial production will lag services growth globally going into 2022 as supply chain pressures continue to bite and the post-pandemic recovery in household spending on services continues. The new, more transmissible Omicron Covid-19 variant, however, remains a key downside risk to our outlook.

Industry will overtake services later on. The recovery in global industrial production will gain considerable momentum later in the year as component shortages and cost pressures ease. Strong orders data and rising backlogs point to the potential for production growth to accelerate once supply chain disruptions begin to unwind, and industry will once again lead growth into the medium term. Meanwhile, with Covid-19 cases starting to rise again in many countries, the re-imposition of domestic and international travel restrictions over the last few weeks is likely to curtail services activity in the near term—particularly in transportation and hospitality.

Industry will overtake services later on. The recovery in global industrial production will gain considerable momentum later in the year as component shortages and cost pressures ease. Strong orders data and rising backlogs point to the potential for production growth to accelerate once supply chain disruptions begin to unwind, and industry will once again lead growth into the medium term. Meanwhile, with Covid-19 cases starting to rise again in many countries, the re-imposition of domestic and international travel restrictions over the last few weeks is likely to curtail services activity in the near term—particularly in transportation and hospitality.- Lingering semiconductor shortages mean only a gradual recovery in the auto sector. European carmakers have been pulverised by semiconductor shortages. So, too, have carmakers in the US, though not as severely. To lessen supply chain disruptions, US automotive companies—such as Ford and General Motors—have reduced electrical features on vehicles. While this pandemic-driven shift in production strategy will likely disappear as semiconductor supply improves, we expect it to remain central in lessening the extent of supply bottlenecks on businesses going into 2022.

- Global shipping bottlenecks will remain complicated. Problems persist throughout the transport and logistics supply chain—from port and warehouse capacity to the ability of logistics networks to deliver goods to their final consumers—and will likely weigh on world trade in goods as we go into 2022. As labour supply problems throughout logistics supply chains subside and shortages in warehousing space are addressed, seaborne freight looks set to recover in the second half of the year.

- Digitalisation and automation will accelerate. With labour supply constraints throughout the pandemic compelling firms to automate their processes, and with fewer workers seeking jobs in high-contact routine occupations, we expect companies to continue investing in labour-saving technologies to increase productivity. Already at least some of the automation we have seen during the pandemic—for example in food preparation and retail—are likely here to stay. This structural shift, accelerated by the pandemic, is one of the reasons why we expect no long-term scarring of industrial production.

For the battered industry sector, 2022 will not be an easy round—but there is hope it will be able to pick itself up off the canvas. With the recovery in industry expected in the second half of the year, businesses have enough room to manoeuvre and start investing in technologies and systems improvements to ensure they are fighting fit to exploit a more solid global recovery in 2023.

Tags:

You may be interested in

Post

Oxford Economics enhances its Commodity Price Forecasts coverage

Oxford Economics expands Commodity Price Forecasts service to include battery metals, agricultural commodities and plastics.

Find Out More

Post

Oxford Economics Expands Regional Presence with the Launch of Chinese Website

Over the past six years we've maintained the unique modelling and analysis that clients and the media have come to rely on from BIS Shrapnel while incorporating Oxford Economics' rigorous global modelling and analytical framework to complement it," said David Walker, Director, Oxford Economics Australia.

Find Out More

Post

Oxford Economics Introduces Proprietary Data Service

Oxford Economics is excited to enrich its suite of asset management solutions with the introduction of the Proprietary Data Service.

Find Out More