Response to oil price cap may not be what is intended for Russia

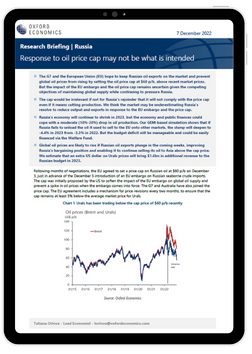

The G7 and the European Union (EU) hope to keep Russian oil exports on the market and prevent global oil prices from rising by setting the oil price cap at $60 p/b, above recent market prices. But the impact of the EU embargo and the oil price cap remains uncertain given the competing objectives of maintaining global supply while continuing to pressure Russia.

What you will learn:

- The cap would be irrelevant if not for Russia’s rejoinder that it will not comply with the price cap even if it means cutting production. We think the market may be underestimating Russia’s resolve to reduce output and exports in response to the EU embargo and the price cap.

- Russia’s economy will continue to shrink in 2023, but the economy and public finances could cope with a moderate (10%-20%) drop in oil production. Our GEM-based simulation shows that if Russia fails to unload the oil it used to sell to the EU onto other markets, the slump will deepen to -4.4% in 2023 from -3.3% in 2022. But the budget deficit will be manageable and could be easily financed via the Welfare Fund.

- Global oil prices are likely to rise if Russian oil exports plunge in the coming weeks, improving Russia’s bargaining position and enabling it to continue selling its oil to Asia above the cap price. We estimate that an extra US dollar on Urals prices will bring $1.6bn in additional revenue to the Russian budget in 2023.

Tags:

Related Services

Service

Commodity Price Forecasts

Monthly reports on commodity price trends and forecasts, as well as weekly briefings on the latest price action.

Find Out More

Service

European Macro Service

A complete service to help executives track, analyse and react to macro events and future trends for the European region.

Find Out More