Research Briefing

| Apr 16, 2024

Spotlight on geopolitical risks and the US economy

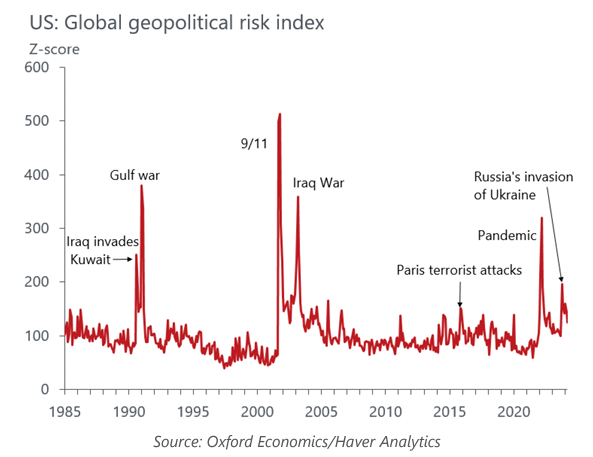

The escalation of geopolitical tensions in the Middle East does not pose a downside risk to the US economy because of its strength, except through a potential larger-than-anticipated increase in oil prices to more than $100 per barrel.

What you will learn:

- We modeled fluctuations in real monthly GDP, controlling for the labor market, inflation, interest rates, and geopolitical risk. Geopolitical risk is higher than that seen prior to the pandemic but could move higher. However, the results were in line with our a priori as the coefficient on the geopolitical risk index was negative and small. However, oil prices can move the needle.

- Higher oil prices would increase the odds that the Fed keeps interest rates high for longer, particularly if market-based inflation expectations rise. Therefore, the fed funds rate would be higher than under the baseline if oil prices hit or exceed $100 per barrel.

Tags:

Related Services

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Global Risk Service

A suite of data-driven and forward-looking tools that provide an objective and transparent measure of risk.

Find Out More

Macro and Regulatory Scenarios

Our models, forecasts, and datasets can be customised to fit the unique needs of your organisation.

Find Out More